Australia raises interest rate as inflation and growth surprise

The Reserve Bank of Australia (RBA) has raised its cash rate target to 3.85%, signaling its concern over rising inflation and strong domestic economic activity. This decision reflects a shift in the RBA’s outlook, as both inflation and growth have exceeded expectations compared with six months ago.

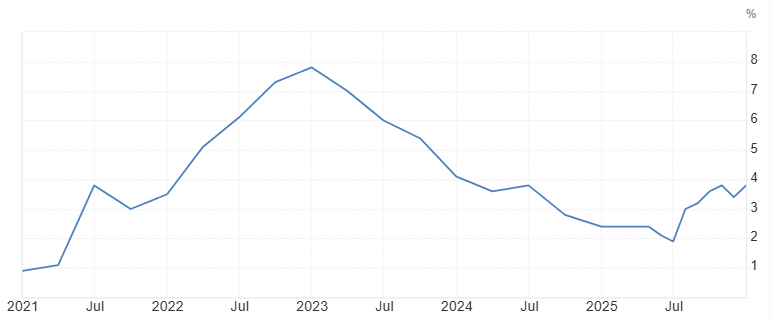

Inflation in Australia rose to 3.4% year-on-year.

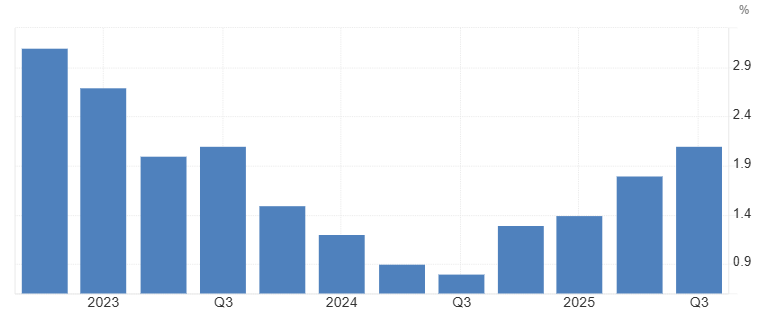

GDP grew by 2.1% over the year to the September quarter.

Unemployment has stayed broadly stable at around 4.25%.

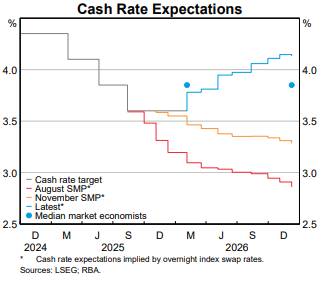

One rate hike in the coming months.

Inflation accelerates beyond expectations

Underlying inflation climbed to 3.4% year-on-year in the December quarter, far above forecasts from three months ago and well above the RBA’s August Statement. Headline inflation increased to 3.6%, driven by broad-based price pressures across services, retail goods, and new home construction.

Volatile items such as fuel and travel contributed to the rise, and the expiry of state electricity rebates added roughly 0.5 percentage points to headline inflation. The RBA emphasized that this acceleration is partly due to capacity constraints, which have proven stronger than previously anticipated. Persistent domestic demand combined with supply pressures is keeping price growth elevated.

Source: Trading economics

Economic growth remains strong

GDP expanded by 2.1% over the year to the September quarter, roughly matching Australia’s potential growth rate and marking the highest growth since Q3 2023. Preliminary data for the December quarter suggest that growth has accelerated further, with private demand particularly strong in the second half of 2025.

Household consumption grew solidly during the September quarter and appears to have continued its momentum into December, surpassing expectations. Dwelling investment also strengthened, reflecting healthy housing market conditions and rising construction activity.

Business investment has increased, though the RBA notes that some of this may be temporary due to its lumpy nature and heavy reliance on imports. Still, the combined strength of consumption and investment has intensified capacity pressures across the economy.

Looking ahead, if demand continues to run above trend, the RBA may be forced to raise rates further, especially if inflation remains elevated and labor markets stay tight. Investors and policymakers should anticipate a period of sustained tightening and higher borrowing costs, as the central bank balances strong growth with price stability.

Source: Australian Bureau of Statistics

Monetary policy and market expectations

Market participants currently expect one rate hike in the coming months, likely in February, with roughly a 75% probability, and a second increase by the end of 2026. Most economists believe the RBA will continue tightening if domestic demand and capacity pressures remain elevated.

If inflation stays stubbornly above target or GDP growth surprises to the upside, the RBA could adopt a more aggressive path of rate increases. Conversely, signs of slowing private demand or easing labor market pressure could reduce the pace of hikes.

Source: LSEG