Fed moves towards another rate cut as data blackout limits visibility

The Federal Reserve is expected to cut interest rates by 0.25% this week, lowering the benchmark range to 3.75%–4%. A softer inflation print and concerns over a weakening labor market bolster the case for continued easing despite a government data blackout.

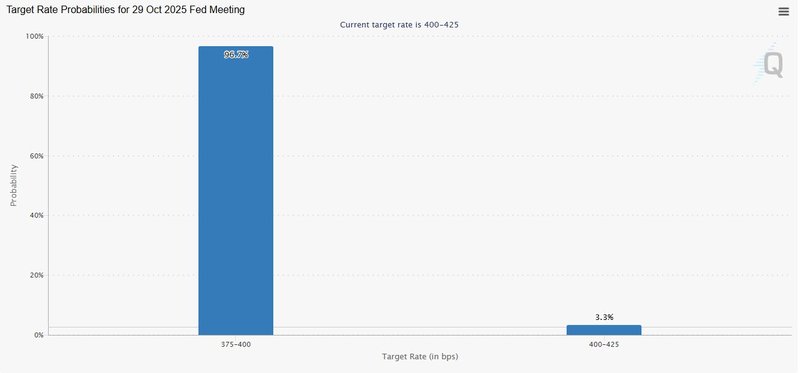

Markets price in a 96.7% chance of a 0.25% Fed rate cut this week.

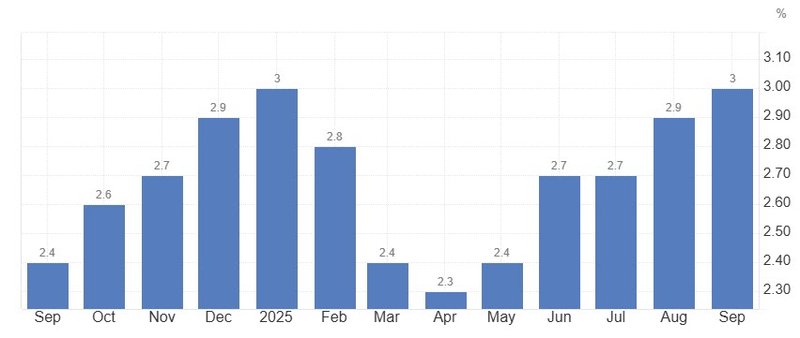

September inflation eased to 3%, lower than forecast.

The data blackout from the government shutdown limits visibility on jobs.

Mortgage rates and loan costs could fall further if easing continues.

Inflation cools, clearing the path for easing

The U.S. inflation rate rose 3% in September, slightly below forecasts, suggesting that President Trump’s latest round of tariffs has not yet pushed consumer prices significantly higher. The subdued reading eased concerns that trade tensions could reignite inflationary pressures and strengthened the case for the Federal Reserve to continue its gradual policy easing.

Source: TradingEconomics

The softer Consumer Price Index reinforced expectations for a 25-basis-point rate cut at Wednesday’s Federal Open Market Committee (FOMC) meeting, which would lower the target range to 3.75%–4% — the second reduction this year. Traders are also pricing in the likelihood of another move in December, potentially bringing cumulative cuts to 0.75% by year-end.

Source: CMEgroup

Balancing act between jobs and inflation

The Federal Reserve’s dual mandate — to foster maximum employment and price stability — has once again become the defining challenge. While inflation has cooled from its 2022 peak of 9.1%, signs of weakness in the labor market have grown more pressing. Chair Jerome Powell recently described conditions as “less dynamic and somewhat softer,” noting that the downside risks to employment have increased.

Yet with the September jobs report postponed due to the ongoing government shutdown, policymakers are relying on private-sector data and alternative labor indicators to assess the economy’s trajectory. Powell said earlier this month that the broader outlook “has not changed much since September,” suggesting that the Fed remains focused on cushioning the employment side of its mandate.

Economists argue that the CPI data will keep the Fed’s attention firmly on labor trends. With hiring slowing and wage gains moderating, a rate cut in October appears all but certain.

What another rate cut means for borrowers

A quarter-point reduction may seem modest, but its ripple effects extend across financial markets. Lower policy rates gradually feed into borrowing costs, offering some relief to households and businesses. Credit card rates and home-equity credit lines — which are typically linked to the prime rate — could fall slightly in the coming weeks, easing repayment pressure for consumers already squeezed by higher living costs.

Mortgage rates, though not directly tied to the Fed’s benchmark, have already moved lower in anticipation of policy easing. The average 30-year fixed mortgage fell to 6.19% last week, its lowest in twelve months, according to Freddie Mac data. While further declines may be limited in the near term, economists believe a sustained easing cycle could keep borrowing conditions supportive for homebuyers heading into 2026.

Markets and policymakers weigh the bigger picture

Despite the policy optimism, uncertainty looms large. The absence of key government data has left officials without their usual analytical compass, increasing the risk of policy missteps. Financial markets, meanwhile, have responded with cautious optimism — equity indices are steady, and Treasury yields have edged lower in anticipation of further accommodation.

Analysts warn, however, that sustained easing could reignite inflation if wage pressures return or if tariffs begin to feed through to consumer prices later in the year. For now, the Fed’s approach remains one of “insurance cuts” — a strategy aimed at stabilizing growth rather than igniting a new expansion.

Easing continues amid uncertainty

With inflation cooling and the labor market under strain, the case for another rate cut is compelling. Yet the broader challenge for the Fed lies in steering policy without a clear picture of the economy’s real-time dynamics. If the government shutdown persists, visibility on employment and output will remain limited — forcing policymakers to rely on high-frequency and private-sector indicators.

For investors and borrowers alike, the message is straightforward: rates are heading lower, but the path ahead is anything but smooth. The Fed’s October decision could mark not just another step in its easing cycle, but also the beginning of a more cautious era of data-blind policymaking.