BoE set to cut rates as inflation cools and growth falters

The Bank of England is widely expected to deliver a quarter-point rate cut on Thursday, as easing inflation and a weakening economy shift the policy debate from price pressures toward jobs and growth — even as divisions on the Monetary Policy Committee remain entrenched.

Markets price a 25-bp cut to 3.75%, the lowest level in nearly three years.

Softer inflation, easing wage growth and back-to-back monthly GDP contractions strengthen the case for action.

A close vote is likely again, with a split decision still the base case.

Guidance is expected to stay cautious, with attention on how close policy is to “neutral.”

The decision: a pre-Christmas cut now looks like the base case

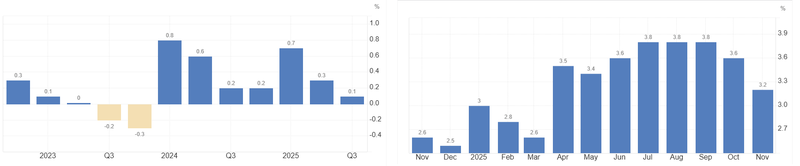

The BoE is expected to lower its benchmark rate by 25 basis points to 3.75% at 12 p.m. London time on Thursday, according to prevailing market pricing and most economist forecasts. The case for a cut has strengthened as inflation has cooled more quickly than expected, while recent activity data have pointed to a soft patch that is increasingly hard to dismiss.

Source: TradingEconomics

The vote: divisions persist even if the outcome shifts

The key question is less whether the BoE cuts than how the committee lines up. The MPC has been split between officials pushing for more evidence that disinflation is durable and those worried policy is staying too tight for too long as the economy loses momentum. A narrow margin remains likely, with investors watching whether any of the more hawkish members soften their stance after the latest downside surprise in inflation.

Guidance: “gradual” stays, but the bar for follow-through may rise

Even if the BoE delivers the cut, it is likely to keep a guarded tone on what comes next. The committee has leaned on “gradual” easing language while stressing that policy becomes less restrictive as rates approach a level that neither stimulates nor restrains demand. Traders will be looking for any signal that the BoE is nearing the end of its easing phase — or, at minimum, that future cuts will be more conditional on data rather than automatic.

Budget effects: near-term disinflation, longer-term uncertainty

Markets will also parse how policymakers frame the impact of Chancellor Rachel Reeves’ budget measures. The BoE has flagged that some steps could temporarily lower inflation in coming quarters, even if the broader fiscal mix raises bigger questions over the medium term. The central bank’s challenge is separating one-off effects from the underlying trend — and judging whether inflation expectations cool alongside the headline numbers.

Growth and inflation: the trade-off shifts toward the real economy

The backdrop has turned more uncomfortable for the BoE. The economy has shown signs of stalling, with recent monthly output data contracting and surveys pointing to weak momentum heading into year-end. At the same time, inflation has run below the BoE’s prior assumptions, giving the committee more room to focus on activity risks — without declaring victory on price stability.