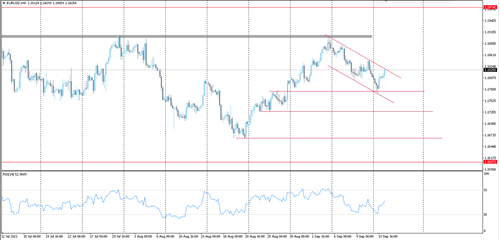

EURUSD

The pair faced correction after achieving a target at 1.1900, and the pair is now moving between the two borders of a descending channel, and near its upper border, so is likely to fell from 1.1830 to test the support levels 1.1775-1.1730.

But if it breaks 1.1830, the rise is likely to extend to 1.1900 levels.

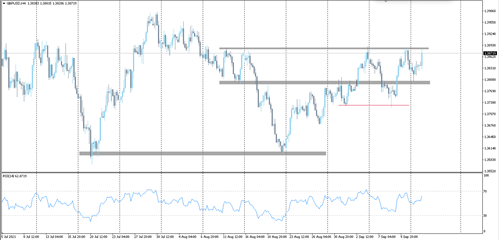

GBPUSD

The pair succeeded in rebounding from the support level of the pair 1.3800, and it is likely to test the resistance 1.3900, and if it is exceeded, the rise may extend to 1.3950 levels.

But if the 1.3800 support is broken, the drop will likely extend to the 1.3730 level.

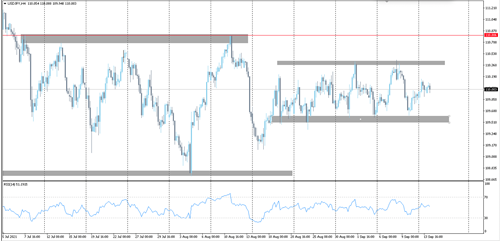

USDJPY

The pair being a support level at 109.50, it tested it more than once and succeeded in maintaining it and rebounding from it to test the 110.20 resistance, which if it remains above, it may extend the rise to the 110.80 level.

The support levels for the pair are at 109.40, in case it is broken, the drop may extend to the level of 108.70.

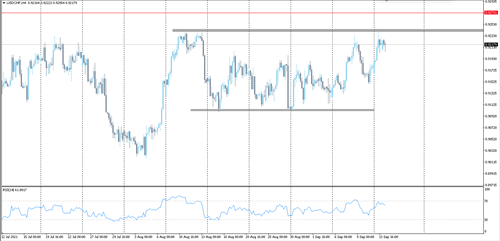

USDCHF

The pair is moving in a wide-ranging consolidation range between the support level 0.9100 and the resistance level of 0.9240, which the pair is trading near now, and, likely, it will not succeed in surpassing this level to face the decline to the levels of 0.9150-0.9100.

But if the resistance 0.9240 is crossed, the rise will likely extend to 0.9275.

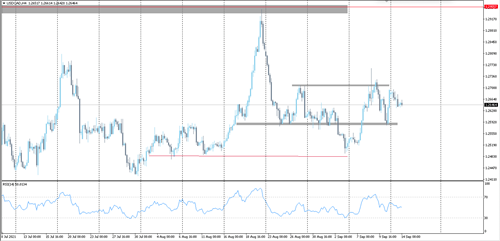

USDCAD

The pair rebounded from the 1.2575 support to test the resistance level at 1.2700 and succeeded in surpassing it, so the correction is likely to return to the experiment at 1.2575, which if broken, may extend the decline to the 1.2500 level.

But if the resistance is exceeded 1.2700 and the price remains above it, it may contribute to pushing the price further up to 1.2800/50 levels.

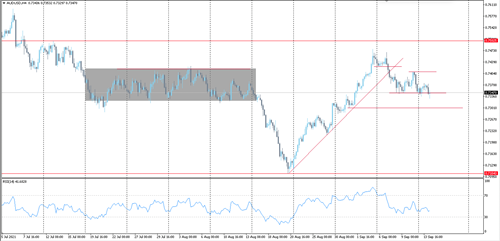

AUDUSD

The pair formed a negative pattern, two double tops, and after it broke the support 0.7424, the pace of the decline increased, and it fell to the support level of 0.7340, and it will likely maintain it to re-experiment on the resistances 0.7400/24

But if we break the 0.7340 support, the drop will likely extend to 0.7300.

Gold

Gold being a bullish broadening pattern, and it is likely that by maintaining the support 1780, it will rise to test the 1804 resistance, which by surpassing it may contribute to the extension of the rise to the levels of 1833-1850.

But if the support of 1780 is broken, the drop will likely extend to the levels of 1770-1755.

Silver

Silver broke the support 23.80, so the current decline is likely to extend to 23.00 - 22.30 levels.

Resistance level: 23.80 - 24.30.

Oil

Oil rose and is trying to stabilize above 70.50, and it is possible that if it remains above it, the rise will extend to levels 72.00-73.50.

Support levels for oil 70.00-69.25.

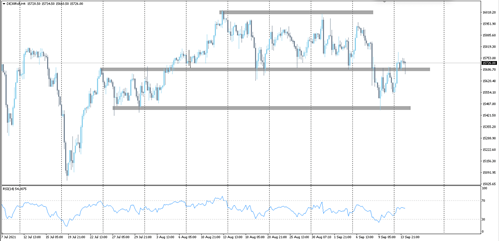

Dow Jones

The Dow Jones fell to the support level 34600 and succeeded in rebounding from it a little bit, and by maintaining it, the rise is likely to extend to the levels of 35000-35200-35500.

But if it breaks the 34600, this may contribute to the extension of the decline to the levels of 34200-34000.

DAX

The German DAX index broke the 15690 support and extended the decline to 15450 levels, and is now trying to stabilize above 15690 again, and the price may persist above, the rise may extend to 15850-16000 levels.

However, in the event of a decline below the level of 15690, it is likely to return to the decline to levels of 15450 again.