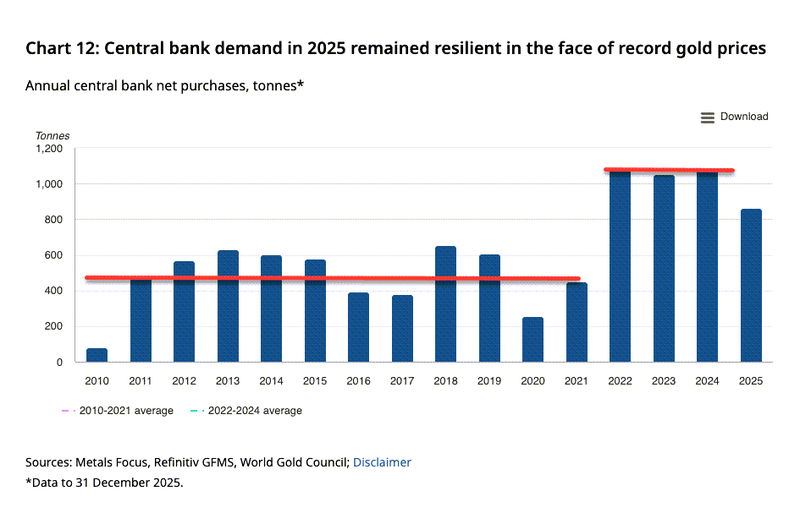

Central bank gold buying cooled in 2025 but stayed far above historical norms

Central bank demand for gold eased last year as higher prices tempered purchases, yet buying levels remained structurally elevated, underscoring gold’s role as a strategic reserve asset amid persistent geopolitical and economic uncertainty.

Central banks bought 863.3 tonnes of gold in 2025, down 21% year on year

Q4 purchases rebounded to 230 tonnes, up 6% quarter on quarter

Demand remained well above the 2010–2021 average of 473 tonnes

Poland, Kazakhstan and Brazil led reported buying, while opaque purchases stayed significant

Buying slows, but remains historically strong

Central bank gold buying moderated in 2025, but remained far above recent historical averages. According to data compiled by the World Gold Council, official sector purchases totaled 863.3 tonnes for the year, marking a 21% decline from 2024 and the lowest annual total since 2021.

Even so, the figure still comfortably exceeded the 2010–2021 annual average of 473 tonnes. In historical context, 2025 represented the fourth-largest annual expansion of central bank gold reserves on record. The all-time peak was reached in 2022, when net purchases hit 1,136 tonnes, the highest level since records began in 1950.

Fourth-quarter rebound offsets earlier caution

While buying slowed through much of the year, central banks stepped up purchases in the final quarter. Official reserves rose by 230 tonnes in Q4, a 6% increase compared with the previous quarter, helping stabilize full-year demand.

The moderation earlier in the year appears closely linked to surging gold prices. The World Gold Council noted that higher prices encouraged a more cautious approach, while stressing that long-term strategic interest in gold remains firmly intact.

Despite the slowdown, gold overtook US Treasuries late in 2025 to become the world’s largest reserve asset by value, reflecting both sustained demand and rising prices.

Poland leads reported buyers

Twenty-two central banks reported increasing their gold reserves by at least one tonne during 2025, led by Poland. The National Bank of Poland added 102 tonnes, lifting its holdings to 550 tonnes, equivalent to about 28% of total official reserves.

Poland has since signaled further accumulation. Last month, the central bank said it plans to buy up to 150 additional tonnes, potentially raising total holdings to 700 tonnes. That would place the country among the world’s ten largest official gold holders, a dramatic shift from 1996, when Poland held just 14 tonnes.

Kazakhstan ranked second among reported buyers, adding 52 tonnes, its largest annual increase since 1993. Brazil also returned to the market in the second half of the year, purchasing 43 tonnes between September and November and lifting reserves to 172 tonnes.

Turkey and the Czech Republic followed steady, incremental strategies. Turkey added 27 tonnes over the year, while the Czech National Bank bought gold for a 34th consecutive month, adding 20 tonnes and bringing total holdings to 72 tonnes. Czech officials aim to reach 100 tonnes by 2028.

China slows officially, opacity persists

China reported a slower pace of accumulation in official data. The People’s Bank of China disclosed a 27-tonne increase in 2025, taking reported reserves to 2,306 tonnes, or just under 9% of total reserves. Official figures show China has increased gold holdings for 14 consecutive months, adding a further tonne in December.

However, the World Gold Council highlighted substantial unreported buying across the official sector. The gap between independent estimates and disclosed data suggests that around 57% of total central bank purchases in 2025 were opaque, implying that some institutions continue to add gold without immediate disclosure.

Sellers remain scarce

Even with record prices, selling was limited. Singapore reported the largest reduction, cutting reserves by 14 tonnes. Russia sold 6 tonnes, Jordan reduced holdings by 1 tonne, and Germany reported a 1-tonne decline linked to its coin-minting program.

Overall, the imbalance between buyers and sellers reinforced gold’s strategic appeal. The World Gold Council said persistent economic and geopolitical uncertainty is likely to sustain demand, noting that 95% of respondents to its 2025 central bank survey expect global gold reserves to increase over the next 12 months, with none anticipating a decline.