Markets brace for busy week of U.S. economic data

Markets are turning their attention to a busy week of U.S. economic data, with the NFP report, retail sales, and the highly anticipated unemployment rate report all scheduled for release. These figures are expected to play a major role in shaping market sentiment and expectations for Federal Reserve policy in the months ahead.

Forecast of just 50K new jobs. If confirmed, this would lead to a clear slowdown in hiring momentum.

A weaker retail sales figure could raise concerns that companies are becoming more cautious.

The unemployment rate is expected to edge higher, rising from 4.4% previously to 4.5%.

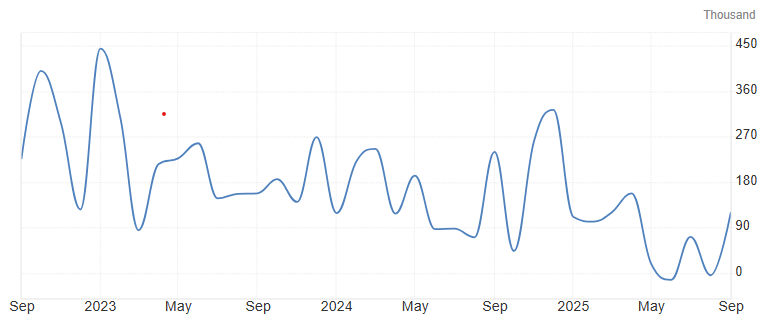

The NFP forecast raises concerns

The Non-Farm Payrolls (NFP) report is one of the most closely watched economic indicators in the U.S., showing job growth across almost all sectors except agriculture. Last month, the economy added 119,000 jobs, already reflecting a slowdown compared with earlier in the year. The upcoming report is expected to be much weaker, with only 50,000 new jobs forecast. Originally scheduled earlier, the release was delayed by 11 days due to the U.S. government shutdown, adding extra attention and pressure to the data.

Investors are not only watching total job growth, but also employment trends in key sectors such as technology, healthcare, and leisure, which often act as early indicators of overall economic health. Wage growth is another critical factor; slower increases could signal easing inflation, potentially influencing the Fed’s interest rate decisions. Conversely, stronger job gains or rising wages would suggest the labor market remains resilient, keeping inflationary pressures higher. The NFP report has also become a political talking point. President Donald Trump has suggested that weaker labor numbers reflect poorly on Fed Chair Jerome Powell, increasing scrutiny on the central bank. Some analysts speculate that if the data is weaker than expected, Powell might feel pressured to start cutting rates—not necessarily because he believes it is needed, but to respond to public and political pressure. Historically, the NFP report can move markets sharply. Stocks react to economic momentum, bond yields and the U.S. dollar respond to potential Fed actions, and gold and other safe-haven assets often benefit if the report disappoints. Beyond immediate market moves, the report helps investors gauge whether the economy is slowing, maintaining steady growth, or holding strong despite higher interest rates.

Source: U.S. Bureau of Labor Statistics

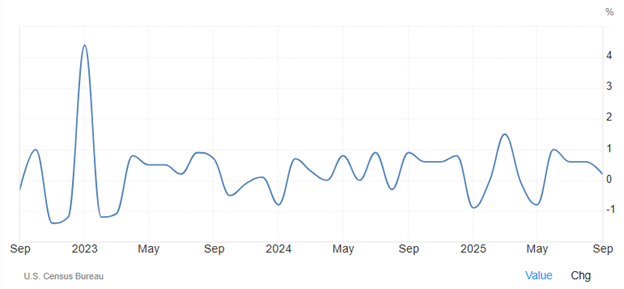

Slower consumer spending

The upcoming Core Retail Sales report will be closely monitored, not just for market moves, but as a gauge of consumer behavior and its broader impact on the economy. If retail sales come in below the 0.2% forecast, it may indicate that household spending is slowing, prompting companies to become more cautious with hiring, production, and inventory. While retail sales may not always trigger immediate price moves on charts, they provide insight into the health of the consumer sector, a major driver of economic growth and a key factor in Fed policy decisions. Slower consumer spending could reinforce expectations that the Fed may need to ease rates sooner to support the economy. Investors often treat this report as a barometer of economic momentum, helping gauge how consumer trends may shape monetary policy and the outlook for risk assets.

Source: U.S. Census Bureau

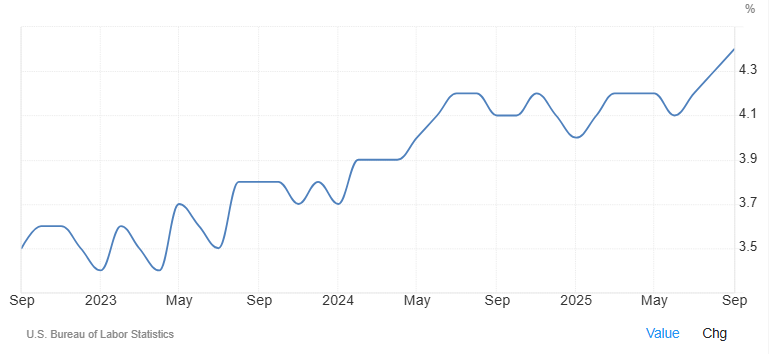

Rising unemployment and market implications

The unemployment rate is expected to edge up from 4.4% to 4.5%, signaling that the labor market may be loosening. For investors, a higher unemployment rate would likely increase expectations that the Fed may need to cut rates sooner to support the economy, even if inflation remains above target. This could push bond yields lower and give a boost to safe-haven assets like gold, while risk-sensitive stocks may rally on hopes of easier monetary policy. At the same time, rising unemployment may caution equities, especially in consumer-focused sectors, as it hints at slowing household income and weaker spending. Politically, weaker labor numbers could increase scrutiny on Fed Chair Jerome Powell, with some suggesting he may feel pressure to act even if he personally views the economy as stable. If the unemployment rate rises as expected and the NFP report shows weaker-than-forecast job growth, markets may interpret this as a sign that a recession is not imminent, but that the economy is gradually slowing. Investors could view these numbers as evidence that the U.S. is on a path of slower, more controlled growth rather than a sharp downturn. Over time, if payroll growth remains weak and unemployment rises, this trajectory may become the likely path for the U.S. economy: moderate expansion, cooling labor conditions, and cautious consumer spending. Such a scenario would likely influence the Fed to adopt a more supportive stance, potentially accelerating rate cuts, while markets adjust expectations for equities, bonds, and safe-haven assets accordingly.

Source: U.S. Bureau of Labor Statistics