Australia’s economy hits its stride

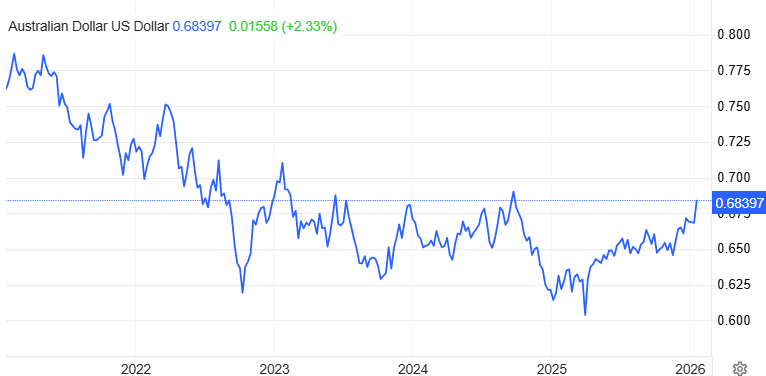

The Australian Dollar held near $0.684, close to a sixteen-month high, as investors priced in tighter monetary policy. Market sentiment has been buoyed not just by employment numbers but also by the upbeat PMI data, signaling that both manufacturing and services sectors are accelerating. Interest rate swaps now indicate a 55.7% chance of a February hike, with over 80% odds of a rate increase by May, reflecting how quickly the market adjusts to economic signals.

65.2K increase in jobs for December.

The composite PMI rose to 55.5.

Australian Dollar held near $0.684, close to a sixteen-month high.

Central bank could signal further tightening.

Employment and monetary policy

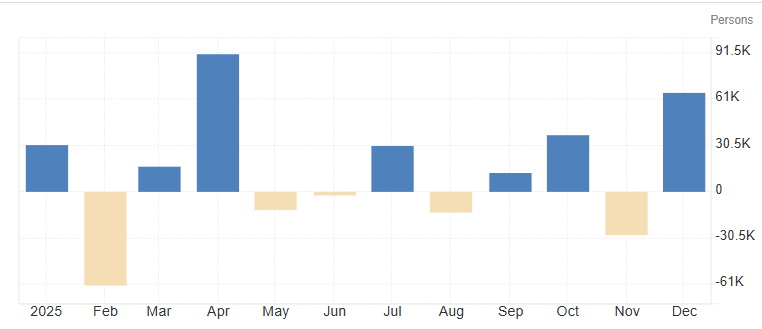

The Australian Dollar strengthened against the US Dollar on Thursday following fresh employment data, reinforcing market expectations of tighter monetary policy from the Reserve Bank of Australia (RBA). The Australian Bureau of Statistics (ABS) reported a surprising 65.2K increase in jobs for December, rebounding from November’s revised 28.7K loss, well above the consensus forecast of 30K. Meanwhile, the unemployment rate fell to 4.1% from 4.3%, beating forecasts of 4.4%.

Youth employment played a significant role, with more people aged 15–24 entering the workforce, contributing to both the employment surge and the drop in unemployment. The strong labor figures add to a growing case for the RBA to maintain a hawkish stance. Markets are now pricing in a roughly 60% chance of a rate hike in February, a dramatic jump from 25% earlier in the week. The labor market’s resilience signals that underlying demand in the economy remains solid, putting policymakers in a position where they may tighten further if inflationary pressures persist.

Source: Australian Bureau of Statistics

Private sector strength

Australia’s economy continues to show momentum across multiple fronts. January’s Flash PMI revealed that the private sector expanded to its strongest level in nearly four years, with both manufacturing and services posting solid gains. The composite PMI rose to 55.5, marking its sixteenth straight month of expansion, while factory activity grew for a third consecutive month and services activity recorded its sharpest increase since early 2022.

Despite headline inflation easing more quickly than expected in November, the International Monetary Fund (IMF) has urged the RBA to remain cautious. Core inflation has lingered above the Bank’s 2%–3% target band for an extended period, meaning that while economic growth is robust, price pressures are still a concern. Combined with tight labor conditions, these factors point toward a central bank likely to maintain restrictive policy for the near term to prevent inflation from regaining momentum.

Bonds, currency, and rate expectations

Australia’s 10-year government bond yield hovered around 4.81%, close to the two-year high reached earlier this month. The surge reflects renewed confidence in the economy’s strength and growing bets on a near-term rate hike from the RBA.

Source: Trading economics

Currency

The Australian Dollar held near $0.684, close to a sixteen-month high, as investors priced in tighter monetary policy. Market sentiment has been buoyed not just by employment numbers but also by the upbeat PMI data, signaling that both manufacturing and services sectors are accelerating. Interest rate swaps now indicate a 55.7% chance of a February hike, with over 80% odds of a rate increase by May, reflecting how quickly the market adjusts to economic signals.

Source: trading economics

Rate expectations

All eyes are now on next week’s December inflation release, a critical input for the RBA ahead of its upcoming meeting. Should inflation remain sticky, the central bank could signal further tightening, which would likely support the Australian Dollar and push yields higher. Conversely, a softer reading might slow expectations for near-term hikes, giving markets a breather.