Fed signals leave the equity bounce fragile as inflation persists and AI optimism fades

U.S. stocks whipped from dump to pump in November on shifting rate-cut odds, but with inflation sticky and AI euphoria showing cracks, the rally is running on fumes. Unless growth, margins, and policy all line up, multiples face gravity.

Stocks tracked December-cut pricing more than fundamentals

AI capex boom meets valuation fatigue and rising skepticism

Effective tariff drag lingers despite recent de-escalation

Market now prices only ~75 bps of cuts through end-2026

Any pause in easing—or growth wobble—could puncture momentum

A rally tethered to the Fed, not fundamentals

November’s equity path was textbook “policy beta.” As odds for a December rate cut waxed and waned, S&P 500 futures moved in lockstep. Seasonals argued for strength; instead, AI optimism cooled, and the long government shutdown muddied visibility. The result: macro hopes, not earnings revisions, did the heavy lifting.

AI spending: from tailwind to test

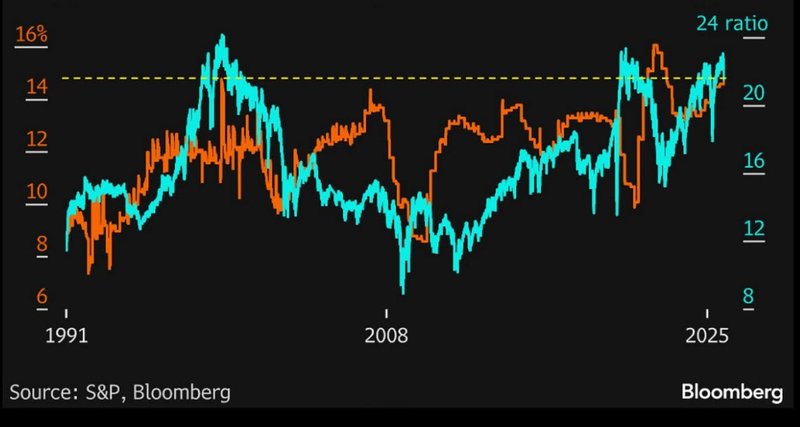

The AI infrastructure binge is still massive, but its ability to float all boats is less certain. Circular financing, rising use of debt by cash-rich platforms, and sheer capital intensity have investors asking where marginal returns settle. With the S&P 500 trading above 22x forward earnings—levels associated with the dot-com crest and the post-pandemic surge—record-high operating margins need to hold. History says that’s a tall order.

Source: Bloomberg

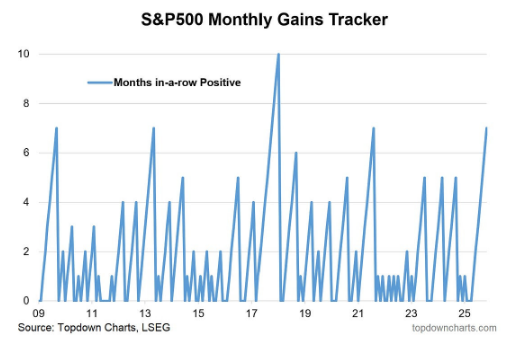

Good news: since 2009, there have been five S&P 500 winning streaks of seven months or more, including the current run. Bad news: 80% of those streaks ended after the seventh month.

Source: Toddown Charts

Since 1928, the S&P 500 has risen 73.2% of the time in December, best of any month; average gain +1.28%. Since 1945, average December return is +1.50%. Record highs may be within reach but Fed controls.

Source: BofA

Trade frictions: slower-burn, still there

Even with the effective U.S. tariff rate easing from its spring peak, it remains far above the sub-3% norms of recent years. The mix of levies and execution uncertainty is a slow-boil headwind for global supply chains and equity risk premia—easy to ignore during upswings, painful when growth stutters.

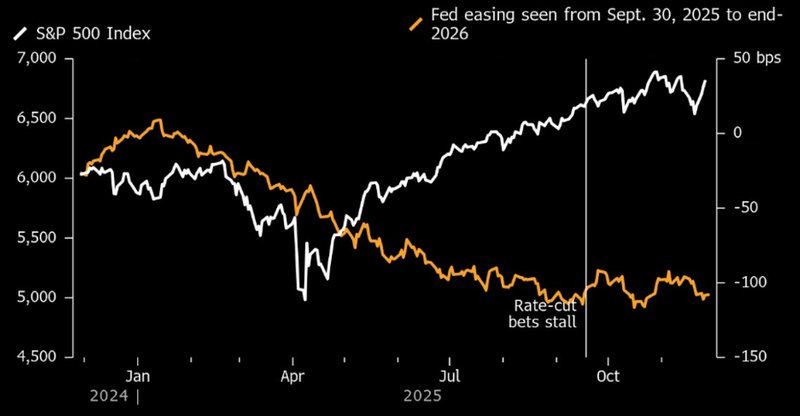

Rates path: less runway than the tape implies

The market’s fixation on whether the first trim arrives on December 10 or in late January misses the bigger picture: pricing now implies roughly 75 bps of cumulative cuts through end-2026. That’s not a classic easing cycle. Equities’ latest momentum faded as hopes for rapid, deeper cuts stalled.

Source: Bloomberg

What has to go right—and what can go wrong

For this rally to extend, three things must align: resilient growth, sustained margins, and modest but continuous policy support. Any of the following could upset the balance:

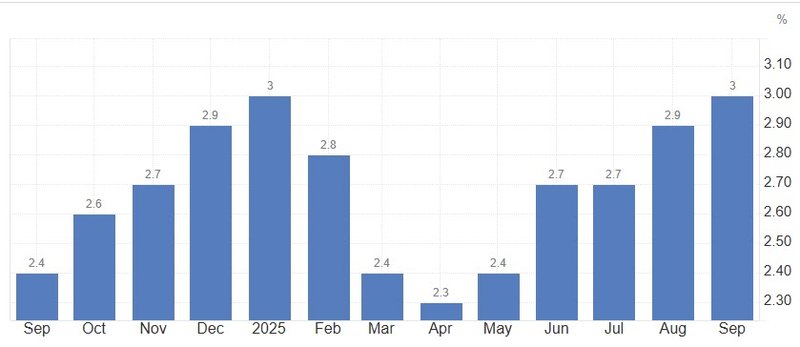

Sticky inflation: running ~1pp above target could force a pause in cuts, pressuring multiples.

Source: TradingEconomics

Growth slip: if labor or demand weakens further, even faster easing may not offset equity drawdowns.

Financial conditions: already easy by historical gauges; additional loosening risks a boom-bust dynamic rather than a soft glide.