Recent weak US economic data have been mostly ignored by the market, under the logic that the powerful stimulus plans from governments and central banks will set the stage for a quick recovery and the carnage has been signaled well in advance.

But while investors generally ignored the scary data on the way down, that might not be the case if the figures start to improve going forward. In this sense, the risks surrounding the dollar from the upcoming US employment data on Friday seem asymmetric and tilted to the upside.

Nonfarm payrolls are expected to fall by 8 million in May, far less than the 20.5 million plunges in April, but still a very concerning number. That’s expected to push the unemployment rate up to 19.5% from 14.7% in April.

If the reading comes in worse than expected, investors might shrug it off as just another piece of bad news for May, which everyone already knows was disastrous. This would mean that if the dollar drops on the news, the drop could be relatively limited. On the other hand, if the data comes in better than expected, that might signal that even May – possibly the peak of the recession – wasn’t as disastrous as feared, and perhaps trigger a more powerful upside reaction in the dollar.

US markets: have the shares gotten over the virus?

Lately there has been lot of talk of a rapid V-shaped recovery as global markets roared back to life in recent weeks, thanks to a wave of stimulus packages from governments and central banks. With Friday’s jobs data in sight, markets already underplaying the lasting impact that double-digit unemployment will have on the economy. The S&P 500 is down just 7% for the year, while the tech-heavy Nasdaq 100 is actually 7.5% higher year-to-date and is back within touching distance of its record high.

At the end of last week, US unemployment claims surpassed 40 million and still the Dow rose. While we do not expect to see losses to match April’s 20 million print, there are expectations for job losses of about 8 million in May, with overall unemployment coming in at just under 20 per cent.

In April alone, the US economy lost every job it created over the entire past decade, and May’s numbers could be just as bad. Some of these will come back quickly, but even if the unemployment rate in May falls 10%, is that really a victory?

In addition, there is also the risk of second waves of both virus infections and bankruptcies. If new virus cases flare up again now that most economies have reopened, that could force a return to lockdowns or at least a longer period of mandatory social distancing measures.

While the recent rally in US equities is remarkable, traders should be guarded against an extended rally. There is still no clarity on how this pandemic will turn out, and we are yet to see the deeper effects on the economy as the second quarter’s data releases filter through.

How will Friday’s reading affect gold prices?

There is no clear long-term relationship between the gold price and job report. However, if the reading surprises investors, gold could move violently in the short term. Usually, good news for the U.S. labor market is positive for the greenback and negative for the shiny metal. In such a case, the price of gold tends to fall on the day when the Nonfarm Payroll Report comes out.

More importantly, how investors react depends on the report’s implications for the short-term interest rates. However, these are not normal times.

Gold has lately been trading around the mid $1720 levels, giving up all its recent gains in trading at the start of this week as surging recovery sentiments, and no new US-China trade developments saw investors reduce haven positions.

Assuming the global recovery rally maintains its strength in other markets, gold looks increasingly likely to return to the lower end of its recent $1688.00 to $1650.00 range. Struggling bullish gold traders can take some comfort in the fact that momentum remains weak in either direction. Thus, at this time a large downside breakout is as unlikely as a large topside one.

Main Economic facts

- Unemployment rate

The unemployment rate in the United States rose from 3.5%, which is considered the lowest since the fifties of the last century, to 14.7% in the month of April 2020, and the largest historical increase since the recession of 1937-1938 when unemployment reached 19%.

- Jobs creation in Non-Farm Payrolls

We have seen the largest number of layoffs in the American non-agricultural sectors throughout history during the month of April, when about 20.5 million American citizens lost their job. We have not seen throughout history. Projections indicate that about 8 million US citizens will have their jobs in the past month in May 2020.

- Hourly income growth rate

Traders rarely monitor this data, which is considered very important, as the deterioration of job markets during the month of April, the demand for professional jobs and experts increased, thus increasing the rate of income growth over the monthly period by 4.7% and over an annual rate of 7.9%. Projections indicate that the hourly income growth rate may be 1%, which is also considered high.

However, now let's look at the weekly jobless claim’s readings, which is one of the important indicators of the job and unemployment data forecast in the United States.

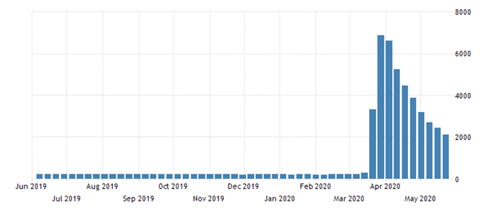

We will notice that a large and massive increase is considered a record in weekly subsidy applications that started since last April, and during May, the weekly subsidy requests were as follows:

- On May 7th, 2020: 3169K

- On May 14th, 2020: 2981K

- On May 21st, 2020: 2438K

- On May 28th, 2020: 2123K

Thus, we find that the number of requests for aid amounted to 10.711 million. But we will also notice a significant slowdown in the number of claims, from levels that reached 6.867 million in April. Consequently, we must know that the American labor markets are still suffering violently from the Corona crisis, but we are beginning to see a slowdown in the collapse of the job markets.

ADP data for private jobs in the United States is a primary indication of Friday's job data

ADP data for the private sector showed 2.76 million people lost their jobs last month in May. However, these results were much better than the expectations that indicated that 9 million Americans may have lost their jobs.

Therefore, it should not be excluded that we see jobs data in the non-agricultural sectors better than expected, nor should it be excluded that we see the unemployment rate a little better than expected, even though it is very likely that we will see a significant rise in unemployment as well as more Americans losing their jobs.