NVIDIA's stock has seen strong momentum supported by upbeat quarterly results

Shares rise more than 100% since the beginning of 2023

Strong upward trend for NVIDIA's stock

Strong quarterly results for NVIDIA's stock that exceeded expectations

US stock indices are witnessing strong increases

NVIDIA shares have see a significant increase over the past few weeks

The company's optimistic forecasts after upbeat quarterly results showed revenue of $6.06 billion, exceeding expectations of $6.01 billion, leading to a rise in its stock prices to levels of $273.00. In addition, the expectation that the acceleration of artificial intelligence adoption will stimulate demand for Nvidia chips forced some on Wall Street to reverse their decision to stay on the sidelines and turn bullish on the chipmaker.

US stock indices closed higher, supported by the NASDAQ and the S&P 500. The NASDAQ index rose by about 1.00% to trade near 13,000.00 points, topping the list of sectors that saw increases, while the S&P 500 index rose by about 0.64% to trade at 4,061.7 points.

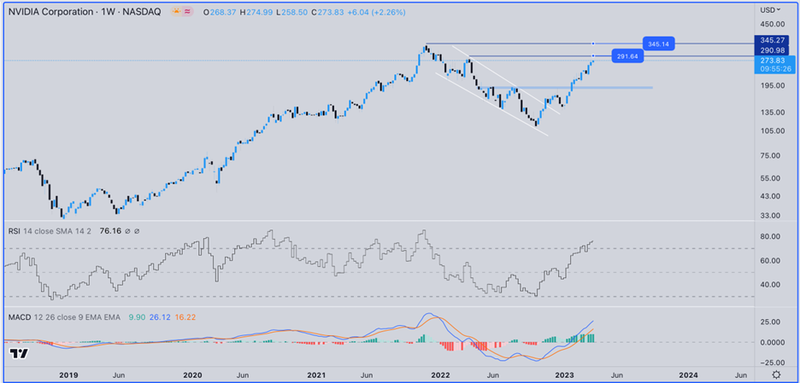

Technicals for the stock

The stock surged near levels of $273.83 after recording its lowest price at the beginning of the year at $140.34. The stock managed to break key resistance near $190.00 and turned into an upward trend, extending its rise to close at the level of $273.83 in the last trading session. It is likely to further extend its rise to test the resistance level of $191.00, and if it manages a breakthrough, the stock's could see a historical peak at the level of $346.00.

The short-term support level for the stock is around $258.00, and it is important for the price to remain above it to complete the upward scenario. However, if the stock declines and breaks $258.00, it is likely to extend the decline to test the level of $224.00 and then $204.00.