Kevin Warsh in the spotlight as Trump nears fed chair pick

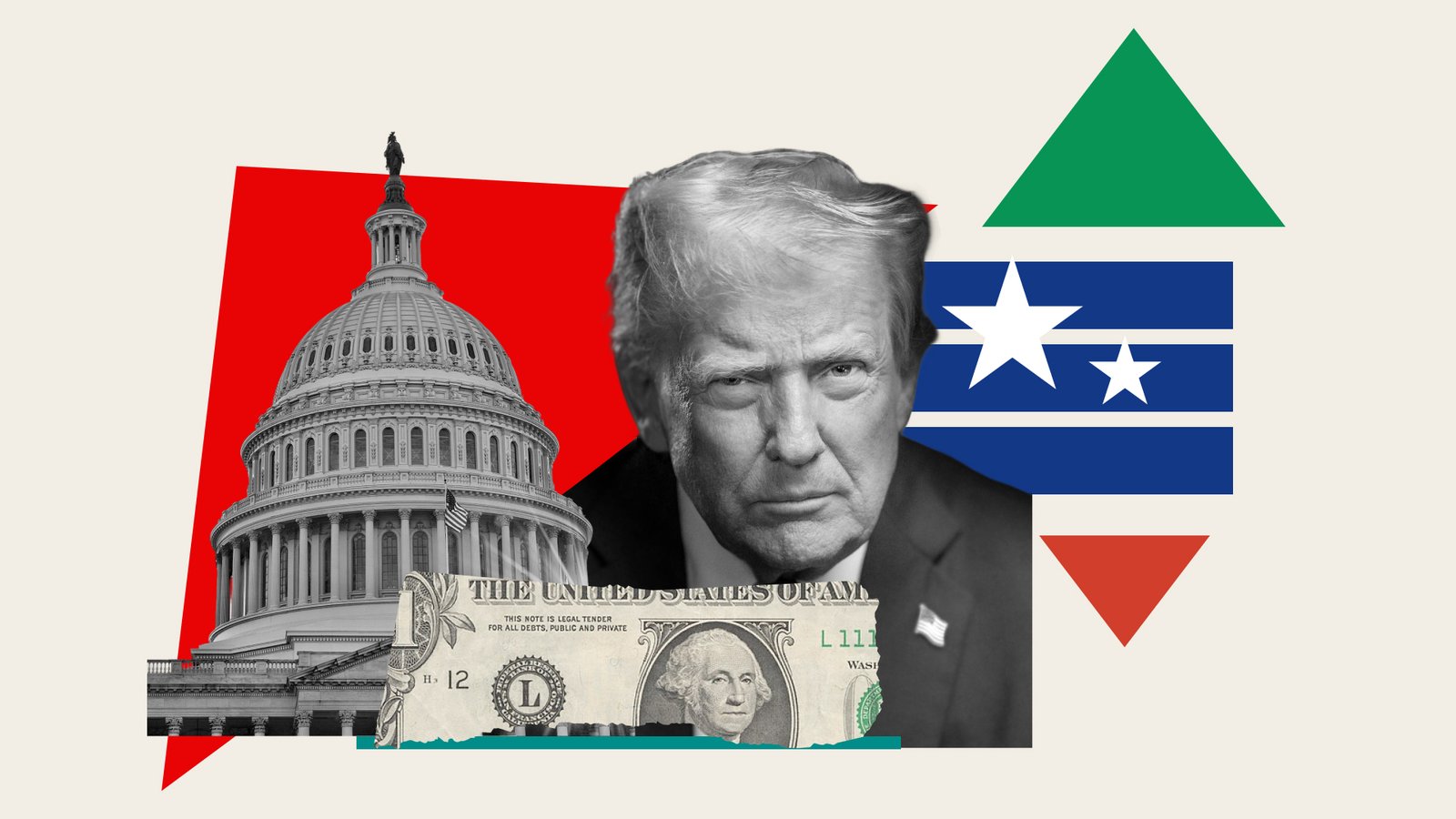

The White House is preparing to unveil a new Federal Reserve chair nominee, a move that could reshape expectations for interest rates and test the confirmation process in Washington.

White House signals imminent announcement for the next Fed chair

Markets react as expectations tilt toward a more rate-cut friendly stance

Senate confirmation may be delayed amid ongoing scrutiny of the central bank

Fed independence remains a central concern for investors

Markets position ahead of the announcement

The US administration is preparing for the president to formally announce his nominee to lead the Federal Reserve, according to people familiar with the discussions. The announcement is expected Friday, though officials caution that the decision is not final until it is made public.

Financial markets moved quickly to price in the shift. US equities slipped, Treasury yields pushed higher and the dollar strengthened, while precious metals came under pressure as investors reassessed the likely direction of monetary policy under new leadership.

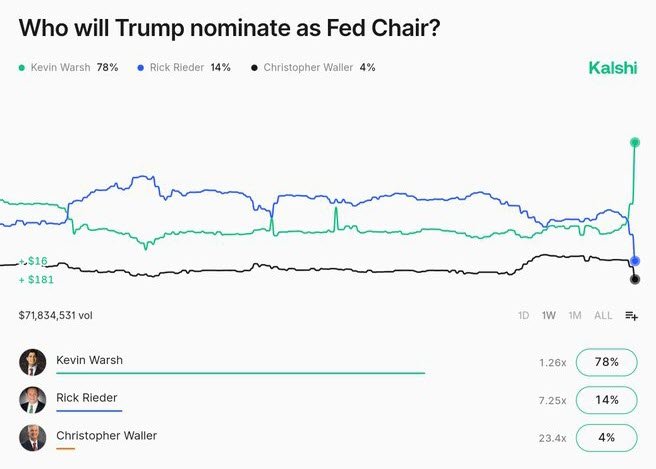

Prediction markets also showed a sharp rise in bets on a specific outcome, underscoring how sensitive markets remain to signals around the future path of US interest rates.

A familiar name returns to the spotlight

The leading contender is Kevin Warsh, a former Federal Reserve governor who served from 2006 to 2011 and has advised the White House on economic policy. If nominated and confirmed, he would succeed Jerome Powell, whose term as chair ends in May.

Warsh has recently argued in favor of lower interest rates, a notable shift from his earlier reputation as an inflation hawk. That positioning aligns with the administration’s push for faster and deeper rate cuts following three reductions late last year, even as the Fed has since paused.

The Federal Reserve earlier this week kept rates unchanged, reinforcing the sense that leadership changes — rather than near-term data — could be the next major catalyst for markets.

Confirmation risks cloud the outlook

Any nomination is expected to face a complicated path through the US Senate. A senior Republican lawmaker on the banking committee has pledged to block Federal Reserve nominees until an investigation into the central bank’s headquarters renovation is resolved, a stance that could delay confirmation.

Senate leadership has indicated that advancing a nominee without full committee support would be difficult, raising the risk of a prolonged vacancy or extended uncertainty at the top of the Fed.

Independence in focus

The looming decision comes at a sensitive moment for the central bank. Legal scrutiny, political pressure and open debate over future rate cuts have intensified concerns about the Fed’s independence — a factor closely watched by investors, especially as the US economy navigates slowing inflation and uneven growth signals.

For markets, the nomination is about more than a single name. It is a signal about how monetary policy may evolve in the months ahead — and whether the next Fed chair will prioritize caution, accommodation, or a more explicitly growth-supportive stance.