During the early morning hours of the European session, the UK Retail Sales figures were released, which came in much better than expected, sending GBP higher across the board.

UK Retail Sales Rises In August

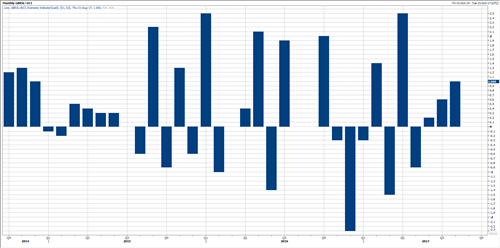

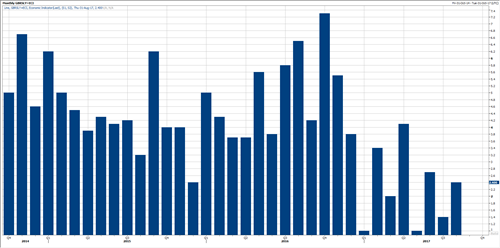

The UK Retail sales posted the third monthly increase in a row, one we have not seen since 2015, rising by 1.0% in August, compared to 0.6% in July, while it had been anticipated to rise by 0.2% only.

Moreover, the YoY Retail Sales advanced to 2.4% in August up from 1.4% in July, while the estimates were to decline toward 1.1%. This is the highest reading in two months.

UK Core Retail Sales Surprised Higher

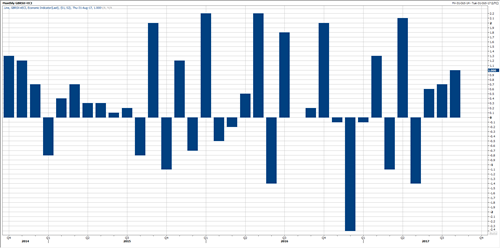

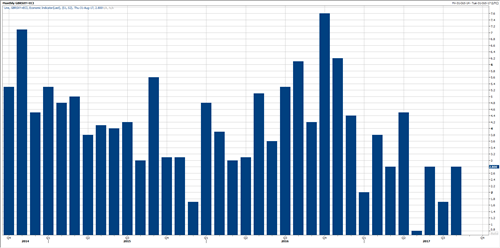

The UK Core Retail Sales came in with another positive outcomes, rising by 1.0% in August after 0.7% in July (Revised from 0.3%), while the estimates were to show only a slight increase of 0.2%. This is also the third monthly increase in a row, one we have not seen since 2015.

In addition, the YoY Core Retail Sales also came in with a surprise higher, rising to 2.8% in August compared to 1.7% in July, while the estimates were to slow down toward 1.4%. This is the highest reading since April of this year.

GBP Spiked Above 1.3550

After few days of a short term retracement to the downside, reaching as low as 1.3465 during yesterday’s trading.

However, the pair managed to stabilize during the Asian and the European session earlier today, while the Retail Sales data pushed the pair higher once again.

In the meantime, the bullish outlook remains valid, since the Bank of England is expected to change the course of the current policy. Investors are pricing in a possible tapering of the ongoing QE and/or to raise the interest rate by 25bps.

Therefore, GBPUSD bids are likely to increase at least until the next MPC Meeting. In return, the possibility of testing 1.3620’s and 1.3660 is marginally higher than before.

What Matters The Most In Today’s FOMC Decision

Traders should be very careful when it comes to today’s FOMC decision. It include the Federal Funds Rate, Economic Projection, FOMC Statement and the Federal Reserve Chair Janet Yellen Press Conference.

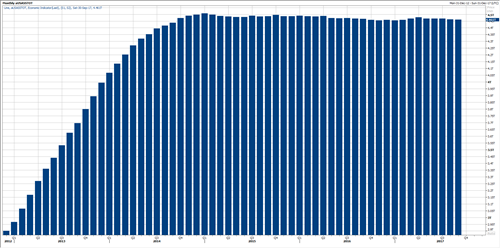

For the time being, the general consensus points to no change, at least when it comes to the Federal Fund Rate. However, the key point in this meeting is the Federal Reserve Balance sheet.

Few months back, the Fed removed the sentence that said “The Fed will be ready to start trimming its balance sheet this year” instead, the Fed replaced this sentence with “The Fed will be ready to start trimming its balance sheet relatively soon”.

This change gave the market an idea that the Fed might not do this anytime this year. Therefore, if the Fed decided to announce it once again today, this will have a notable impact on the markets.

If the Federal Reserve decided to start trimming its balance sheet by few billions of dollars, this won’t change the current trend, whether in USD Index and/or the US bullish trend. In fact, the current trend is likely to accelerate.

On the other hand, if the Fed decided to start unwinding its balance sheet with a huge bulk of assets (unlikely), this would be the only reason for the US Dollar to turn higher, while the US equities may suffer for some time.

Remember to read the Fed’s statement very carefully before taking your decision.

Edited by:

Nour Eldeen Al-Hammoury

Market Analyst