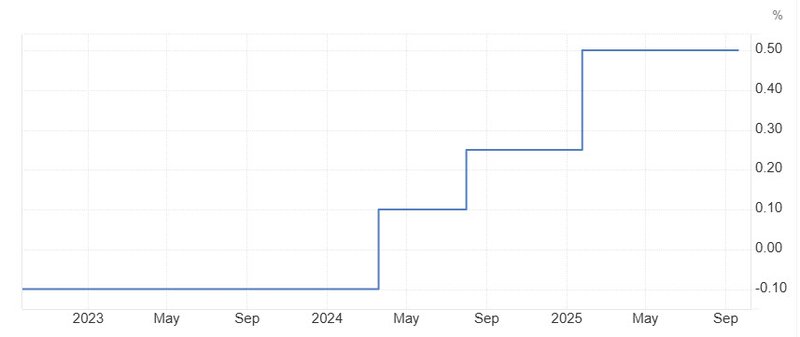

BOJ holds rates at 0.5% while moving towards a policy change

The Bank of Japan left its benchmark rate at 0.5% in September, but dissent from two hawkish board members and the surprise decision to begin preparing ETF and J-REIT sales highlight growing pressure to tighten policy.

BOJ keeps policy rate at 0.5% with a 7–2 split vote.

Takata and Tamura dissent, calling for an immediate hike to 0.75%.

Surprise announcement to sell ETFs and J-REITs signals policy normalization.

Markets react with yen gains and Nikkei retreat.

October meeting expected to bring a 25 bps hike.

A cautious step toward normalization

The Bank of Japan (BOJ) maintained its policy rate at 0.5% during its September meeting, a widely expected decision. Yet the tone of the meeting carried hawkish undertones, with two of the nine board members voting for a 0.75% hike. The split decision underscores mounting pressure within the central bank to gradually wind down its ultra-loose stance as the domestic economy stabilizes.

Source: Tradingeconomics

The BOJ also surprised markets with its announcement that it will begin preparing to sell holdings of ETFs and J-REITs. Though the planned pace — about 0.05% of annual market trading volume — is modest, it signals confidence in financial stability and a willingness to step back from years of market support.

Hawkish dissent grows

The dissenting votes from Hajime Takata and Naoki Tamura, both known for their hawkish views, are notable not just for their content but also for their timing. With most dovish board members appointed during former Prime Minister Shinzo Abe’s tenure now gone, the balance within the BOJ is tilting. Their call for an immediate hike suggests that momentum for tightening is building, particularly with external uncertainty reduced following the new US–Japan trade deal.

This alignment of domestic resilience and external stability could set the stage for the BOJ to deliver a long-awaited 25 bps increase at its next meeting in late October.

Market reaction: Yen up, stocks down

Financial markets were caught off guard by the BOJ’s ETF announcement. The Nikkei 225 reversed earlier gains to fall as much as 1.8%, before settling about 0.6% lower. Meanwhile, the yen strengthened, trading around ¥147.5 per dollar compared to ¥148 earlier in the day.

The reaction highlights the market’s sensitivity to any signs of the BOJ withdrawing from its extraordinary easing policies. For years, Japan’s equity markets benefited from central bank purchases of ETFs, and a shift toward unwinding those holdings raises new questions about liquidity and valuation.

October in focus

Looking ahead, Governor Kazuo Ueda is expected to keep the door open for an October hike, stressing that external risks have eased and domestic inflation is now more entrenched. Core-core CPI remains above 3%, reinforcing arguments for policy normalization.

Still, political instability at home and the risk of global growth shocks could temper the BOJ’s pace. Ueda’s challenge will be to balance the hawkish voices pressing for immediate action with the cautious majority that prefers gradualism.

September’s meeting reinforced the sense that the BOJ is entering a new phase of policy. The combination of dissenting hawks, ETF unwinding, and improving external conditions point toward a 25 bps hike in October. For investors, the message is clear: the era of unquestioned BOJ support is ending, and Japan’s markets must now stand more firmly on their own.