Global economy in 2026: rate cuts, AI investment and the uneven fallout from tariffs

The global economy is heading into 2026 with surprising resilience. A softer Federal Reserve, a booming wave of AI-driven investment and a global rollback of red tape are set to cushion the blow from the trade war’s lingering effects. Growth is expected to cool from 2025’s strong performance but remain broadly stable, while inflation pressures shift asymmetrically — sticky in the U.S., softer elsewhere. China is positioned for a slowdown as tariffs bite, Europe leans on Germany’s fiscal surge fo

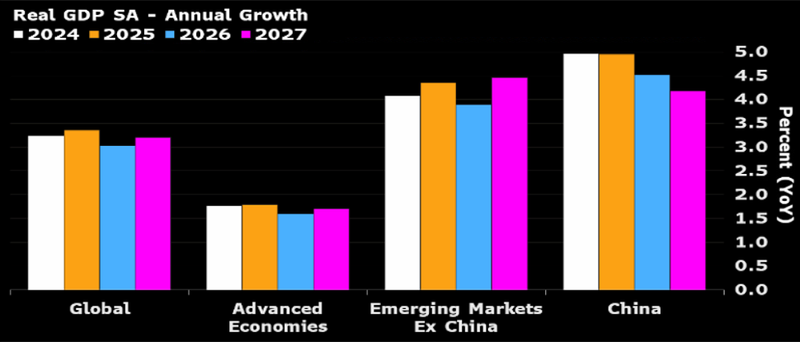

Global growth projected at 3% in 2026, easing from 3.4% in 2025

Fed expected to cut another 100 bps, supporting AI-driven capex

China slows as tariffs and structural headwinds collide

Europe relies on Germany’s defense-investment boom to offset trade drag

Global outlook: resilience holding despite shocks

The world economy has absorbed an unusually heavy set of shocks — a turbulent trade war, elevated policy uncertainty and a government shutdown in the U.S. — yet growth has held up far better than many feared. After expanding an estimated 3.4% in 2025, global GDP is expected to ease to around 3% in 2026 before picking up again in 2027.

A shift toward easier policy in advanced economies will underpin the expansion. The Federal Reserve is expected to cut another 100 basis points next year, providing a crucial backstop as AI investment accelerates and deregulation broadens. Meanwhile, the inflationary drag from tariffs in the U.S. is met with a very different dynamic abroad: for most countries, weaker demand and redirected goods flows are pushing inflation down.

Source: Bloomberg

Momentum cooled briefly at the start of President Donald Trump’s second term, as policy uncertainty spiked and government agencies shuttered. But as shutdown staff returned to work in Q4, global trackers swung back into positive territory — an encouraging sign as 2026 approaches.

What is driving growth: the AI capex wave, rate cuts and lighter regulation

The next leg of global expansion rests heavily on the investment boom tied to artificial intelligence. The U.S. is already seeing a surge in AI-related capex as tax incentives, deregulation and falling rates combine. With uncertainty fading and new trade agreements expected next year, corporate spending is set to broaden further.

This backdrop explains why U.S. GDP growth is projected to accelerate to roughly 2.3% in 2026 from 1.8% this year. The Fed’s focus has shifted: policymakers see greater danger in a weakening labor market than in another inflation uptick. With unemployment expected to hold near 4.5% into mid-2026, a full year of rate cuts is likely.

Tariffs will keep U.S. inflation somewhat elevated, but the Fed appears increasingly comfortable with the trade-off if it protects hiring and prevents a deeper slowdown.

The tariff divide: inflation in the US, disinflation everywhere else

The trade war continues to deliver a sharply divided set of outcomes.

In the U.S., tariffs are pushing up import costs, although companies have absorbed much of the pressure through margin compression. The broader effect is a squeeze on corporate profitability that encourages companies to cut costs and slow hiring.

Outside the U.S., the dynamic flips. Goods diverted from U.S. markets are weighing on global prices, leaving inflation pressures softer across Europe and emerging markets. Global inflation is projected to end 2025 near 3%, down sharply from 5% in late 2024, and stabilise around similar levels through 2026.

Much now hinges on China — where the mismatch between supply and domestic demand remains one of the biggest deflationary forces in the global economy.

Central banks diverge in 2026: Fed easing, BoJ tightening, others somewhere in between

Major central banks are set to chart dramatically different paths next year.

The Fed is expected to deliver four rate cuts as it prioritizes labor-market risks.

The People’s Bank of China maintains scope for mild easing amid a broadening slowdown.

The Bank of England is also preparing to cut.

The European Central Bank, with inflation already close to target, appears near the end of its easing cycle.

Japan stands apart: the Bank of Japan is moving cautiously toward higher rates, pressured simultaneously by firm inflation, a weak yen and a pro-stimulus government.

Across emerging markets, easier global financial conditions are likely to open the door for additional rate cuts. The GDP-weighted global policy rate is expected to fall to 5.1% in 2025 and continue sliding toward 4.2% in 2026.

US outlook: stronger growth and steady disinflation, despite tariff friction

The U.S. enters 2026 in strong shape. A combination of Fed easing, large-scale AI investment, expanded tax incentives and reaccelerating business sentiment is expected to lift growth. Even with firmer domestic activity, policymakers are convinced that labor-market fragility — not inflation — poses the biggest risk.

With price pressures increasingly dominated by tariff effects, and with consumer demand cooling, inflation risks are viewed as manageable. The Fed’s priority next year will be ensuring that a labor-market slump does not take hold.

Euro-area outlook: tariff drag meets German stimulus

Europe’s medium-term outlook hinges on two competing forces. The tariff shock from the U.S. is only partly absorbed, and more of its impact will flow through to consumers and supply chains next year. Yet Germany’s fiscal surge — driven by defense spending and infrastructure — is set to inject meaningful stimulus.

With growth expected to slow to 0.9% in 2026, the region will rely heavily on Berlin’s ability to mobilize funds efficiently. While the ECB is likely done easing, risks still tilt toward an additional cut if inflation undershoots the 2% target.

UK outlook: modest growth overshadowed by political risk

The UK’s recovery remains fragile. GDP is expected to grow about 1.2% in 2026, helped by slightly stronger quarterly momentum and a gentle rise in household spending as rates fall.

Yet political uncertainty is a major risk. Betting markets assign more than a 50% chance the prime minister is replaced next year, and concerns over long-term fiscal consolidation continue to weigh on investor confidence.

China outlook: slow growth, structural challenges, and limited policy space

China faces a slower 2026 as tariffs, property-sector stress and intense price competition collide. A calmer global backdrop gives Beijing breathing room to focus on deep structural issues early in the new Five-Year Plan, but policymakers are reluctant to unleash another large stimulus package.

The central challenge is clear: a persistent supply-demand imbalance threatens to drag on growth and reignite trade tensions if left unchecked. Confidence among private firms will depend heavily on how the government supports demand in the coming year.

Japan outlook: dovish BoJ, persistent inflation, political pressure

Japan enters 2026 with a distinctly stagflation-tilted mix: inflation remains firm, the yen stays weak, and consumption looks increasingly fragile. The BOJ is expected to lift rates slowly — to around 1% by end-2026 — but political pressure from a pro-stimulus administration may limit how far and how fast the central bank moves.

Inflation is set to ease to about 2.3% next year, but households remain squeezed by rising costs and limited wage gains. Growth, meanwhile, is expected to slow to 0.7%.