EU Q4 2025 Outlook

Weak growth meets stubborn inflation as ECB holds steady

The eurozone enters Q4 with weak growth and stubborn services inflation. A stronger euro and fragile global conditions are weighing on demand, while the ECB looks set to keep rates at 2.00% into December as quantitative tightening continues.

Growth recovery remains uneven

Euro area momentum has picked up slightly but remains fragile. September flash PMIs show the bloc growing at its fastest pace in 16 months, driven by a rebound in German services while France continues to contract. This two-speed core leaves the recovery brittle. With new orders still weak, the expansion looks more like a slow repair than a strong surge, arguing for caution over celebration.

Domestic demand is moving up, though the pace remains modest. Labour markets remain tight, with euro area unemployment at 6.2% in July, supporting real incomes. Retail volumes are choppy month to month but still above last year’s levels.

Bank lending is also recovering slowly. The ECB’s July survey showed little change in credit standards, while August data point to slightly faster loan growth for firms and households. It’s far from a boom, but it helps support spending as tariffs and a stronger euro weigh on trade-exposed sectors.

Stubborn inflation and external pressures

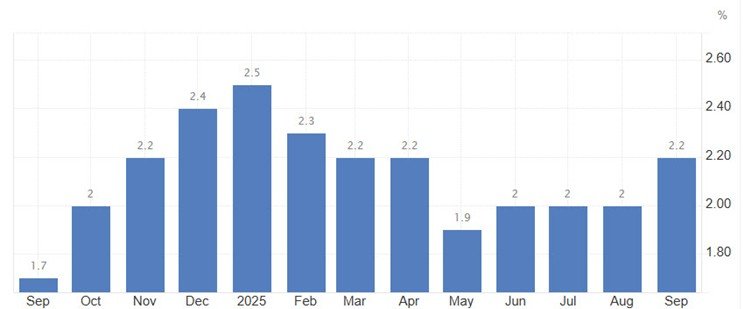

Euro area consumer inflation rose to 2.2% in September 2025 after three months at 2.0%, edging just above the European Central Bank’s mid-point target. Services costs remain the main driver, keeping pressure on policymakers.

Trade frictions are less severe than before but remain a headwind. The US–EU framework has lowered headline tariffs on most EU goods to about 15%, but 50% Section 232 tariffs on steel and aluminium remain in place, with exemptions and quotas still under discussion.

Washington’s formal rollout clarified timing and some exemptions, but an expanding list of metal-related goods continues to raise compliance costs and create uncertainty. The result is less panic than in July, but still a drag on EU manufacturers’ confidence going into year-end.

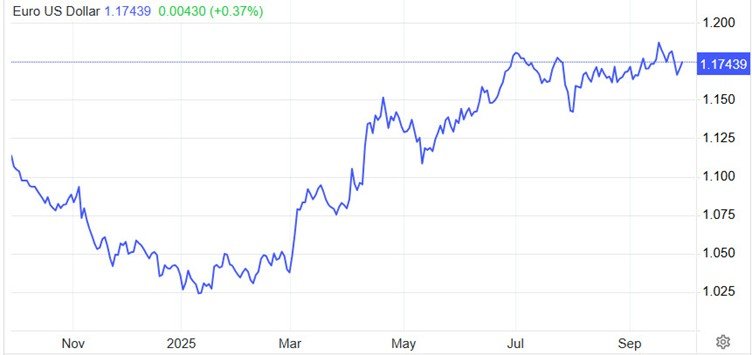

The euro’s rise is a mixed blessing. It lowers energy import costs and helps ease headline inflation, but the pace of appreciation is tightening conditions for exporters before they can adjust. With global demand soft and US tariffs unresolved, the stronger euro is doing part of the ECB’s job, giving the Governing Council room to remain patient.

ECB expected to hold rates at 2%

ECB policy is set to stay deliberately steady. The central bank kept its deposit rate at 2.00% in September and is expected to hold again at its meetings on 30 October and 17–18 December, when new staff projections are due.

Markets share this outlook after officials described risks as more balanced and indicated that further easing would only follow a clear deterioration in the data or a sharp euro surge that tightens conditions excessively.

The ECB is allowing its balance sheet to shrink passively. Pandemic Emergency Purchase Programme (PEPP) reinvestments ended in late 2024, while the older Asset Purchase Programme (APP) is winding down as bonds mature.

As a result, excess liquidity has fallen to around €2.8 trillion from a peak near €4.7 trillion in 2022. Liquidity is still ample but steadily declining, keeping short-term money-market rates close to the 2% policy floor. Longer-term yields, however, are being shaped more by government borrowing needs, especially Germany’s new investment funds and corporate tax relief, than by ECB rundown mechanics.

Looking ahead, the ECB’s 2026 review is expected to set out new long-term lending tools for banks and define a steady-state bond portfolio to ensure the financial system retains sufficient liquidity once quantitative tightening nears its limits.

Political risks keep the narrative noisy

Germany’s shift toward higher public investment is supporting the recent PMI rebound, although it will take time for spending to filter into real projects. The extra borrowing is also lifting longer-term yields as Bund supply rises.

France, meanwhile, remains a political weak spot: repeated budget disputes and leadership changes are weighing on business confidence and already showing up in PMIs.

That uncertainty risks dampening investment plans into Q4. While the ECB is unlikely to shield governments from their fiscal troubles, the spillover effects help explain its cautious approach to further rate cuts.