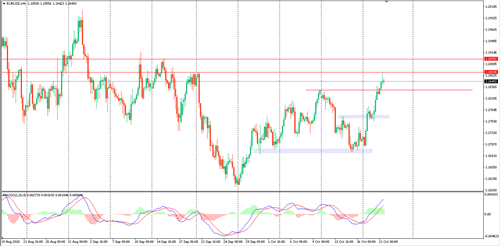

EURUSD

This pair succeeded in achieving our expected targets at 1.1830 - 1.1870. We now expect it to test 1.1830 support levels again.

If the pair succeeds in stabilising above this broken support, we will target 1.1870, then 1.1900.

The pair's support levels are 1.1830 / 1.1770.

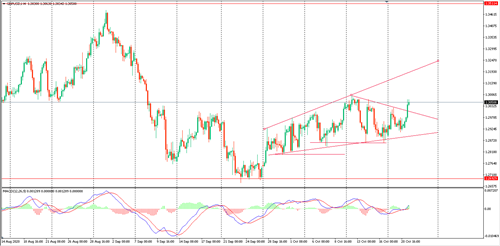

GBPUSD

This pair succeeded in rising above 1.30 levels, and we expect the pair to continue to do so by targeting 1.3080, then 1.3200.

The pair’s support levels are 1.30000 – 1.29000

USDJPY

This pair fell below its support level of 105.00, so we expect it to target 104.00 and, if it breaks this level, 102.50.

The pair’s resistance levels are 105.00 – 106.00.

USDCHF

This pair succeeded in achieving yesterday's target at 0.9050. We expect the price to continue to fall to 0.9000.

The pair’s resistance levels are 0.9050 – 0.9100.

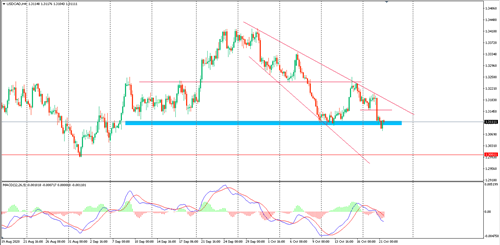

USDCAD

This pair succeeded in achieving the target of 1.3100 and retreating slightly below it, but it managed to rise above it again.

If it holds above 1.3100, a test is expected at 1.3150 / 1.3200.

If the pair breaks the support level of 1.3100, the decline is expected to continue towards 1.3000.

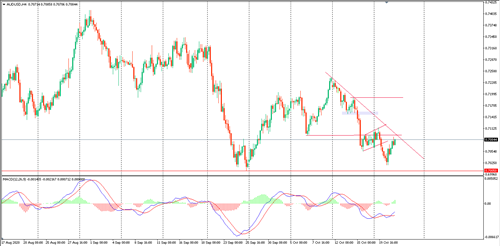

AUDUSD

This pair fell and broke the 0.7095 level, so we expect the price to continue its fall to 0.7000, and then to 0.6920

Resistance levels are at 0.709 - 0.7120

Gold

Gold is moving within an up channel, and we expect it to encounter resistance at $1923. If it surpasses this level, we may target 1933 - 1950.

Support levels are 1900 - 1880; if it breaks these, we may target 1850.

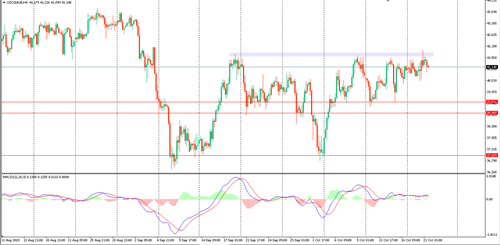

WTI

Oil faced resistance at $41.70 and failed to overcome it. We expect the decline to continue to $39.00, and then $37.00.

If it succeeds in breaching the $41.70 resistance level, we may target $43.50.

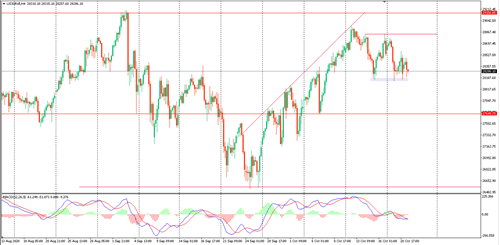

Dow Jones

The Dow Jones fell to our target of 28150, and later rebounded from it. We expect that it will test the resistance level of 28850; if it surpasses this we may target the high of 29200.

Support levels are at 28100; if it breaks these, we may target 27650 points.