GBP in focus as bank of England stands firm on rates

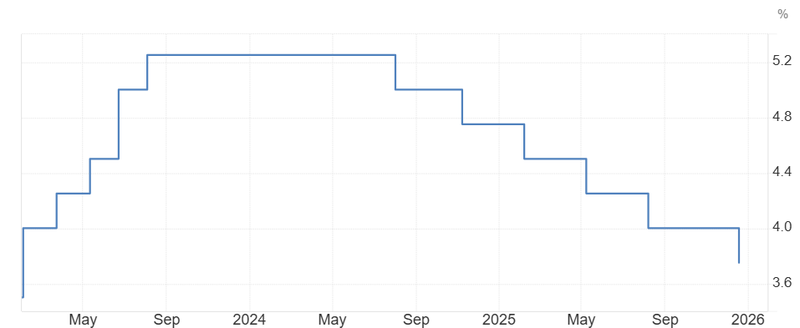

The British pound is back in focus today as the Bank of England is widely expected to keep interest rates unchanged at 3.75%, the Bank is wary of being fooled by temporary factors. Officials are still uneasy about wage growth, which remains sticky.

Interest rates expected to be unchanged at 3.75%.

Inflation could return to the Bank’s 2% target by April or May.

December’s rate cut was a close 5–4 vote.

Unemployment to average 5.4% this year, the highest since 2015.

Interest rates unchanged at 3.75%

The British pound is back in focus today as the Bank of England is widely expected to keep interest rates unchanged at 3.75%, choosing patience over urgency as it waits for clearer signs that inflation is truly under control.

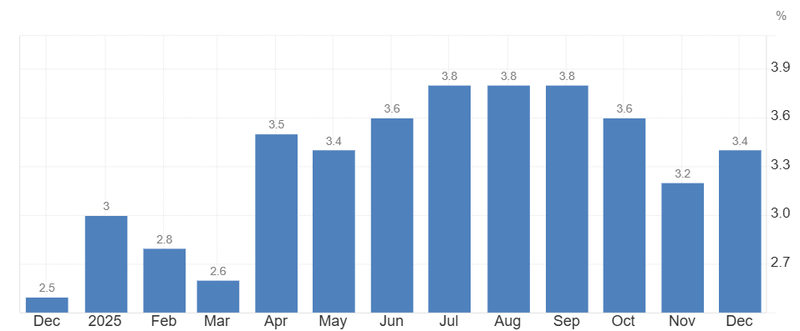

At first glance, the decision looks straightforward. In reality, it reflects how uncomfortable the Bank’s position has become. The UK currently has the highest borrowing costs among major developed economies, while inflation at 3.4% in December remains the highest in G7. Growth is weak, the labor market is cooling, and yet inflation refuses to fade quietly.

For policymakers, this is a delicate balancing act. Cutting rates too early risks reigniting price pressures. Waiting too long risks choking an already fragile economy.

Source: Bank of England

Inflation is falling, but not convincing yet

Governor Andrew Bailey has previously suggested inflation could return to the Bank’s 2% target by April or May, helped by last November’s budget measures and a softer U.S. dollar, which makes imports cheaper and eases price pressure. On paper, that sounds encouraging.

But the Bank is wary of being fooled by temporary factors. Officials are still uneasy about wage growth, which remains sticky. A recent BoE survey showed wage expectations holding at 3.7%, higher than what would normally align with stable inflation. After living through inflation above 11% in 2022, the MPC is in no rush to declare victory.

There are hints of improvement private sector pay growth may be drifting closer to 3%, a level consistent with the inflation target but for now, the data is mixed rather than reassuring.

Source: Office for National Statistics

Markets adjust expectations

That caution is clearly reflected in market pricing. December’s rate cut was a close 5–4 vote, exposing a deeply divided committee. Since then, investors have pushed back expectations for the next cut. According to LSEG data, markets now see April or even July as the most likely window much slower than the four cuts delivered in 2025.

The message from the BoE is simple: rates are approaching a “neutral” level, and from here on, every move will depend on evidence, not optimism.

Economic and political pressure

Outside Threadneedle Street, the picture isn’t getting easier. The UK economy remains sluggish, frustrating Prime Minister Keir Starmer, whose government has yet to see a convincing rebound in consumer or business confidence.

Political uncertainty is also unsettling bond markets. Thirty-year gilt yields recently hit their highest level since November, partly fueled by criticism surrounding Starmer’s brief appointment of Peter Mandelson as ambassador to the U.S.

Meanwhile, the labor market is showing cracks. The National Institute of Economic and Social Research expects unemployment to average 5.4% this year, the highest since 2015, another warning sign that tightening financial conditions are starting to bite.