Dollar volatility under Trump

Short-term volatility is likely to continue. Headlines, political speeches, and rumors could push the dollar in either direction, reflecting the “yo-yo” behavior Trump described.

U.S. Dollar recently touched its lowest level in four years.

Weaker dollar to make US exports cheaper.

Administration actively favors a weaker dollar to support trade competitiveness.

Trump’s comments fuel market volatility

The US dollar is testing new lows as markets grapple with a mix of political uncertainty, global pressures, and looming questions over monetary policy. The DXY index recently touched 97.00, its weakest level in four years, reflecting not only investor caution over potential Fed indecision but also broader concerns about US fiscal and trade dynamics.

Dollar weakness is feeding through to markets in multiple ways: US exporters stand to gain from more competitive pricing abroad, but importers and companies servicing dollar-denominated debt face higher costs, adding complexity to the inflation outlook. Global actors, including China and Japan, continue to navigate policies favoring weaker currencies, reinforcing downward pressure.

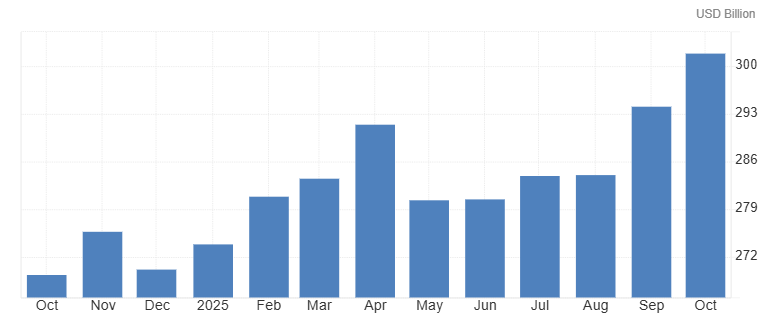

Source: Trading economics

Dollar weakness and policy speculation

Trump’s commentary is raising a subtle but important question: is the administration tacitly or actively favoring a weaker dollar to make US exports cheaper and reduce trade deficits? A lower dollar does make US goods more competitive abroad, but it also increases the cost of servicing debt denominated in foreign currencies and raises import costs for domestic consumers.

US exports of goods and services in late 2025 were about $302.0 billion in October, while imports remained higher at around $331.4 billion, leaving a persistent trade deficit. Historically, the US trade deficit has ballooned exceeding $1.2 trillion in 2024 as imports have consistently outpaced exports despite policy efforts.

Markets are weighing these factors carefully. While the Fed retains independence, any perception that political figures are attempting to influence the dollar can create yo-yo-like volatility, as investors adjust positions based on headlines rather than fundamentals.

Source: U.S. Census Bureau

What’s coming for the Dollar

Short-term volatility is likely to continue. Headlines, political speeches, and rumors could push the dollar in either direction, reflecting the “yo-yo” behavior Trump described. If the administration actively favors a weaker dollar to support trade competitiveness, the greenback could trend lower over the coming months, potentially reaching fresh multi-year lows.

However, the path is not without risk. A weaker dollar can improve US export competitiveness, but it also raises debt servicing costs and could stoke inflation, putting the Federal Reserve under pressure. Markets must navigate this tension carefully, weighing the trade-off between economic growth, currency stability, and financial costs.

China and Japan

Trump’s point on China and Japan is not new both countries have historically maintained policies that indirectly support weaker currencies to make their exports more attractive. These dynamics put additional pressure on the dollar, especially when combined with US political uncertainty and trade tensions.