Europe outlook Q2 2025

EU policymakers face pressure to stimulate a slowing economy

The eurozone economy is stagnating despite cooling inflation, prompting the ECB to continue rate cuts while closely monitoring trade risks and fragile growth.

Trump's tariff threats — even with a 90-day pause — continue to cloud the EU’s outlook, potentially hurting exports and weighing on GDP forecasts for 2025.

While markets hope for a rebound driven by consumer spending, weak private demand and uncertain sentiment make a robust recovery unlikely without further stimulus.

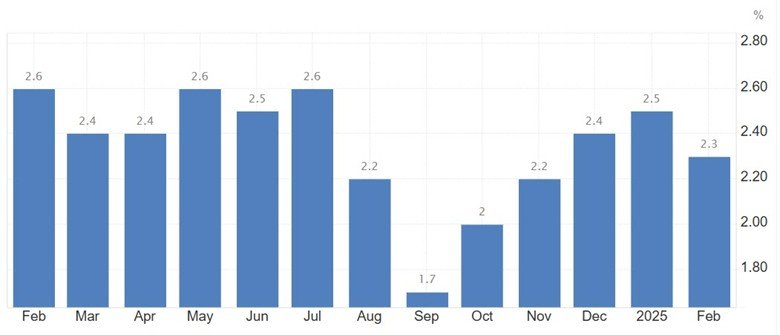

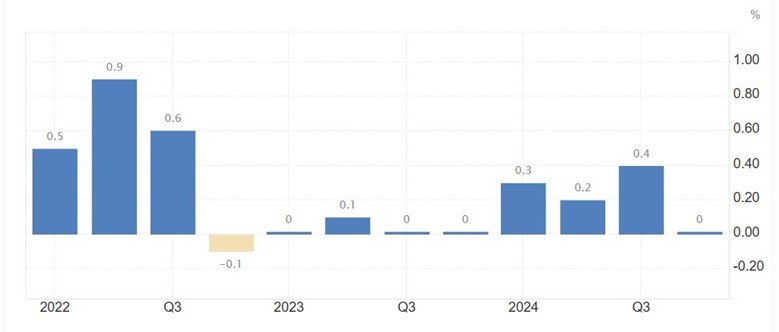

The European Union enters the second quarter of 2025 navigating a tenuous economic path. Data from the first quarter show inflation in the eurozone moderating toward the European Central Bank’s goal, but overall growth remains lacklustre amid persistent external risks. Headline consumer prices in the 20-nation bloc slowed to about 2.3% in February, down from 2.5% in January, moving a step closer to the ECB’s 2% target. The underlying inflation has also eased slightly, with core price growth dipping as pressures in services begin to abate. This cooling of inflationary pressures has opened the door for continued monetary policy easing, even as GDP figures underscore an anaemic economy: output was flat in the final quarter of 2024 and early indicators suggest only a modest return to growth at the start of 2025.

Interest rate cut in doubt

ECB policymakers have taken note of the subdued economic momentum. The central bank cut interest rates for the fifth consecutive meeting in March, affirming that rapidly slowing inflation now allows a focus on boosting growth. Rates have been reduced steadily since mid-2024 and another trim is anticipated in the coming quarter. Indeed, officials in Frankfurt have downgraded growth projections – the ECB now expects the eurozone economy to expand just 0.9% in 2025, a downgrade from 1.1% forecast in December. Inflation for the year is seen averaging 2.3%, slightly above target but on a clear downward trajectory. With price pressures cooling, “all conditions are in place” for further easing, as one rate-setter noted, given that economic growth is anaemic and a trade war is a distinct possibility. The central bank’s next moves in April will likely pause to see incoming data confirm a promising recovery or a need for additional stimulus.

Trump tariffs threaten a fragile rebound

Following President Trump's announcement of a 90-day pause on the proposed tariffs, Europe's fragile economic recovery remains under pressure. Although the delay offers a window for negotiation, the threat of tariffs - potentially affecting up to $100 billion worth of EU exports, including automobiles, steel and aluminium - continues to cast a shadow over the bloc's outlook. The European Commission warns that even the prospect of renewed trade tensions could shave up to 0.3 percentage points off the EU’s projected GDP growth of 0.9% for 2025. Germany, which accounts for nearly 28% of EU exports to the US, remains particularly vulnerable. While Brussels has held off on retaliatory action, the spectre of escalation still looms, risking investment delays and undermining business sentiment - factors that may force the European Central Bank to revisit its policy stance to shield the recovery.

Markets bet on a consumption revival

Despite the challenges, financial markets have occasionally latched onto optimistic scenarios for Europe’s economy. Easing inflation and steady employment have fuelled hopes that consumers might unleash pent-up spending and energise a stronger rebound. Pointing to improving sentiment indicators and household savings as reasons to expect an economic pick-up later in the year. Indeed, January’s uptick in business activity provided some hope that the eurozone’s economic recovery may finally gain speed. However, policymakers remain cautious. So far, predictions of a consumption boom have repeatedly failed to materialise, and private sector demand stays tepid. The prevailing view is that such optimism may be exaggerated – a robust recovery is possible only if confidence returns in earnest, something that hinges on resolving trade uncertainties and sustaining policy support. For now, the EU’s Q2 outlook is one of restrained expectations: inflation drifting lower, stimulus on hand and a watchful eye on Washington’s next move as Europe strives to turn fragile stabilisation into durable growth. Recession is still the scenario we look at with Trump’s aggressive move.

Euro faces crucial levels

The euro remains trading below its descending trendline and key resistance at 1.1220. This technical setup suggests a potential continuation of the downtrend, with downside targets at 1.0730 and subsequently 1.0500. A break below recent support levels could accelerate the move toward the next key level at 1.0320. However, a decisive breakout above 1.1220, confirmed by a monthly close, would shift the outlook to the upside, opening the path toward 1.1500 and potentially 1.1680.