Japan’s 30-year bond sale draws strongest demand since 2019, easing pressure on super-long yields

Japan’s 30-year auction cleared with a 4.04 bid-to-cover, the best since 2019, pulling the 30-year yield down to 3.39% and offering relief to a market braced for a potential BOJ hike in December.

30-year bid-to-cover at 4.04; yield slips 3 bps to 3.39%

Solid follow-through after a firm 10-year sale earlier this week

Shorter tenors edge higher as December hike odds rise to ~91%

Focus turns to issuance mix and next week’s 5- and 20-year auctions

Japan’s super-long bonds found a firm bid after weeks of strain. The Ministry of Finance’s 30-year sale drew the strongest participation since 2019, with a bid-to-cover ratio of 4.04 and a tight tail, signaling investors are stepping back in at higher yields. The result nudged the 30-year yield down to 3.39%, tempering a selloff that had pushed term premiums to multi-decade highs.

Source: Bloomberg

The auction follows a well-received 10-year sale, suggesting buyers see value across the curve as levels reset. Together, the back-to-back wins ease immediate pressure in the super-long sector, where pension and life insurers typically anchor demand.

Front end stays edgy as hike odds firm

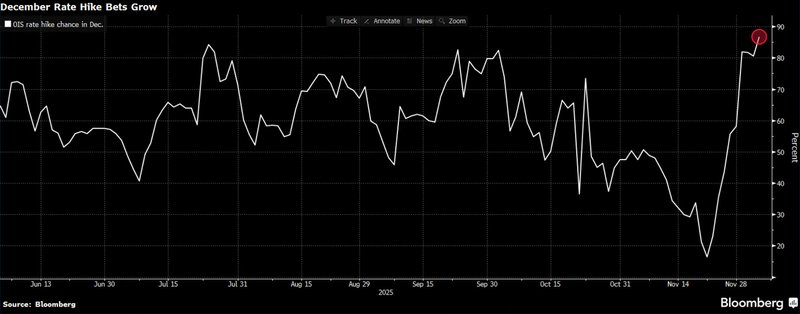

While the long end breathed out, shorter maturities remained sensitive to policy risk. The 10-year yield rose to about 1.94% and the five-year hovered near 1.41%, reflecting swaps that now price roughly a 91% chance of a December move. Recent comments from Bank of Japan Governor Kazuo Ueda—framing any hike as consistent with still-accommodative conditions—kept hike expectations elevated versus a week ago.

Source: Bloomberg

Issuance mix and curve shape in focus

Dealers have urged a reduction in super-long issuance to stabilize the far end. At the same time, near-term funding needs are rising: the government has already flagged more short-dated supply, adding roughly ¥300 billion to two- and five-year auctions and ¥6.3 trillion to Treasury bills to help finance the latest economic package. If overall issuance rises without a meaningful trim to super-long supply, the curve could steepen again.

Who’s buying—and why it matters

Higher yield levels are drawing back traditional liability-driven investors, with life insurers and pensions better able to match long-dated obligations. If the BOJ delivers a single hike and then pauses, that path would support a gradual re-engagement at the long end while containing volatility at the front.

Key Japan officials signal readiness to accept a December BOJ rate hike

The yen firmed after reports indicated that top figures within Prime Minister Sanae Takaichi’s administration would not stand in the way if the Bank of Japan opts to raise rates in December.

The currency strengthened as much as 0.3% to ¥154.77 per dollar in late-Asia trading on Thursday, outperforming most of its Group-of-10 peers. Earlier in the day, Reuters reported that a December hike is now the BOJ’s base case, with the government prepared to tolerate the decision, citing three senior officials.

Source: TradingView - Author

Source: Bloomberg

Markets quickly repriced. Overnight index swaps lifted the probability of a December hike to about 91%, up from 56% just a week ago. Still, resistance remains inside parts of the bureaucracy, where some officials argue the timing is premature.

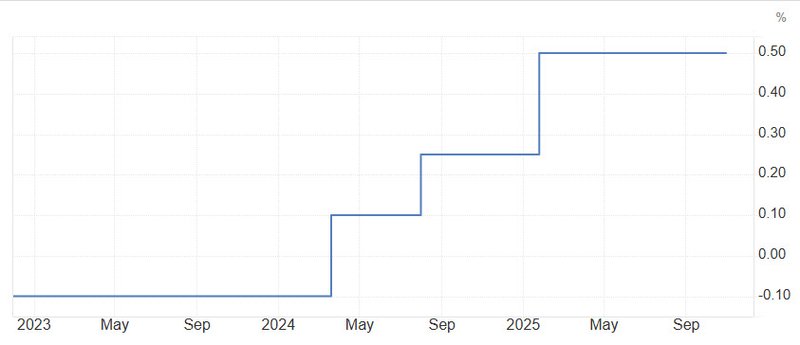

Japan’s policy rate path has clearly shifted from “stuck in negative” to a step-by-step normalization cycle: after sitting around -0.10% through 2023 and early 2024, the rate moves higher in discrete hikes—first into positive territory, then up again, reaching roughly 0.50% in 2025 on this chart. With that tightening trajectory established, the market’s focus is now on whether the Bank of Japan delivers another move in December, which would extend the exit from ultra-loose policy and keep pressure on front-end yields, the yen, and global carry-trade positioning.

Source: Tradingeconomics

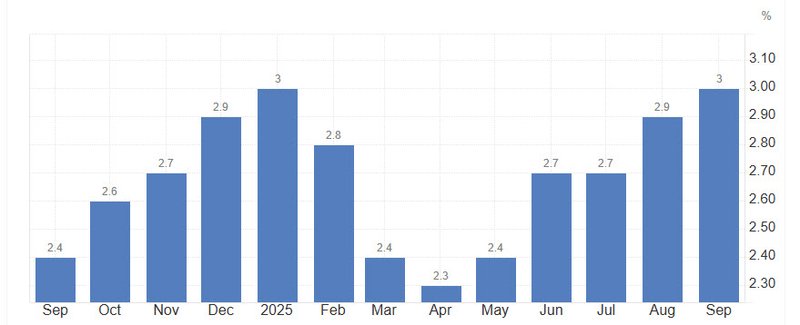

Japan’s dilemma is getting louder in the data: inflation is re-accelerating toward the 3% handle after dipping in spring, with the latest readings back near the cycle highs.

Source: Tradingeconmics

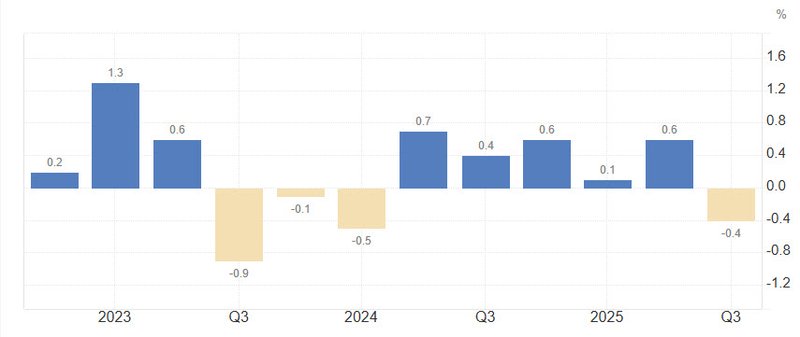

While growth remains choppy and increasingly fragile, swinging between small expansions and contractions and slipping negative again in the latest quarter. That mix leaves the Bank of Japan stuck between its mandate and its margin for error—tighten to keep price pressures anchored and defend the yen, and it risks squeezing an economy that’s struggling to sustain momentum; stay cautious, and it risks letting above-target inflation and FX weakness harden into a more persistent problem.

Source: Tradingeconmics