Fed minutes show policymakers split over December rate cut

Yesterday, the Fed minutes came with one clear message: the board is nowhere near agreement on whether there will be a rate cut in December. It confirmed what traders have been sensing for weeks: the Fed is split, the data is messy, and nobody wants to commit to a move without seeing more clarity. The ghost of inflation is rising again.

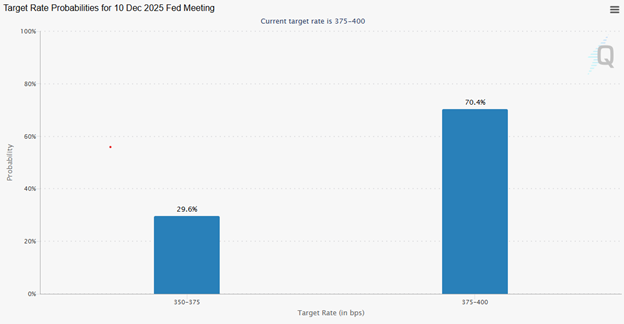

Odds of a December rate cut dropped from 54% to 30%.

Inflation remains sticky around 3.0%.

Ending QT raises questions about starting QE.

Three camps inside the board

The minutes showed the board divided into three camps. A handful of members argued for another rate cut in December, pointing to the labour market and signs that demand is softening. Another group agreed that there should be more rate cuts, but without rushing into them. A third camp still believes in the famous phrase “higher for longer”.

Ending QT raises questions about whether starting QE could allow inflation to accelerate again. Inflation remains the sticking point for the Fed, which had been hoping for a soft landing. Policymakers admitted they are relying more on business contacts and surveys to understand the real economy.

Odds dropped from 54% to 30%

For traders, the takeaway is straightforward: a December cut is no longer the base case. Before the Fed minutes, markets were leaning toward the possibility of a small cut. After the release, those odds dropped from 54% to 30% for a December rate cut, and bond traders have pushed expectations for the next move into Q1 2026.

Source: CME Group

What happens next

The Fed made it clear that it needs more evidence before shifting policy again. If jobs data and inflation soften, the committee could warm up to cuts in early 2026.

The Fed is divided, and the data is uncertain. For now, traders should expect a cautious central bank and a market that stays sensitive to every new data release.