Wage growth, inflation, and the future of rate cuts

U.S. wage growth has moved to the center of market attention as investors and policymakers closely watch signs of cooling or renewed inflation pressure in the world’s largest economy. While the labour market has shown early signs of slowing from its post-pandemic strength, wages remain one of the most sensitive components of the inflation outlook.

Wage growth has shown resilience even as hiring activity has softened.

Acceleration in wages could revive fears that inflation will remain sticky.

A stable labour market with moderating wage growth would give the Fed room to ease policy.

Critical economic signal

Wages play a unique role in the U.S. economy. They directly affect household purchasing power, consumer confidence, and overall demand. When wages rise in a healthy but controlled way, they support consumption without fueling inflation. However, when wage growth accelerates too quickly, it can amplify inflationary pressures through higher production costs and stronger consumer demand. Strong wage growth has also proven to be a powerful tool for gaining public support, as seen in the period before 2021 when rising incomes boosted confidence and spending. Yet that same surge in demand later contributed to overheating across the economy, ultimately helping to drive U.S. inflation to a multi-decade high of 9.1%. In recent months, wage growth has shown resilience even as hiring activity in the labour market has softened. This mixed picture has created uncertainty: on one hand, consumers still have income support; on the other, persistent wage growth risks slowing the pace of disinflation that the Federal Reserve has been working to achieve.

Between rising wages and fear of inflation

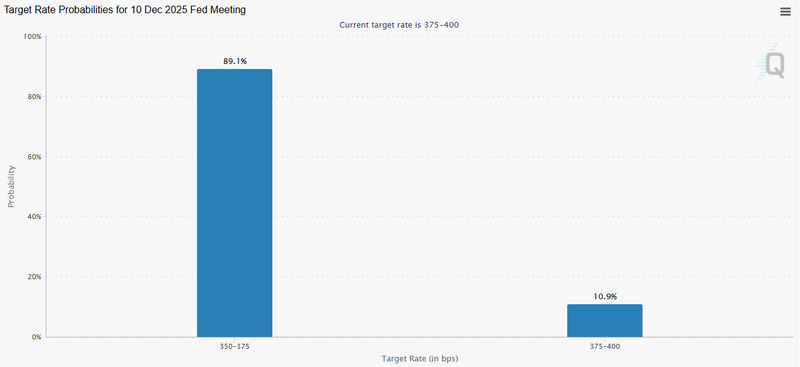

Markets are now highly sensitive to upcoming labour-market and inflation indicators, particularly private-sector employment data, non-farm payrolls, wage-growth reports, and service-sector activity surveys. Rising wages, alongside the expected shift toward quantitative easing and the growing probability now near 90% of a December rate cut, have made inflation data especially critical in the coming months. Any unexpected acceleration in wages, combined with looser monetary policy, could revive fears that inflation may pick up again. This data-dependent environment means that even modest deviations from forecasts can trigger sharp moves across equities, bonds, and currency markets.

Source: CME Group

Quantitative easing is now underway

Wage growth has become an even more critical variable for policymakers. The Federal Reserve is not only focused on headline inflation figures, but also on whether wage pressures are feeding into a broader and sustained inflation cycle. If wages continue to rise faster than productivity, companies’ cost structures become structurally higher, making it difficult for inflation to return to the Fed’s 2% target and putting the dream of a soft landing at risk. This is why policymakers repeatedly emphasise a “data-dependent” approach. A stable labour market with moderating wage growth would give the Fed the flexibility to cut rates more confidently without triggering a renewed wave of inflation. For now, both markets and policymakers remain in a wait-and-see mode. Every wage report, employment release, and inflation update has the potential to reshape expectations. Until clearer trends emerge, volatility is likely to remain elevated across financial markets.