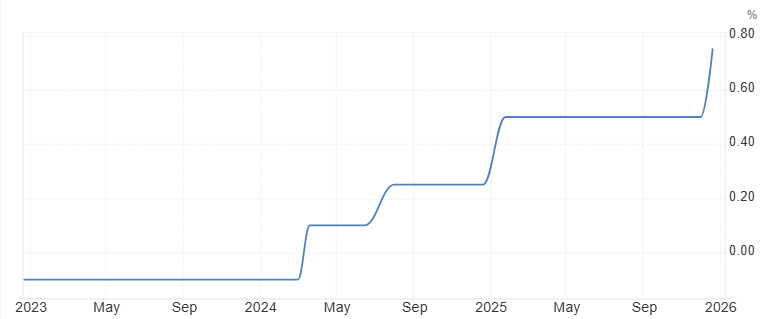

Japan raises interest rates to 30-year high

Bank of Japan (BOJ) raised its key interest rate on Friday to 0.75%, the highest level seen in three decades. This move marks another step in ending years of ultra-loose monetary policy, and many policymakers indicated they are ready for more increases if inflation and economic data continue to justify it.

Core inflation remained above the BOJ’s long-standing 2% target.

Yields on Japanese government bonds have climbed.

Japan’s interest rates are still low compared U.S. and Europe.

Japan’s rate hike marks a turning point in monetary policy

This decision reflects a growing confidence that Japan’s economy has moved away from the deflationary conditions that dominated for decades. More importantly, it signals that the BOJ is no longer focused solely on stimulating growth at any cost but is now balancing growth with price stability. Policymakers have made it clear that further rate increases remain possible if inflation and wage trends continue to support tighter policy. The move was widely expected by markets and approved unanimously by the BOJ board, reinforcing the message that the shift is not temporary or reactive, but part of a longer-term strategy. After years of emergency-style monetary policy, Japan is now entering a normalization phase, even if the pace remains cautious. Future rate hikes will depend on whether inflation remains stable and whether wage growth becomes broader and more durable. Bond yields will likely stay sensitive to BOJ communication, especially any signals about the pace of normalization or further reductions in market support. Overall, Japan’s shift represents a historic change: a move from crisis-era policy toward a more conventional monetary framework. For investors, it marks the return of Japan as a market where interest rates, inflation, and bond yields once again matter not because of emergency support, but because of economic fundamentals.

Source: Bank of Japan

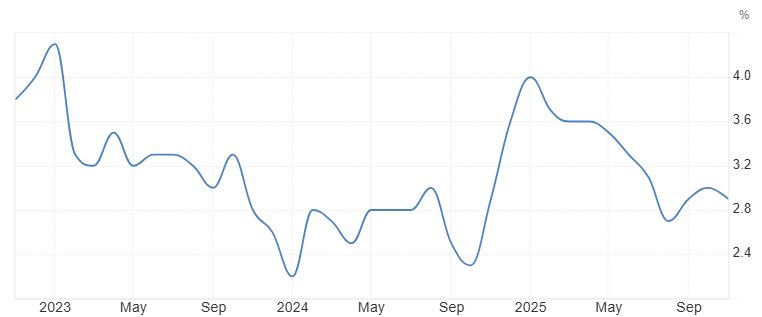

Inflation steady, not surging

Inflation in Japan has not spiked sharply, but it has remained consistently above the BOJ’s 2% target, which is a key reason behind the rate hike. Core inflation, which excludes food, has stayed elevated for many months, showing that price pressures are no longer driven only by temporary factors. Several forces are supporting inflation. A relatively weak yen has increased import costs, especially for energy and food. Wage growth, while uneven, has improved in certain industries, helping domestic demand. At the same time, companies have become more willing to pass higher costs on to consumers, something that was rare in Japan for many years. Crucially, the BOJ does not need inflation to rise further to justify tighter policy it simply needs inflation to remain stable and sustainable. From the central bank’s perspective, steady inflation combined with gradual wage growth suggests that the economy can now tolerate higher interest rates without slipping back into deflation.

Source: Ministry of Internal Affairs & Communications

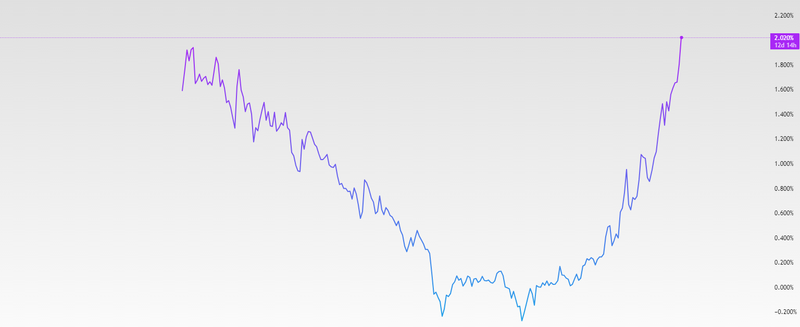

Bond Yields and the End of Yield Curve Control

The most visible market reaction to the BOJ’s policy shift has been in Japanese government bond yields, especially at the long end of the curve. Yields have climbed as investors adjust to a world where the BOJ is no longer actively suppressing borrowing costs. For years, the BOJ operated under a policy known as Yield Curve Control (YCC). Under this framework, the central bank capped yields on 10-year government bonds by buying unlimited amounts of bonds whenever yields rose above a certain level. This policy was designed to keep long-term borrowing costs extremely low, support government spending, and encourage investment. However, YCC increasingly distorted the bond market. Trading volumes dried up, price discovery weakened, and the BOJ became the dominant holder of government bonds. As inflation became more persistent, maintaining yield caps grew harder and more costly. By raising rates and allowing yields to rise more freely, the BOJ is effectively stepping away from strict yield curve control. This does not mean yields will surge uncontrollably, but it does mean the bond market is regaining a more natural role in setting prices. Higher yields now reflect expectations of tighter policy, stronger inflation persistence, and reduced central bank intervention. The steepening of yields also matters for global markets. Japan has long been a source of cheap capital for the world. As Japanese yields rise, domestic investors may find local bonds more attractive, potentially reducing overseas capital flows over time.

Source: Trading View