Fed cuts rates as dissent grows, starts T-bill buys

The Fed delivered a third straight 25 bp cut, but deepening dissent and a surprise plan to buy $40B/month in T-bills show a central bank easing policy while shoring up market plumbing. The bar for further cuts just rose.

Two formal dissents, one for a larger cut; multiple “silent” dissents in the projections

$40B/month T-bill purchases to rebuild reserves and cool funding stress

Odds of rapid follow-on easing fade as internal divisions widen

Markets refocus on liquidity, labor data, and the chair transition in 2026

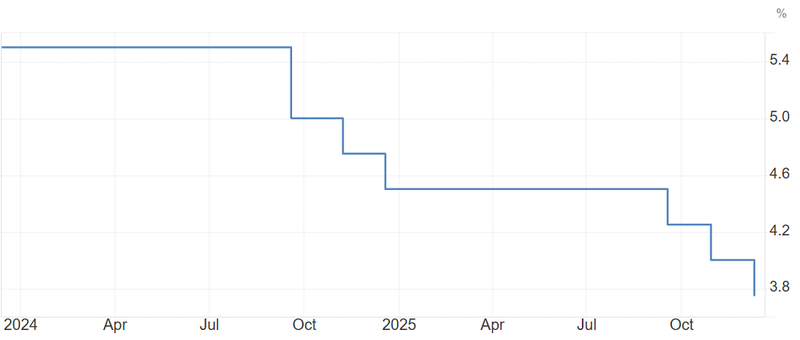

The Federal Reserve delivered its third consecutive 25-basis-point rate cut, but the decision—marketed as a routine risk-management step—unmasked a central bank grappling with widening internal fractures and intensifying liquidity pressures. Chair Jerome Powell may have succeeded in securing a majority vote, yet the underlying message was harder to disguise: consensus inside the Federal Open Market Committee is eroding, and the path beyond December is anything but settled.

Source: TradingEconomics

The rate cut itself was widely expected. What was not expected was the breadth of resistance beneath the surface and the Fed’s simultaneous announcement of $40 billion per month in Treasury-bill purchases, an aggressive move to shore up reserves and stabilize short-term funding markets. Together, the decisions paint a picture of a central bank easing policy while fighting to maintain operational control of the financial system.

A divided Fed: Powell’s thin mandate

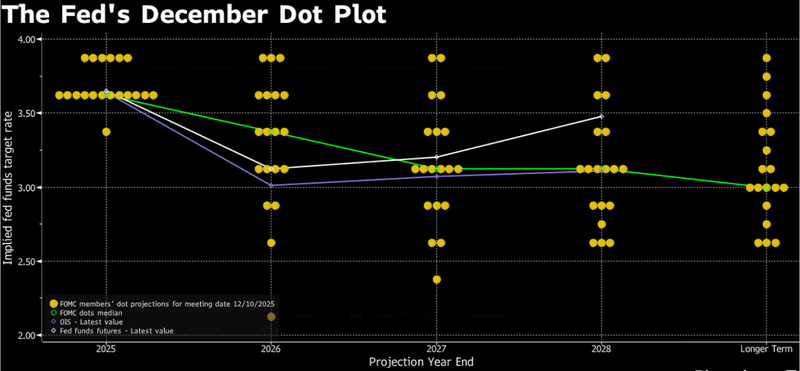

Powell has long positioned himself as the institution’s consensus builder, but Wednesday’s vote exposed the limits of that role. Only three policymakers formally dissented—two preferring no cut at all, one arguing for a larger move. The real challenge, however, lay inside the so-called “silent dissents” buried in the Fed’s updated projections.

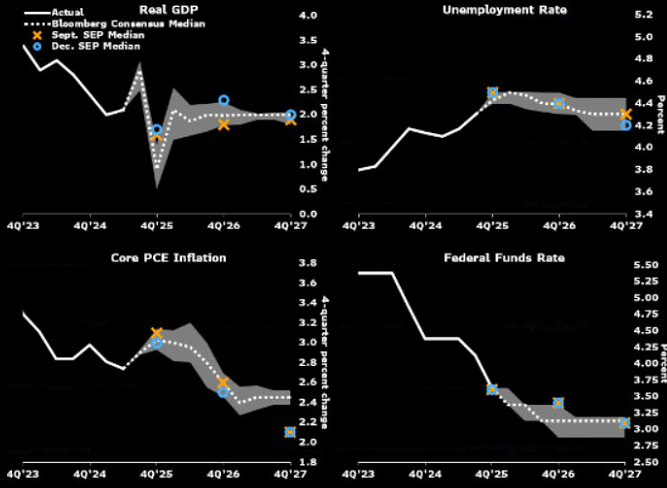

Six officials penciled in year-end 2025 interest rates exactly where they were before the cut. In Fed-speak, that is as close as one can get to saying: We didn’t support this move, and we don’t think we should be cutting more.

Source: Bloomberg

These weren’t fringe voices. Several came from regional bank presidents with reputations for discipline on inflation, even if they lacked a vote this year. Their message was unmistakable: inflation is still above target, the labor market is weakening, and the Committee risks easing too quickly.

One former policymaker, ex-Philadelphia Fed President Patrick Harker, described the split as unlike anything he had seen in a decade. “I would have joined the silent dissents,” he said. “The cut was a mistake.”

That level of disagreement is rare—and destabilizing. It also raises the stakes for the next Fed chair, who will inherit a Committee more polarized than at any point since the pre-Volcker era. President Trump’s expected nominee, widely believed to be Kevin Hassett, will start his term with a committee already divided on fundamental questions of inflation, labor slack, and policy timing.

Regional banks lean hawkish: warning from the grassroots

Another revealing thread came from outside the voting table. Each of the 12 regional Federal Reserve banks submits a recommendation for the discount rate, typically mirroring the president’s policy preference.

Only four banks requested a rate reduction. Eight requested no change—effectively signaling opposition to Powell’s cut.

Regional presidents have historically leaned more hawkish than the Washington-based Governors, and this episode followed the pattern. But the scope of the divergence underscores the communication risk Powell now faces: when nearly two-thirds of the system’s leadership believes the Committee is easing too quickly, market confidence can turn fragile.

Powell, for his part, defended the disagreement as “normal” given the current environment. Inflation remains above target; labor-market pressure is rising; and data delays from the government shutdown have forced policymakers to operate in a “fog of uncertainty.”

But beneath that reassurance was a blunt acknowledgement: “We have one tool. We cannot address both upside risks to inflation and downside risks to employment at the same time.”

The liquidity shock the Fed couldn’t ignore

If the dissent narrative signaled ideological tension, the Fed’s unexpected T-bill purchase program signaled operational urgency.

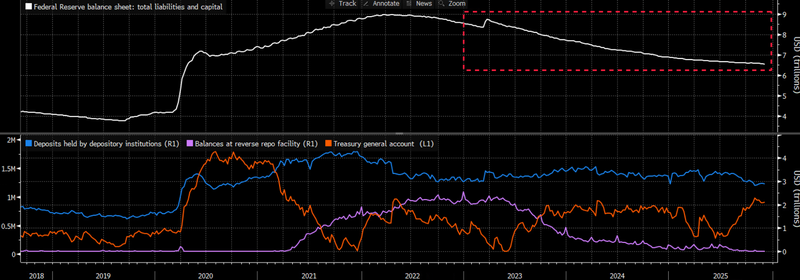

The central bank announced it will begin buying $40 billion per month in short-dated Treasury bills, starting immediately. The goal: rebuild reserves that have slipped to levels the Fed no longer considers safely “ample.” The purchases aim to keep overnight funding markets stable, especially heading into year-end when banks shrink balance-sheet exposure to satisfy regulatory reporting.

Source: Bloomberg

The Fed insisted the move is not quantitative easing. It targets T-bills, not long-duration securities, and is framed strictly as a reserve-management exercise. But the scale and timing caught markets off guard.

- Repo rates retreated quickly after the announcement

- Short-term futures rallied as borrowing pressure eased

- Two-year swap spreads widened to the highest since April

Wall Street had expected a smaller program—perhaps $15–20 billion per month—starting in January. Instead, the Fed acted immediately and at twice the anticipated size.

The comparison to 2019 was immediate. Back then, an unexpected spike in repo rates forced the Fed to pump hundreds of billions into the system. The institution is determined to avoid a repeat.

Why the Bill Purchases matter more than the rate cut

For financial markets, the balance-sheet decision may eclipse the policy-rate move in importance.

Rate cuts influence macro conditions gradually.

Reserve shortages, by contrast, can spark immediate funding stress.

The Fed has spent nearly two years shrinking its balance sheet. But with Treasury ramping up bill issuance, cash moving out of the central bank’s overnight facility, and regulatory reshuffling ahead of year-end, the Fed found itself approaching uncomfortable territory. Powell acknowledged the squeeze directly, saying short-term rates have climbed “quicker than expected.”

In simple terms:

The Fed cut rates to support the economy—but had to intervene simultaneously to prevent funding markets from seizing up.

This combination underscores the delicate balancing act the central bank is navigating as it tries to ease without loosening financial conditions too aggressively or letting market plumbing buckle.

A weaker consensus and a narrower path

Markets still expect the Fed to pause for a while after this cut. The widening dissent—formal and silent—raises the bar for further easing. At the same time, the Fed’s own liquidity actions suggest policymakers fear tightening conditions emerging from the plumbing rather than the policy stance itself.

For Powell, the next few months may be the most difficult of his tenure:

- Inflation is cooling, but still above target

- Labor-market data has softened meaningfully

- Key economic releases were delayed for weeks

- Politics now loom unusually large ahead of the chairmanship transition

Source: Bloomberg

A new chair in 2026 will inherit the same dilemma—except without Powell’s established credibility.