US jobs report preview: Slowing growth may push Fed closer to rate cuts

The August 2025 non-farm payrolls report is expected to confirm a weakening US labor market, with forecasts of +75,000 jobs and unemployment rising to 4.3%. A soft reading could strengthen expectations for a Federal Reserve rate cut this month, with significant implications for the dollar, equities, and gold.

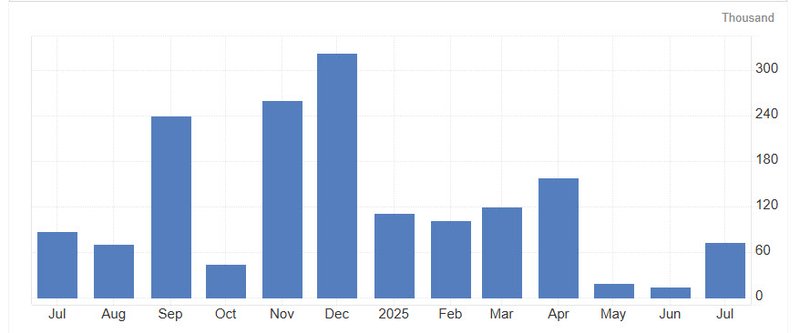

Consensus calls for +75,000 jobs in August, slightly above July’s +73,000 but far below earlier 2025 levels.

Unemployment expected to rise to 4.3% while wage growth slows to 3.7% y/y.

Prior months saw downward revisions of 258,000 jobs, highlighting deeper weakness.

Manufacturing has lost jobs for three consecutive months, while labor participation fell to a 31-month low.

Fed policymakers are under pressure to deliver a September cut as markets price in more than 50 bps of easing by year-end.

Labor market momentum fades

After years of strong payroll gains, the US labor market is showing clear signs of fatigue. August’s NFP report is projected to show just 75,000 new jobs, a pace consistent with July’s disappointing outcome and well below the 110,000 expected a month ago.

The unemployment rate is set to climb to 4.3%, while average hourly earnings growth is expected to ease from 3.9% y/y to 3.7%. The labor force participation rate has dropped to a 31-month low, and factory payrolls have shrunk by 36,000 over three months.

Perhaps most alarming are the downward revisions to earlier data: May and June payrolls were cut by a combined 258,000 jobs, underscoring that the labor market has been weaker than initially believed.

For the Federal Reserve, the August report comes at a pivotal moment. Chair Jerome Powell has already signaled that labor market risks now outweigh inflation concerns. Still, the Fed faces a conundrum: job creation is cooling, but wage growth remains elevated enough to risk a wage-price spiral.

Market expectations: A September cut is priced in

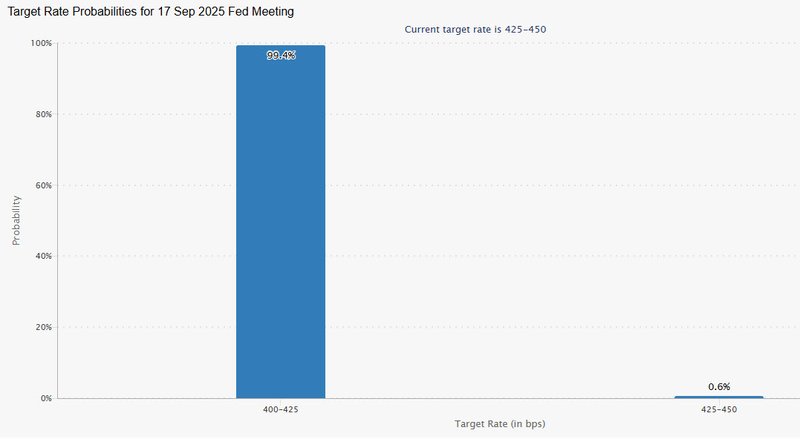

Financial markets are convinced the Fed will cut in September. Fed funds futures show:

- September: a 25 bps cut is almost fully priced.

- October: a further cut is seen as a coin flip.

- December: nearly 40% odds of another reduction.

Officials like Atlanta Fed President Raphael Bostic have said the jobs data could be decisive. “I am not ruling out a September rate cut depending on the coming jobs report and other data,” he noted.

That means even a moderately weak report will likely lock in a cut. Only a major upside surprise in hiring and wages could derail current expectations.

Leading indicators: Mixed signals

Economists often look at early indicators to anticipate the NFP report:

- ISM services employment: steady at 46.5 (below 50, contractionary).

- ISM manufacturing employment: 43.8, little changed and still weak.

- ADP private payrolls: just +54,000 vs. +106,000 prior.

- Jobless claims: 4-week average rose to 231,000 from 221,000.

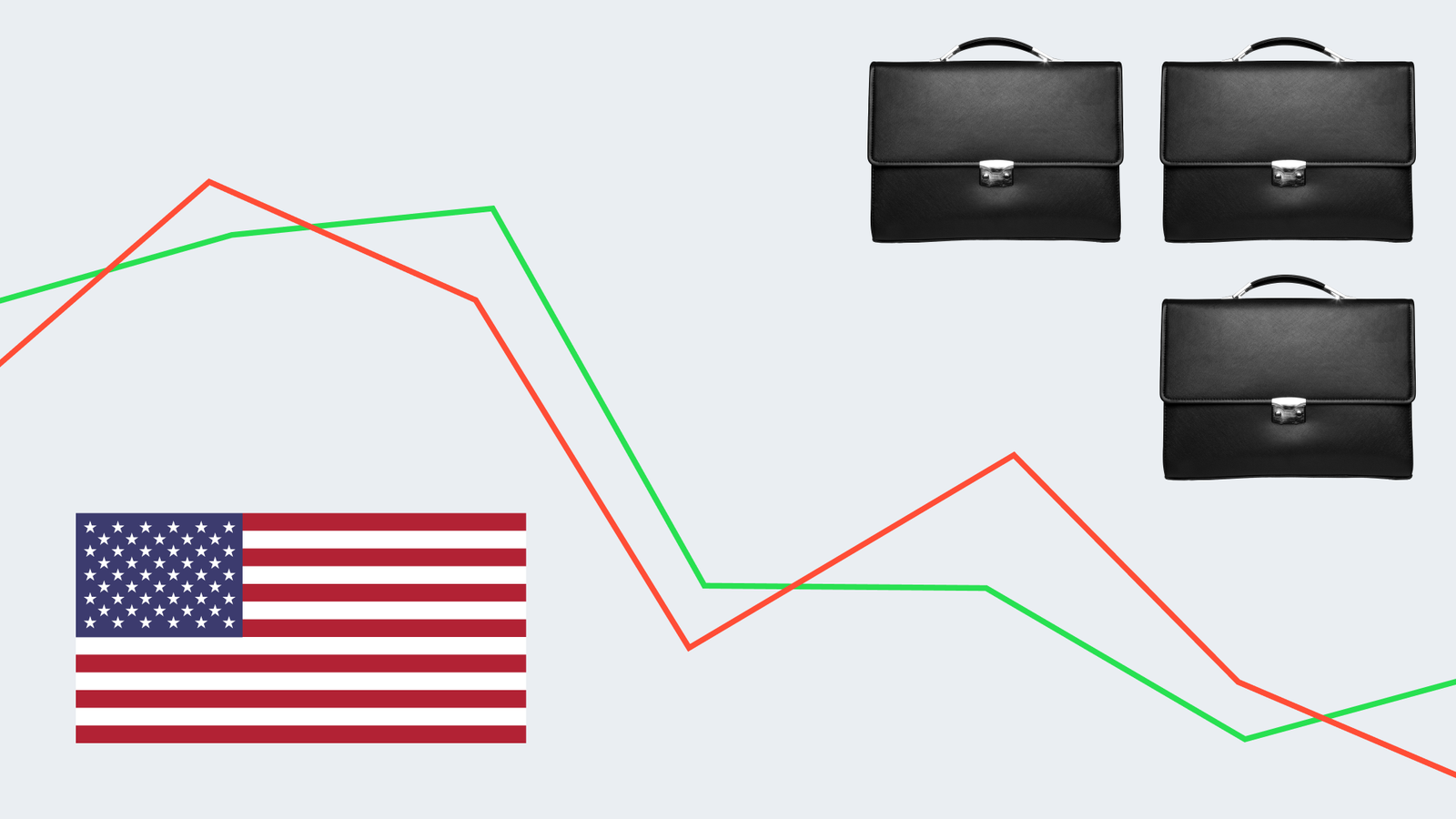

Market scenarios: How assets may react

The jobs report rarely moves just one market — its ripple effects hit FX, equities, bonds, and commodities.

US dollar (DXY):

- Weak print (<50K, soft wages): bearish, DXY could break below 97.50.

- In line (~75K, wages ~0.3%): neutral, market focus shifts to October FOMC.

- Strong print (>125K, wages >0.4%): bullish, rate-cut bets pared back.

Equities (Dow Jones, S&P 500):

- Weak jobs → bullish (reinforces cuts, liquidity support).

- Strong jobs → bearish (delays easing, higher yields weigh on valuations).

Gold:

- Weak jobs/wages → bullish, as lower yields and dovish Fed support safe-haven demand.

- Strong jobs/wages → bearish near-term, though geopolitical risks keep a floor under prices.

Treasuries:

- A weak report drives yields lower.

- A strong report could see the 10-year yield push back above 4.5%.

What to watch in the NFP release

- Headline jobs growth: a sub-100K pace suggests the economy has entered a slower “new normal.”

- Unemployment rate: expected to edge higher to 4.3%, with risks of further increases later this year.

- Wages: a key determinant of whether inflation risks remain sticky; any surprise above 0.4% m/m could complicate the Fed’s dovish stance.

- Participation rate: continued declines signal underlying weakness beyond the headline unemployment number.

Some Fed officials argue the US may be entering a new phase where monthly job growth below 100K is sustainable. With immigration boosting labor supply, a slower pace of hiring may still be consistent with stable unemployment.

Yet for markets, the perception of slowdown matters as much as the data itself. If the economy cannot generate jobs at last year’s pace, investors will increasingly expect easier policy — regardless of whether the Fed believes the labor market is balanced.

The August 2025 NFP release is more than a data point: it is a referendum on the US economy’s resilience and the Fed’s independence. A weak print would seal the case for a September cut, likely boosting stocks and gold while pressuring the dollar.

But the deeper risk lies in the divergence between slowing job creation and persistent wage growth. If wages remain sticky, the Fed may find itself trapped — easing into weakness but unable to declare victory on inflation.

For investors, today’s report is not just about the numbers. It is about understanding how the Fed will interpret them, and how that interpretation will cascade across global markets.