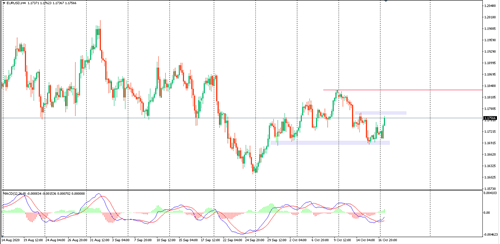

EURUSD

This pair succeeded in rebounding from 1.1690 support and is now testing 1.1770 resistance, and if it succeeds in surpassing it, we may target 1.1830 to 1.1870 level.

If the pair does not cross the resistance level of 1.1770, it may retreat to 1.1690 support once again.

GBPUSD

This pair succeeded in rising to 1.30 levels and faces resistance at 1.3070 - 1.3100 levels, but we expect it to retreat from there. Support levels are 1.2860.

If the pair surpasses the resistance level of 1.3100, the pair may continue its rise, targeting 1.3150 - 1.3200.

USDJPY

This pair is still moving above 105.00, so we expect it to continue rising to 106.00 - 106.50.

Support levels are 105.00-104.00

USDCHF

This pair rose and tested 0.9160. We expect it to retreat from these levels to 0.9080 - 0.9070.

If breaks the resistance level of 0.9160, we expect it to continue rising to 0.9200 - 0.9250 levels.

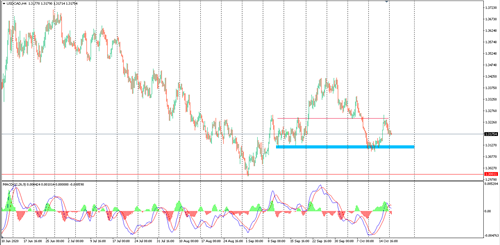

USDCAD

This pair faces support at 1.3100. If it stabilises above these levels, it may target resistance at 1.3240.

If the pair breaks its support level at 1.3100, it may target 1.30.

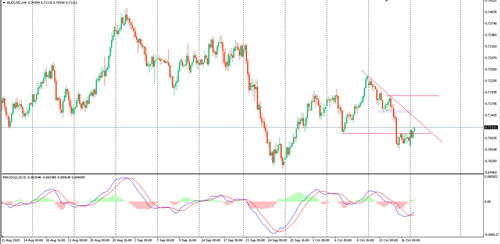

AUDUSD

This pair fell and broke 0.7095 level, so we expect the price to continue its fall to 0.7000.

Resistance levels: 0.7095 – 0.7150

Gold

Gold is moving within an up channel, and we expect it to encounter resistance at $1913. If it surpasses it, we may target 1933.

Support levels are 1900-1880; if it breaks these, may target 1850.

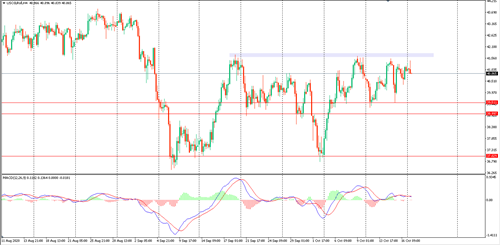

WTI

Oil faced resistance at $41.70 and failed to overcome it, going on to break the support level at 41.00. We expect the decline to continue to target 39.00, and then 37.00.

Resistance: 41.70 - 43.00.

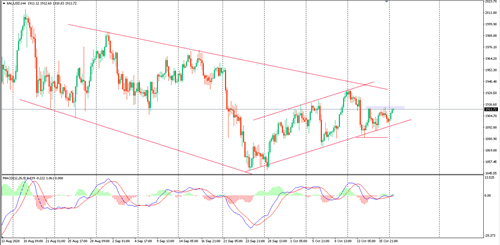

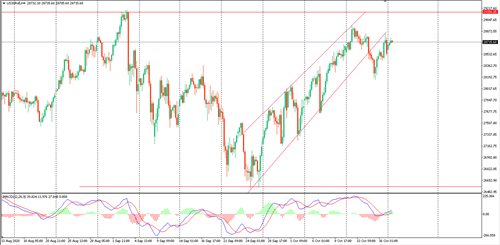

Dow Jones

The Dow Jones fell and broke the support of 28400 while re-testing the level of the broken trend line. We expect the decline to continue to 28150 and then break it to target 27700 points.

Resistance 28600 - 29000.