Silver surges past historical highs with parallels to the Hunt Brothers’ market saga

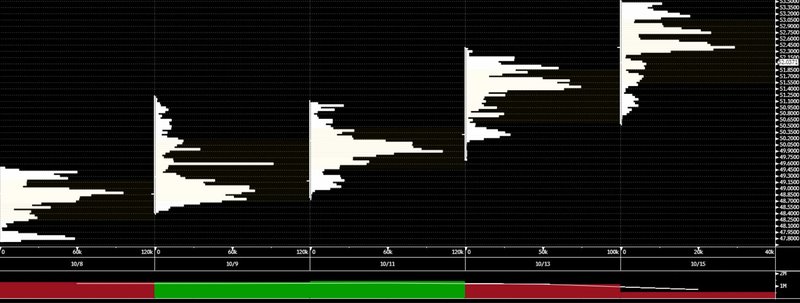

After forty-five years, silver has broken through its all-time high, surpassing levels not seen since the Hunt brothers’ legendary 1980 squeeze. Spot prices in London vaulted above $53.40 per ounce this week as liquidity strains in the bullion market triggered a scramble among traders and arbitrageurs.

Spot silver surges above $53.40, breaking the 1980 Hunt brothers’ record.

Liquidity shortage in London drives premiums over New York to near-record highs.

One-month silver lease rates soar past 30%, signaling market stress.

Analysts warn volatility could intensify amid tight supply and speculative flows.

A historic breakout four decades in the making

On Tuesday, the global silver market witnessed a moment that traders will remember for decades: spot prices pierced the 1980 ceiling once set during the Hunt brothers’ attempt to corner the market. The milestone came amid surging physical demand, constrained supply, and mounting liquidity pressure in London — the center of global silver clearing.

London spot silver climbed to $53.40 per ounce, surpassing the old benchmark that had endured as both a symbol of excess and a cautionary tale. The rally has been nothing short of spectacular, propelled by a combination of safe-haven flows, declining interest rates, and speculation that industrial demand — from solar to electronics — will continue to outstrip supply.

London’s liquidity crunch and the transatlantic rush

Behind the record lies a crisis of liquidity. The London Bullion Market, historically the world’s deepest pool for precious metals, is now facing acute scarcity. Lease rates for one-month silver have soared above 30%, the highest since records began, making it prohibitively expensive for traders to maintain short positions.

The imbalance has turned logistics into strategy. With London prices trading at a premium of up to $3 per ounce over New York, traders reportedly chartered transatlantic cargo flights to physically move bullion and capture arbitrage spreads. Although the premium has since narrowed to around $1.75, it underscores the structural stress in the system.

Goldman Sachs analysts noted that the silver market’s smaller size — roughly one-ninth of gold’s — amplifies every move. “In the absence of central bank buying to stabilize prices, even a modest reversal in investor inflows could produce exaggerated volatility,” they warned.

From hunt brothers to hedge funds: the anatomy of a squeeze

The echoes of 1980 are unmistakable. Back then, Texas oil magnates Nelson and William Hunt used leverage and futures contracts to corner nearly one-third of the world’s deliverable silver supply. When regulators tightened margin rules, the bubble imploded, sending silver prices from $50 to below $11 within months.

Today’s dynamics are different but share a familiar fragility. Instead of a single speculative cabal, the market now faces a diffuse army of investors, ETFs, and algorithmic funds chasing momentum. Yet the structural ingredients — excessive leverage, constrained supply, and funding stress — are remarkably similar.

A series of rate cuts by the Federal Reserve, combined with fiscal deficits and resurgent safe-haven demand, has created the perfect backdrop for silver to outperform. Exchange-traded funds have expanded their holdings, while industrial users are struggling to secure supply amid record-low inventories at London’s vaults.

Safe havens and systemic strain

The broader precious metals complex is riding the same macro wave. Gold, platinum, and palladium have all surged between 55% and 82% this year, as global investors hedge against inflation, political risk, and concerns over the U.S. government’s fiscal trajectory.

Yet silver’s rally has outpaced them all, transforming from a secondary precious metal into the market’s barometer for liquidity stress. Analysts say the move reflects not only investor demand but also structural deficits in supply — a theme reinforced by Bank of America’s recent upgrade of its 2026 price forecast from $44 to $65 per ounce.

Policy uncertainty adds fuel to the fire

Adding another layer of tension, traders are watching for results from the U.S. government’s Section 232 investigation into critical minerals — including silver, platinum, and palladium. Fears that these metals could be targeted under new tariff or export-control measures have injected geopolitical risk into an already overheated market.

The combination of supply deficits, speculative leverage, and regulatory uncertainty has made silver uniquely volatile. Should the Bank of Japan’s or Federal Reserve’s monetary decisions further shift global liquidity, another wave of volatility could easily follow.

Unfinished business of the hunt brothers?

Whether the comparison to 1980 proves prescient or premature depends on how the liquidity crisis resolves. If physical shortages persist and central banks remain passive, silver could sustain its momentum deep into next year. But if speculative positioning unwinds abruptly, the correction could be equally historic.

What is clear is that silver has reclaimed its place at the center of global market drama — not as a relic of the past, but as a living barometer of financial tension. Forty-five years after the Hunt brothers’ downfall, their unfinished business may be finding a new generation of traders to test history’s limits once again.