The Reserve Bank of Australia kept interest rates unchanged at 1.50% as widely expected, and the Central Bank has maintained its recent neutral approach, pointing to low interest rates that will continue to support the Australian economy. Keeping monetary policy as it is will be consistent with the sustainability of growth and will help reach the inflation target.

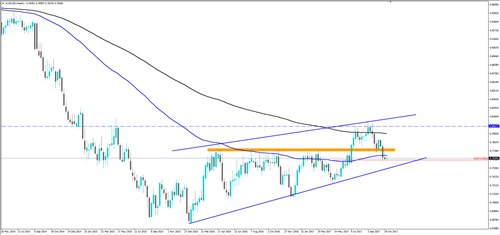

Australian Dollar Weekly Chart:

AUDUSD didn't notice a significant move in the wake of the decision as it moved within 20 pips up and down and is currently stabilizing above levels we mentioned yesterday, as it moves within a bullish wedge on the weekly chart which supports the pair's decline either with the break of the rising trend line or perhaps after testing the upper limit of the wedge pattern targeting the 0.65 levels.

Eurozone ministers are continuing to prepare for the Euro summit on December 4, where many issues concerning the monetary and economic union are expected to be discussed in a comprehensive manner. The constructive talks with the Greek government by the institutions (EC / ECB / IMF / ESM) were also reviewed in the context of the ongoing third revision of the Greek economy. The euro group is set to elect a new president of the group at the summit next month.

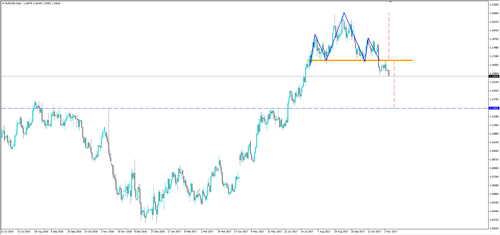

Daily chart for EURUSD:

EURUSD remains under the pressure of the head and shoulders pattern on the daily chart after breaking the neckline, currently trading at 1.1560, its lowest since July 20. And it seems to target levels of 1.13.

Tomorrow, the markets will be awaiting tomorrow's interest rate decision from the Reserve Bank of New Zealand. As we mentioned yesterday, it is expected that the bank won't take action at this time and that interest rates will remain at 1.75%, with inflation stabilizing near the midpoint of the target range.