Safe-haven rush lifts gold and silver to record highs amid US–China strain

Gold and silver surged to record highs on Friday as mounting credit concerns in the U.S. banking sector and renewed tensions between Washington and Beijing reignited investor demand for havens. Bullion briefly reached $4,379 an ounce — its highest level ever — while silver shattered its four-decade ceiling to touch $54.38. The rally gained momentum on expectations of a major Federal Reserve rate cut before year-end, reflecting growing unease over financial stability and geopolitical risk.

Gold touched $4,379 and silver hit $54.45, marking historic peaks.

U.S. regional credit strains and U.S.–China tensions spurred safe-haven flows.

Markets now price in at least one large Fed rate cut by year-end.

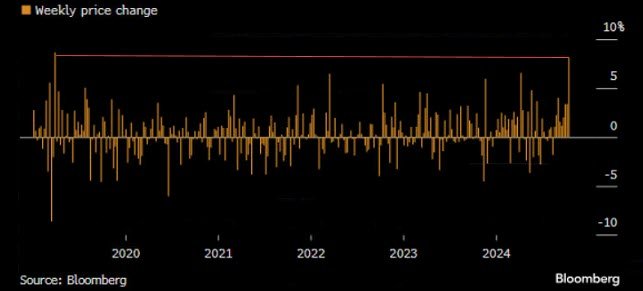

Precious metals posted their strongest weekly performance since 2020.

Historic surge across precious metals

Gold and silver could close the week at historic levels, extending a rally that began in August and accelerated amid heightened market uncertainty. Bullion rose as much as 1.2% on Friday to a record $4,379.93 per ounce before easing slightly, while silver broke decisively above its 1980 peak to $54.45 per ounce.

The surge marked the metals’ largest weekly advance in nearly five years. Platinum and palladium also rallied, supported by broad haven demand and tightening liquidity conditions across global markets.

Source: Bloomberg

Credit concerns revive demand for security

Investor anxiety grew after two U.S. regional lenders disclosed loan irregularities linked to potential fraud, reigniting concerns about credit quality in parts of the financial system. The news came at a time when the ongoing government shutdown has delayed official economic data releases, reducing market visibility and amplifying caution.

With limited access to updated economic indicators, traders turned to gold and silver as reliable gauges of market confidence. The absence of data and growing credit worries combined to create a renewed flight to tangible assets, viewed as a refuge in periods of financial opacity.

Geopolitical tension adds another layer of risk

Tensions between the U.S. and China intensified following a sharp exchange between both countries’ economic officials. China’s Ministry of Commerce publicly criticized Washington’s use of trade threats and warned against further escalation, arguing that decoupling would harm both economies.

The confrontation came less than a week after renewed tariff discussions and export restrictions reignited trade-war fears. Investors who had positioned for calmer U.S.–China relations were forced to reposition, adding fuel to the demand for safe-haven metals.

Rate-cut expectations underpin the rally

The market’s conviction that the Federal Reserve will deliver another rate cut this year provided a powerful tailwind for precious metals. Traders have priced in the likelihood of at least one large policy move by December, with some expecting multiple cuts through early 2026.

Fed Chair Jerome Powell confirmed that the central bank remains on track to ease again this month, emphasizing that the labor market’s softening requires caution. Lower interest rates tend to weaken the dollar and reduce the opportunity cost of holding non-yielding assets such as gold and silver, helping explain the sustained rally across the precious metals complex.

Silver’s breakout magnifies London’s liquidity crunch

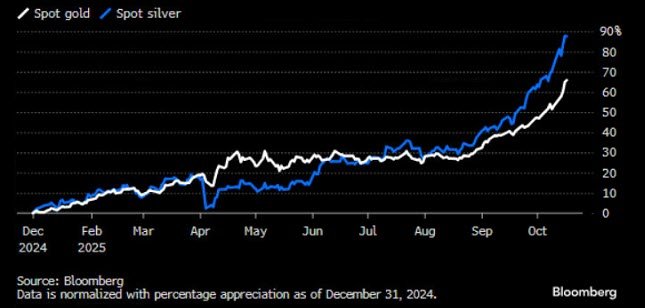

Silver’s rally has been particularly dramatic, driven by both macro and structural factors. The metal has surged nearly 87% since the start of 2025, supported by investor inflows, industrial demand, and severe tightness in the London market.

Liquidity in London’s silver trade has thinned to multi-year lows, pushing the local benchmark to command premiums of more than $1 per ounce above futures prices in New York. Over the past week, more than 15 million ounces have been withdrawn from COMEX-linked warehouses — one of the largest outflows in recent memory — as traders rush to meet delivery shortages overseas.

Although silver slipped 0.5% during Friday’s Asian trading, it remains up more than 7% for the week, underscoring the market’s exceptional momentum.

A return to hard assets amid rising uncertainty

The parallel rallies in gold and silver underscore a deeper global shift toward hard assets as faith in policy stability wanes. Central banks have been steadily diversifying reserves away from the U.S. dollar, while institutional investors are expanding positions in physical bullion and ETFs as a hedge against rising debt, fiscal uncertainty, and political interference.

Gold has gained roughly 65% this year, supported by central-bank purchases, ETF inflows, and mounting fears over global credit conditions. Silver has outpaced even those gains, bolstered by industrial relevance in clean energy and semiconductor applications — and by its role as “the high-beta metal” during times of systemic stress.

Source: Bloomberg

Volatility, but structurally bullish

While both metals are now technically overextended, analysts see the broader trend as structurally bullish. Any confirmation of further Fed easing or renewed U.S.–China friction could drive gold toward $4,500 and silver beyond $56.

Short-term volatility remains a risk, especially if credit fears stabilize or data flow resumes, but few expect the underlying drivers — fiscal strain, global trade frictions, and policy uncertainty — to dissipate quickly.

For now, precious metals have reclaimed their traditional role as the ultimate measure of trust. When confidence in credit, policy, or data wavers, investors return to what history has always recognized as real value.