Australia inflation cools, but pressure remains on the RBA

Australia’s inflation slowed to a three-month low in November, offering tentative relief that price pressures are easing. However, inflation remains above the Reserve Bank of Australia’s target range, keeping policy tightening firmly on the table. The Australian dollar strengthened to a 15-month high as markets continued to price the risk of another rate hike early next year. While energy and housing costs are cooling.

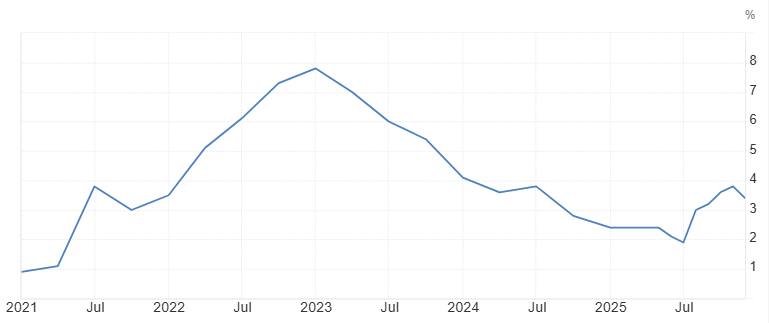

Australia’s annual inflation rate eased to 3.4% in November from 3.8% in October.

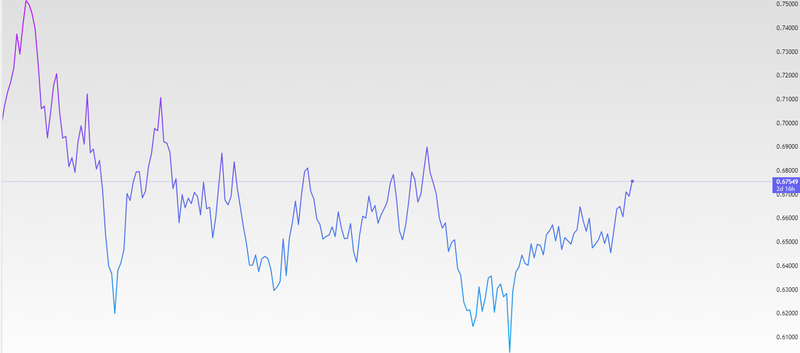

The Australian dollar climbed to around $0.675, reaching its strongest level in 15 months.

Markets currently assign about a 35% chance of a rate hike at the February meeting.

Inflation slows but remains above target

Australia’s annual inflation rate eased to 3.4% in November from 3.8% in October, coming in below market expectations of 3.7% and marking the lowest reading since August. The slowdown was driven mainly by softer housing-related costs and a sharp deceleration in electricity prices. Housing inflation cooled to 5.2%, reflecting slower rent increases, while electricity inflation dropped to 19.7% from 37.1% after government rebates expired. Price pressures also moderate across a wide range of categories including clothing, furnishings, health, recreation, and alcohol and tobacco, suggesting that higher interest rates are gradually restraining consumer demand.

However, inflation remains uneven. Food prices edged higher to 3.3%, and communication costs accelerated to 1.3%, showing that some everyday expenses continue to rise. Transport, education, and financial services inflation remained steady. Importantly for policymakers, the trimmed mean CPI eased only slightly to 3.2%, staying above the RBA’s 2–3% target band. Monthly inflation was flat, but the persistence of elevated core inflation explains why the central bank remains cautious. With Australia now relying on the full monthly CPI series as its primary inflation gauge, policymakers are closely watching whether this moderation continues into the new year.

Source: Australian Bureau of Statistics

Australian dollar strength reflects policy divergence

The Australian dollar climbed to around $0.675, reaching its strongest level in 15 months, as investors responded to the inflation data and the broader interest rate outlook. Even though inflation has cooled, it remains high enough to keep the possibility of further tightening on the table, especially when compared with other developed economies that are already discussing rate cuts. This policy divergence has supported the currency, alongside firm commodity prices and improved global risk appetite.

The AUD’s strength also reflects confidence that Australia’s economy can withstand higher rates better than many peers. Strong employment, resilient consumer spending, and steady demand from Asia have helped offset the drag from tighter financial conditions. As a result, foreign capital flows have favored Australian assets, reinforcing upward pressure on the currency. However, a stronger Australian dollar also poses risks by tightening financial conditions further and weighing on exporters if the move becomes too sharp.

Source: Trading View

RBA policy outlook and market expectations

The Reserve Bank of Australia has made it clear that policy remains data dependent. While inflation is moving in the right direction, it is not yet within the target range, and officials have warned that the current 3.6% cash rate may need to rise if progress stalls. Markets currently assign about a 35% chance of a rate hike at the February meeting, with expectations being built that the cash rate could reach 3.85% by May if inflation proves sticky.

The next key test will be the full fourth-quarter inflation report later this month. Analysts caution that a core inflation reading of 0.9% or higher for the quarter could push the RBA toward action. The central bank is walking a fine line between preventing inflation from becoming entrenched and avoiding unnecessary damage to growth. For now, the latest data suggests inflation is cooling gradually rather than collapsing, meaning the RBA is likely to remain cautious, with the Australian dollar and bond markets highly sensitive to every new data release.