Gold plunge deepens as crowded rally trades unwind

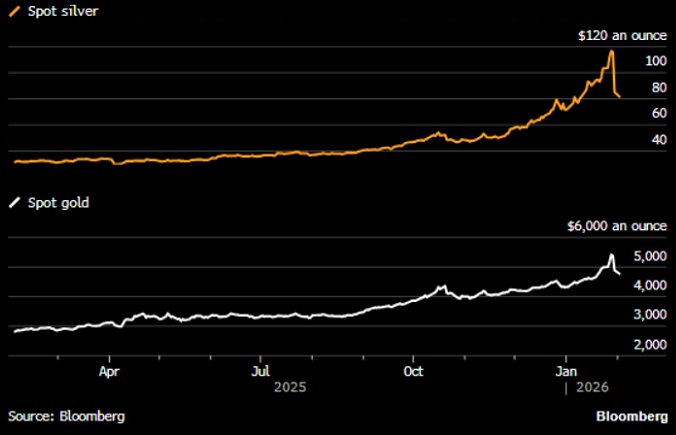

Gold and silver extended sharp losses as investors rushed to exit an overcrowded precious-metals trade, with ETF outflows, leveraged positions and a stronger dollar amplifying one of the fastest reversals in years.

Gold slid as much as 10%, extending its steepest fall in more than a decade

Silver erased all year-to-date gains, plunging up to 16%

ETF selling and leveraged derivatives accelerated the unwind

China’s dip buying may determine whether prices stabilize

A brutal reversal after record highs

Gold extended its selloff after Friday’s historic plunge, falling as much as 10% on Monday and leaving prices nearly 20% below the all-time high reached just two sessions earlier. Silver fared even worse, slumping up to 16% after suffering its largest intraday drop on record at the end of last week.

The speed and scale of the move underscored a sudden retreat in risk appetite was draining liquidity from the market.

Source: Bloomberg

ETFs and leverage fuel the selloff

The rally that carried gold and silver to unprecedented levels had been driven by a potent mix of geopolitical anxiety, concerns over currency debasement and doubts about Federal Reserve independence. In January, that momentum accelerated sharply as speculative flows — particularly from China — added fuel to the advance.

As prices turned, the unwind was swift. Selling pressure was led by bullion-backed exchange-traded funds and leveraged derivatives, according to traders in Asia.

Most buyers who were already sitting on profits had one foot out the door. Once prices started falling, stop-losses and margin calls did the rest.

China’s role now critical

Whether Chinese investors step in to buy the dip is expected to be decisive for near-term price direction. While Shanghai benchmark prices extended losses after reopening, they continued to trade at a premium to international markets, a sign of still-robust domestic demand.

Over the weekend, retail buyers flocked to Shenzhen’s major bullion markets to purchase jewelry and bars ahead of the Lunar New Year. The pullback may actually stimulate physical demand, even as speculative activity cools.

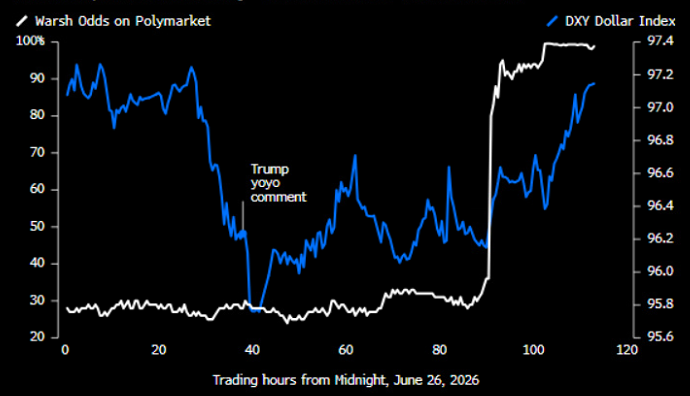

Warsh nomination jolts sentiment

The immediate trigger for Friday’s rout was news that US President Donald Trump plans to nominate Kevin Warsh to lead the Federal Reserve. The prospect of a more hawkish Fed chair lifted the dollar and undermined a key pillar of the precious-metals rally.

Warsh is widely seen by markets as the toughest inflation fighter among the shortlisted candidates, raising expectations of tighter monetary policy and a firmer greenback — both traditionally negative for dollar-priced bullion.

Source: Bloomberg

Fundamentals intact, but pain not over

Even before the news, volatility and soaring prices had begun to strain traders’ risk limits. A surge in call-option buying had mechanically reinforced the rally, forcing option sellers to hedge by buying futures, according to Goldman Sachs Group Inc.. Once prices turned, that dynamic reversed sharply.

Those fundamentals — heavy sovereign debt, geopolitical risk and long-term currency concerns — remain firmly in place. Deutsche Bank has reiterated a longer-term gold target of $6,000 an ounce, saying conditions do not yet point to a lasting reversal.

Silver faces extra pressure

For silver, the collapse below last year’s closing levels risks easing the supply tightness that had emerged in China. Analysts say once expectations of a one-way rally break, short sellers become more willing to deliver metal, helping relieve shortages.