US Tariffs and silver national security

The latest move by the United States to impose a 25% national security tariff on certain high-end semiconductors marks a significant escalation in the ongoing effort to reshore critical technology supply chains. While the immediate focus of the policy is the semiconductor sector, the broader implications extend well beyond chips, with notable spillover effects into silver.

Donald Trump’s earlier threat of tariffs as high as 100% on chips not produced domestically.

Consequence lies in the materials required to support domestic chip manufacturing.

Supply chain adjustments may involve shifts in procurement patterns rather than immediate changes in total demand.

Tariffs as industrial policy, not trade policy

According to U.S. trade data, the country imported approximately $110–120 billion worth of semiconductors and related devices in 2024, with a significant portion linked to advanced logic and AI-capable chips. While not all imports fall under the new tariff criteria, the affected segment represents a high-value portion of the market. The White House has described the measure as a “phase one” action, indicating that additional tariffs or restrictions could follow depending on negotiations with foreign governments and semiconductor firms. President Donald Trump has previously stated that tariffs on non-U.S.-made chips could rise as high as 100%, underscoring the strategic rather than temporary nature of the policy.

The tariff initiative is part of a broader effort to reduce U.S. dependence on foreign semiconductor manufacturing, particularly from East Asia. Despite recent investments, the United States currently accounts for around 12% of global semiconductor manufacturing capacity, down from nearly 40% in 1990, highlighting the scale of reshoring ambitions relative to existing capacity.

Hidden demand for silver

In 2024, global silver mine production was estimated at approximately 820–830 million ounces, while total demand exceeded supply by a margin of 100 million ounces, according to industry data. Electronic-related demand has been one of the more stable components of consumption, compared with jewelry or investment demand, which tends to fluctuate more with price and macroeconomic conditions. The linkage between semiconductor policy and silver demand therefore reflects a structural industrial relationship rather than a speculative one.

Alongside semiconductor tariffs, the US also completed a month-long national security review of critical minerals, including silver. President Donald Trump ultimately stopped short of imposing sweeping tariffs, instead signaling a preference for bilateral negotiations and discussing the possibility of price floors. While no immediate measures were enacted, the review itself had already influenced market behavior.

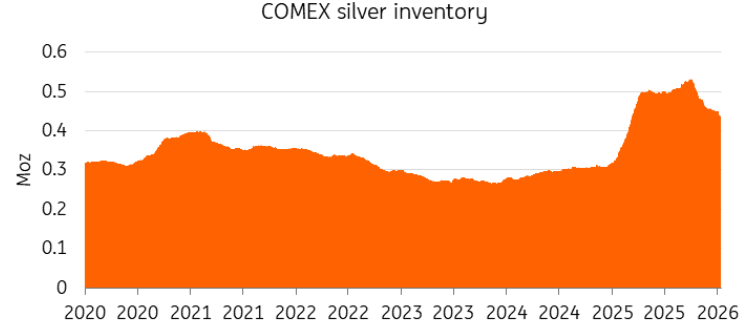

Fears that tariffs could be imposed led to precautionary stockpiling of silver in the United States, contributing to a global short squeeze in October that helped drive an end-of-year rally to record highs. According to Bloomberg, about 434 million ounces of silver are currently held in Comex-linked warehouses in New York, roughly 100 million ounces more than a year earlier, when trade disruptions tied to tariff uncertainty intensified. The concentration of inventories in US storage reduced available supply elsewhere, amplifying volatility in global silver markets.

Source: COMEX

Supply chain and cost implications

Semiconductor manufacturing is among the most capital-intensive industrial activities, with leading-edge fabrication plants costing $15–20 billion per facility and requiring long lead times for construction and qualification. Tariffs on advanced chips can influence cost structures across the technology supply chain, particularly for U.S. firms that rely on imported high-performance processors for data centers, defense systems, and advanced computing applications.

For upstream materials such as silver, the effects are more indirect. Silver prices and availability are influenced by mining output, recycling rates, and demand from multiple sectors, including electronics, solar energy, and automotive electronics. As semiconductor production shifts geographically, procurement strategies for silver may adjust accordingly, affecting logistics, refining, and inventory management rather than total global consumption.