The Reserve Bank of Australia (RBA) showed optimism for the Australian economy to grow in the second quarter of 2017 as the bank's decision to hold interest rates at 1.50% at its historic low earlier this month as consumption growth recovered despite pressure from high levels of debt. The Australian dollar rose strongly against the US dollar, reaching a two-year high of 0.7942.

In the UK, the slowdown in inflation in June dampened pressure on the Bank of England to raise interest rates and shift to tightening monetary policy amid uncertainty over the start of Brexit negotiations. The consumer price index (CPI) rose by 2.6% against expectations with 2.9% as May reading, the highest in four years. The pound fell significantly against the US dollar to its lowest level since last Friday at 1.3004, after releasing the data.

Despite the decline of economic sentiment in the ZEW survey in the eurozone, investors headed for buying the EURUSD pair, to reach its highest level in more than a year at 1.1582, as markets awaited the ECB meeting on Thursday and the prospect of tightening monetary policy or easing the stimulus program which launched by the Bank in 2015.

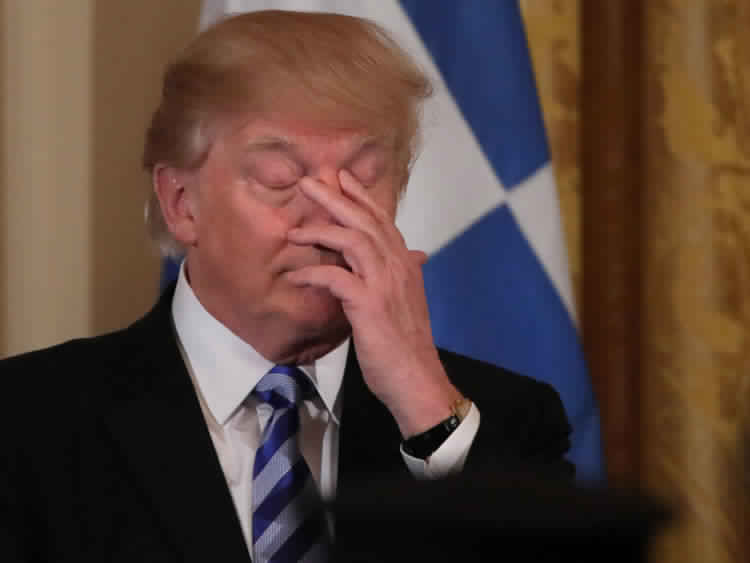

Investors were not only optimistic about the ECB's shift, but the US dollar was weak against its rivals because of the failure to pass the health care bill, opening the door to ability of Donald Trump, the US president to achieve his promises, one of these promises was the repeal of the Obama-care Act, and markets seem to lose confidence in Trump's fulfillment of his promises. The dollar index hit its lowest level in nearly a year at 94.25 at an important support level.

Daily Wrap Up – 18 July

18 Jul 2017 07:36 PM

Prices may be delayed by 5 seconds. Prices above are subject to our website terms and conditions. Prices are indicative only

© 2023 Equiti, All Rights Reserved