Global inflation's shift: Local drivers and emerging market slowdowns

Price growth worldwide is increasingly shaped by domestic conditions rather than synchronized global forces such as tariffs. Services costs are rebounding in the US, decelerating in the euro area, and remaining persistently high in the UK.

Global CPI inflation projected to slow to 3.2% in Q4 2025, down from 3.4% in Q2.

US inflation pressures shift to services and vehicles, while tariff effects fade.

Eurozone price growth stabilizes near the ECB’s 2% target; UK faces persistent core services inflation.

China remains in deflation, while India’s good harvests support record-low inflation

Global backdrop: Disinflation gains momentum

Global CPI inflation is projected to ease to 3.2% in Q4 2025 from 3.4% in Q2 2025 — returning to pre-pandemic norms and less than half the 6.8% pace seen in Q2 2024.

- Advanced economies: Inflation is expected to hover near 2.5% over the next few quarters, slightly above central bank targets but down from 2.8% a year ago.

- Emerging markets: Excluding China, price growth is forecast to ease to 5.8% by Q4 2025 from 7.2% in Q2, with double-digit inflation in Argentina and Turkey moderating sharply from 2024 peaks.

- China: Inflation fell back to zero in Q2 and is set to remain subdued, weighed by price competition and weak demand.

United States: Services push inflation higher

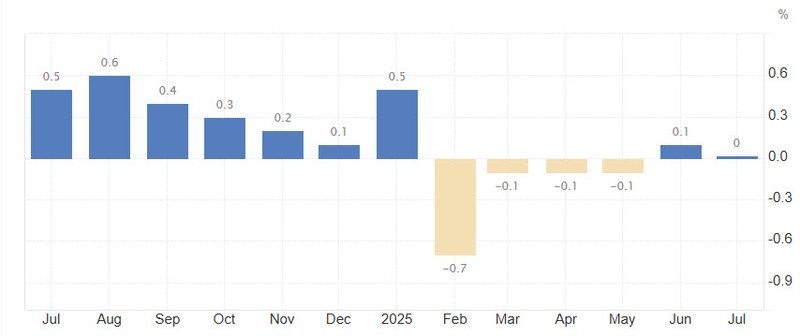

US core CPI rose 0.32% in July, the fastest monthly pace since January, driven by airfares (+4%) and a rebound in car prices. Tariff-related goods inflation slowed, with the pass-through rate dropping to 0.23 from 0.27 in June. Headline CPI held at 2.7% y/y, with core climbing to 3.1%.

Implication: Core PCE (due Aug. 29) could surprise on the upside, complicating expectations for a September Fed rate cut.

Euro area: Inflation at target, pressures easing

Eurozone HICP inflation remained at 2.0% y/y in July, with core at 2.3%. Services inflation decelerated to 3.1% from 3.3%. Slowing wage growth, weaker external demand, and a stronger euro point to further disinflation ahead, with inflation expected to undershoot target in the medium term.

United Kingdom: Above-target inflation risks persist

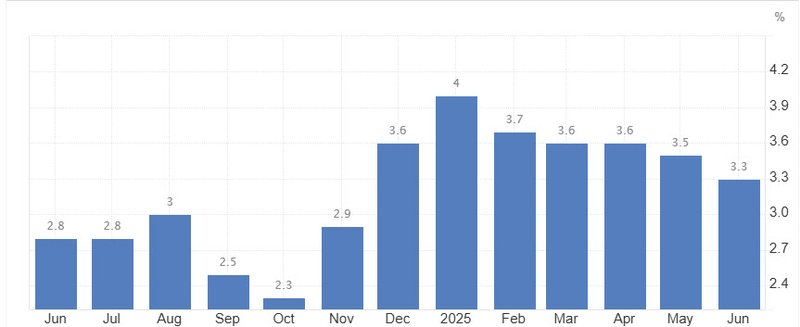

UK CPI rose to 3.6% y/y in June, lifted by energy, food, and administered prices. Core services inflation excluding volatile components ticked up to 4.2%. Headline CPI is expected to average 3.6% in 2H 2025, with risks skewed toward persistence if inflation expectations stay high despite weak growth and a soft labour market.

China: Deflation entrenched

Consumer prices returned to zero growth in July, while factory-gate prices stayed in deflation for the 34th straight month. Without stronger policy measures, the GDP deflator is set for a 10th consecutive negative reading this quarter.

Japan: Cooling headline, underlying firmness

Tokyo CPI slowed to 2.9% in July from 3.1% in June. Base effects from energy subsidies contributed, but food and dining-out costs remain supported by higher rice prices and labour expenses. The BOJ is expected to raise rates gradually, with the next hike likely in October.

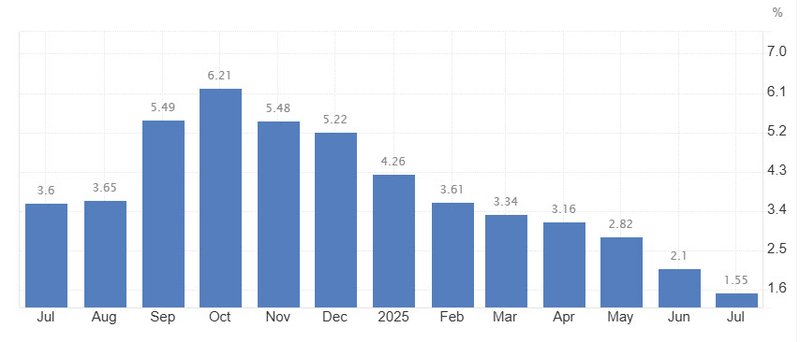

India: Inflation below target

CPI fell to 1.6% y/y in July, the lowest in eight years, from 2.1% in June. Good harvest prospects from surplus monsoon rains should keep food inflation subdued, allowing the RBI to resume rate cuts in October.

Other regional highlights

- Turkey: Annual CPI eased to 33.5% in July from 35.1%, marking a 14th straight slowdown.

- Brazil: Inflation cooled to 5.2% y/y, still above target.

- Argentina: Inflation slowed to 36.6% y/y, the lowest since 2020.

- South Africa: CPI rose to 3.0% y/y in June, with transport costs rebounding.

- Indonesia: CPI at 2.4% y/y remains at the lower end of target.

- Thailand: Deflation deepened to -0.7% y/y in July.

- Australia: Softer 2Q CPI at 2.1% y/y supports an RBA cut in August.

- New Zealand: 2Q CPI at 2.7% y/y keeps RBNZ on track for more easing this year.

Local drivers to define inflation path

The shift from globally synchronized price shocks to more localized inflation dynamics will complicate central bank policy coordination in 2H 2025. While emerging markets drive the headline slowdown, advanced economies — particularly the US and UK — face stubborn domestic price pressures that could slow or delay monetary easing.

Global inflation is no longer moving in unison — the battle is now local, with emerging markets driving the slowdown while the US and UK wrestle with stubborn domestic pressures.