Moody's agency surprised the markets this morning after downgraded China rating to A1 from Aa3 and changing its outlook from negative to stable. Debt levels in the Chinese economy were expected to rise further in the coming years, and reforms are likely to slow growth, the agency said. The debt burden is estimated to rise toward 40% of GDP by 2018.

This downgrade was the first since 1989. In response, China rejected the move. The Finance Minister said that the agency had overestimated the risks to the economy and underestimating the government's reform agenda, citing an inappropriate method.

Also this morning, the European Central Bank published the Financial Stability Report, indicating that debt sustainability concerns have increased over the past six months amid the prospect of higher yields. The European Central Bank said that the re-pricing of the bond market could be achieved by the effects of rising yields in advanced economies, especially in the United States.

European Central Bank policymakers are expected to begin thinking about tapering the massive quantitative easing program that began in January 2015, bringing the volume of asset purchases to around 60 billion Euros a month.

In Canada, the central bank kept the interest rate unchanged at current levels of 0.50%, while the statement of interest was released from any negative terms, pointing to the economic figures in line with the Bank's latest forecast, and that the Canadian economy began to fully adapt to the oil price declines. Pointing to that the current degree of monetary stimulus is appropriate at present. This supported the Canadian dollar to rise strongly against rivals.

Oil ministers began informal consultations during the day on the duration of production cuts, excluding the idea of deepening the size of the reduction at the present time. It is now divided over the length of time that members want, where Saudi Arabia and Russia are in favor of extending the agreement for 9 months. Kuwait and the UAE would like further analysis of the situation and would prefer to extend the agreement only six months.

Thursday will be the date of the official meeting in Vienna, headquarter of the OPEC for the final decision. The markets are now cautiously awaiting the meeting, as Crude Oil erased its gains since the beginning of trading day, reaching its highest level since April 19 at 51.84$ a barrel, currently trading at 51.20$. The drop came directly after US crude inventories fell for the seventh week in a row by 4.4 million barrels.

On the technical view, take a look at the most important moves during the day:

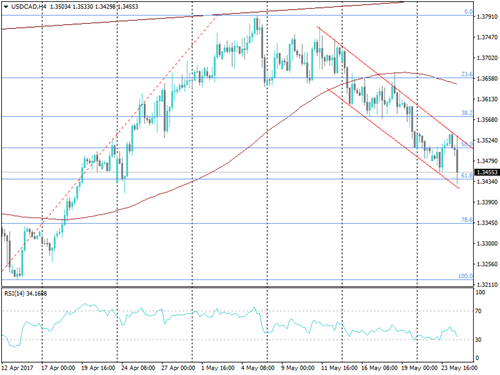

USDCAD

The pair couldn’t hold the highest resistance level of 50% Fibonacci at 1.35 and pulled back below it reaching to 61.8 Fibonacci at 1.3440, We expect the pair to rebound to test 1.35, breaking down of support level at 1.3440 could send prices much lower to level of 1.3345.

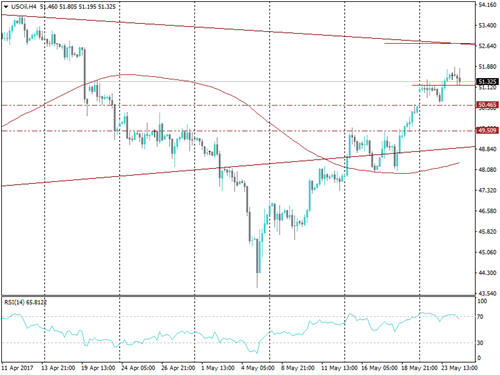

Oil

Oil is trading around the 51.20$ support level, where we expect a bounce back to 51.85 and then 52.70.