ECB’s Schnabel signals rate hike potential

ECB board member Isabel Schnabel indicated that the next move for the ECB might be a rate increase rather than another cut, though she was quick to clarify that such a hike is not expected immediately, the ECB had lowered interest rates by a total of two percentage points before pausing its easing cycle in June.

Risks to growth and inflation in the eurozone currently appear tilted toward the upside.

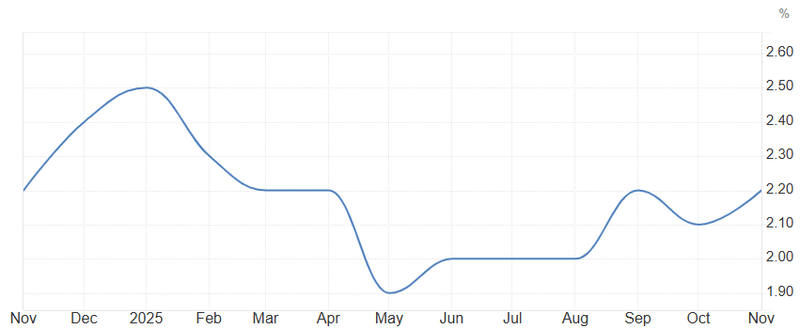

CPI across the euro area have stabilized close to the ECB’s 2% target.

Downside surprise in inflation would weaken the case for a hike.

Incoming data will clear the uncertainty

market expectations that a hike rather than a cut could be the next move, stressing that risks to growth and inflation in the eurozone currently appear tilted toward the upside. She pointed out that the recent slowdown in inflation has stalled just as the economy shows signs of resilience and fiscal stimulus begins to take effect. Though the possibility of a rate hike has been flagged, Schnabel said the ECB will continue to rely on incoming data to guide its decisions. This dovish to hawkish appearance has put markets in a state of uncertainty, the possibility of a future hike has bolstered expectations for euro area bond yields.

Core inflation remains sticky

Recent CPI readings across the euro area have stabilized close to the ECB 2% target, but the pace of improvement has clearly slowed. Core inflation has proven sticky, with services prices remaining elevated and wage pressures lingering. Schnabel suggests that policymakers are cautious that inflation may not continue to fall smoothly toward target and could instead re-accelerate if current trends persist. By signaling comfort with market pricing for a future hike, Schnabel effectively linked policy expectations to the behavior of inflation itself. If CPI data begins to show renewed upside surprises, markets could quickly bring forward pricing for tighter monetary policy. Euro area bond yields have already shown sensitivity to this shift in tone.

Source: trading economics

Inflation watch

The key issue now is incoming CPI releases confirm this risk. If inflation holds near target while core CPI remains high, the ECB may face pressure to keep policy restrictive for longer or even consider renewed tightening. On the other hand, any downward core CPI surprise in inflation would weaken the case for a hike and push expectations back toward policy ease and stability. upcoming inflation will be the center of market focus. The ECB is no longer viewing inflation as a downside risk story. Instead, the balance is becoming more symmetrical, with upside CPI risks now taken just as seriously. For markets, this means that every inflation release over the coming months will carry greater weight in shaping expectations for both the timing and direction of the ECB’s next move.