Beijing’s mitigating dollar risk

China’s financial authorities are currently executing a complex maneuvering strategy on two fronts. Internationally, Beijing is actively shielding its banking sector from increasing volatility in United States sovereign debt. Domestically, the central bank is engaged in a massive liquidity injection to stabilize local markets ahead of the Lunar New Year.

Chinese regulators urging domestic banks to curb their exposure to U.S. Treasuries.

Central bank set the midpoint rate at 6.9929.

China’s 10-year government bond yield fell to approximately 1.8% on Monday, its lowest level in two weeks.

CPI stands at 0.8%, the highest level recorded since March 2023.

Curbing treasury exposure

The most significant signal for global investors is the directive from Chinese regulators urging domestic banks to curb their exposure to U.S. Treasuries. This move is explicitly framed around "market risk," but the timing suggests a deeper geopolitical calculation.

Confidence in U.S. dollar assets has eroded following reports of renewed American pressure on European allies regarding the control of Greenland. With threats of tariffs on eight European nations looming if they block U.S. ambitions for the territory, the risk profile of holding U.S. assets has shifted. Beijing’s guidance to its banks serves as a defensive wall, reducing the systemic risk that could bleed into China’s balance sheets should American diplomatic tensions escalate into a broader trade conflict or trigger a sell-off in U.S. bonds.

Breaking the psychological barrier

For the first time since May 2023, the People’s Bank of China (PBOC) has strengthened the yuan’s daily fixing rate past the psychologically critical level of 7 per U.S. dollar.

On Friday, the central bank set the midpoint rate at 6.9929. This is a decisive move. After weeks of maintaining the benchmark slightly on the weaker side of the 7 marks, the PBOC has allowed the renminbi to be appreciated. This adjustment appears to be less about aggressive yuan strength and more about capitalizing on dollar weakness. The greenback has softened as markets digest the instability inherent in the recent geopolitical ultimate regarding Greenland, allowing Beijing to reprice its currency without expending significant reserves.

The lunar new year injection

While navigating these international currents, the PBOC is simultaneously fighting a liquidity battle at home. The demand for cash ahead of the Lunar New Year has created a temporary funding gap estimated at nearly 3.2 trillion yuan.

To prevent this seasonal demand from choking the financial system, the central bank has intervened aggressively. Last week saw an injection of 600 billion yuan via 14-day repurchase agreements. Market expectations now suggest the PBOC will add up to 3.5 trillion yuan more before the holiday period begins.

The impact of this dovish intervention was immediate. China’s 10-year government bond yield fell to approximately 1.8% on Monday, its lowest level in two weeks. This decline in yields indicates that the market is confident the central bank will keep the taps open, prioritizing systemic stability and cheap funding over concerns about currency flight.

Source: Tradingeconomics

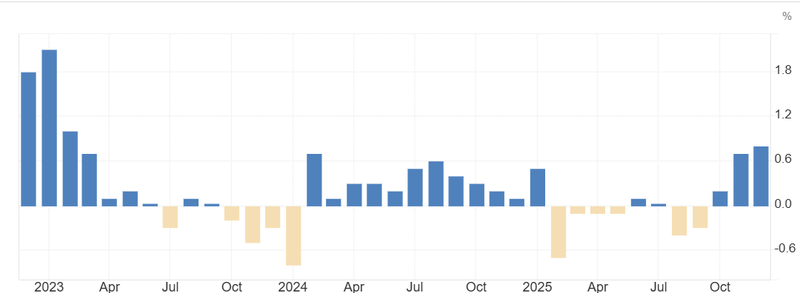

The inflation signal

Beyond the immediate liquidity concerns, market attention is squarely fixed on this Wednesday’s release of China’s Consumer Price Index (CPI) data. This upcoming print is viewed as a definitive litmus test for the efficacy of Beijing's recent stimulus measures.

The inflation trend over the last quarter points to a nascent reflationary cycle. For three consecutive months, the CPI has recorded readings higher than the previous period, signaling a potential break from the deflationary pressures that plagued the economy throughout 2024 and 2025. The most recent data point stands at 0.8%, the highest level recorded since March 2023.

Implications for Policy and Markets If Wednesday’s data confirms this upward trajectory, it would provide fundamental validation for the People’s Bank of China’s (PBOC) current strategy. A sustained rise in CPI suggests that the liquidity injections are finally filtering down to consumer demand, rather than just sitting in bank reserves. As inflation ticks up (currently at 0.8%), the real interest rate in China effectively lowers, providing further passive easing to the economy without the PBOC needing to aggressively cut nominal rates.

Source: National Bureau of Statistics of China