Oil falls on rising supply and tentative Ukraine peace

The oil continues to trade under pressure as a combination of rising global supply and the U.S and Ukraine agreed on a new updated peace framework to end the Russia-Ukraine war. Prices have been unable to regain upward momentum after last week drop, reflecting the negativity and the concern of surplus forming into 2026.

Peace deal increases the probability that sanctions will be lifted.

Updated peace framework and the resume of Russia-Ukraine peace discussions.

The dollar has firmed and puts more pressure on commodities.

Medium-term remains that oil drift lower and trades in softer range.

Rosneft and Lukoil sanctions

The new U.S sanctions on Russian oil firms Rosneft and Lukoil, came into effect on Nov-21.

Those sanctions cut off major pathways for Russian oil exports and restrict global buyers and bank from transacting with these companies; the peace agreement is important for the Russian oil market. A peace deal increases the probability that sanctions will be lifted.

Geopolitical risk

One of the biggest new came last week was the updated peace framework and the resume of Russia-Ukraine peace discussions. Any progress toward a political settlement could bring additional Russian barrels back into global market and reinforcing the supply.

Traders remain cautious, past negotiation rounds have failed to lead to real outcomes, leaving room for sharp reversals if talks break down again.

Macro environment

The macro landscape is adding more pressure with Fed now uncertain that a December rate cut is not guaranteed, the dollar has firmed and putting more pressure on commodity prices.

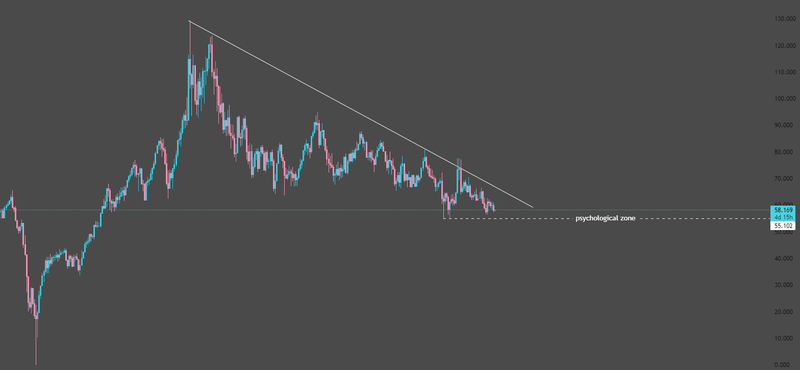

Typically, when the USD is strong it weighs on oil because it makes crude more expensive for global buyers, if the upcoming market events remain solid the expectations of a delayed rate cut could drag oil prices lower through the end of the month and target the psychological zone 55.10.

Source: Trading View

Market outlook

With supply rising, inventories building and geopolitical turning less supportive, the overall picture remains to the downside.

However, oil is a market with quick reversals remembering what happened on April-2025, any disruption in the Middle East, Russia, or major OPEC decision, another breakdown in peace negotiations could produce fast and sharp upside movement.

But without such catalyst, the medium-term remains that oil drift lower and trades in softer range as the market digests increasing supply.