The structure and features of China’s securities market explained

China’s capital markets rank among the largest and most consequential globally. They comprise multiple stock exchanges in the Mainland (Shanghai, Shenzhen and Beijing) alongside the Hong Kong Exchange, and a wide-ranging bond market that includes sovereign, financial, corporate, green and asset-backed issuance.

China’s capital market combines state participation with private capital and is composed of Shanghai, Shenzhen, Beijing and Hong Kong exchanges.

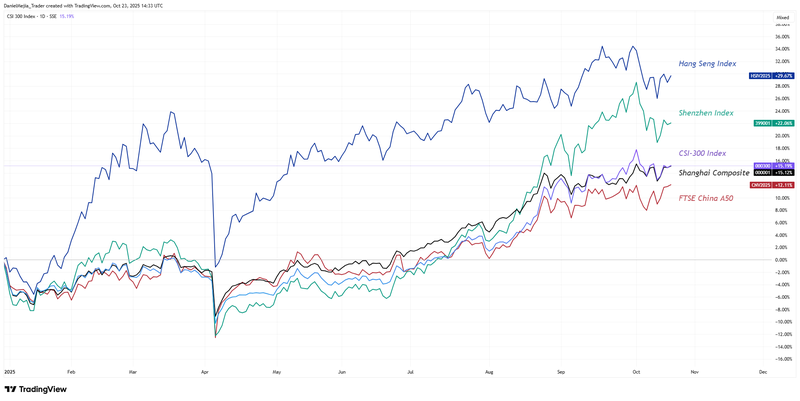

Major equity benchmarks include the Shanghai Composite, Shenzhen Component, CSI 300, Hang Seng Index and the FTSE China A50.

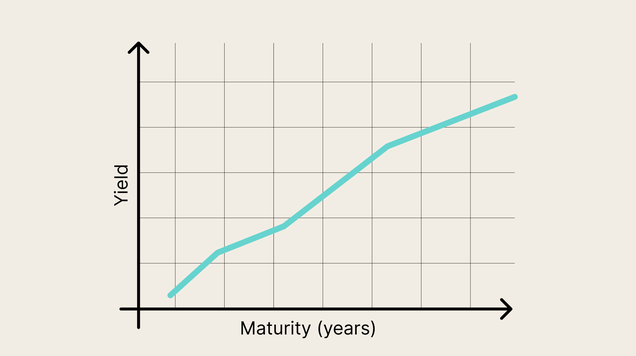

The Chinese bond market comprises government, credit, financial, green and asset-backed securities and is already among the world’s largest.

The CSRC is the principal supervisor for Mainland markets; the SFC regulates Hong Kong; the People’s Bank of China (PBOC) exerts monetary and indirect market influence.

China’s securities market: general overview

China’s capital market performs two broad economic functions: it allocates financing to firms—including many rapidly expanding, innovation-oriented companies that generate employment and domestic demand—and it provides debt financing that supports public and private-sector investment. The market’s institutional design reflects a hybrid model in which state ownership and policy objectives coexist with private investment and market-based mechanisms.

The market is supervised primarily by the China Securities Regulatory Commission (CSRC) and the Securities and Futures Commission (SFC), with ancillary influence from the People’s Bank of China (PBOC) through monetary policy and liquidity operations. State entities frequently play a material role as shareholders and as policy actors, a feature that distinguishes China’s markets from many Western counterparts where market forces are comparatively more dominant. Appreciation of this state–market interplay is necessary to assess price behaviour, issuer incentives and regulatory developments.

Listed companies are distributed across four principal trading venues: the Shanghai Stock Exchange (SSE), the Shenzhen Stock Exchange (SZSE), the Beijing Stock Exchange (BSE) and the Hong Kong Exchange (HKEX). Each venue serves particular segments of the corporate spectrum and contributes to the overall market ecology. Equity performance is monitored by a set of headline indices—among them the Shanghai Composite, Shenzhen Composite, CSI 300 and Hang Seng—which function as barometers of corporate health and investor sentiment.

Concurrently, the bond market is diversified and deepening. Debt issuance spans sovereign and quasi-sovereign paper, corporate credit, financial-institution issuances, green bonds and various asset-backed securities. As Chinese authorities continue to liberalise aspects of the financial system, observers expect the bond market’s relative importance to expand further.

Stock exchanges in China

China's stock exchanges are diversified into strategic areas that seek to boost the business market via specific approaches. The stock exchanges are divided between those belonging to Mainland China andMainland China stock exchanges

the Hong Kong Stock Exchange.

Shanghai Stock Exchange (SSE): Formally reconstituted in 1990, the SSE is one of the world’s largest exchanges and the dominant venue on the Chinese Mainland. It offers A- and B-share classes (primarily for domestic investors and approved foreign institutions) and lists a broad cross-section of sectors, including many large, state-linked enterprises.

- Shenzhen Stock Exchange (SZSE): Also established in 1990, the SZSE is notable for its concentration of companies in technology, renewables, new materials and biotechnology — sectors with higher innovation intensity. The exchange hosts A- and B-share classes and includes sub-markets such as ChiNext for growth-oriented firms.

- Beijing Stock Exchange (BSE): Launched in 2021, the BSE focuses on small and medium-sized enterprises (SMEs), particularly firms with innovative profiles that are in early stages of development. Its creation forms part of policy efforts to broaden financing channels for smaller companies and to deepen capital-market support for innovation.

Hong Kong Stock Exchange

- Hong Kong Exchange (HKEX): The Hong Kong Exchange serves as an international gateway to Chinese issuers and global capital. It accommodates different share types, including H-shares (Mainland-incorporated firms listed in Hong Kong), Red Chips (companies incorporated outside the Mainland with significant state ownership) and P-Chips (private companies with Mainland revenues but incorporated elsewhere). HKEX plays a pivotal role in facilitating cross-border listings, international investor access and offshore capital flows.

Major stock indices in China

The performance of Chinese equity markets is measured primarily through the following indices:

- Shanghai Composite (SSE): Evaluates the performance of all stocks listed on the Shanghai Stock Exchange. It includes sub-indices, such as the SSE 50 Index and the SSE Mega-Cap Index, which comprise the 50 and 20 largest companies by market capitalisation, respectively.

- Shenzhen Component Index (SZI): Assesses the performance of the 500 largest and most liquid companies listed on the Shenzhen Stock Exchange. The SZI encompasses two key sub-indices: the Shenzhen 100 (SZ100), which tracks the 100 largest companies, and the ChiNext Index (CNT), which tracks the 100 largest and most liquid companies listed on the ChiNext market, with a focus on innovative and emerging industries.

- CSI 300: Composed of the 300 largest and most liquid A-shares listed on the Shanghai and Shenzhen stock exchanges. Due to its hybrid composition, it is considered the most representative benchmark for Mainland Chinese stocks.

- Hang Seng Index (HSI): The HSI includes the largest and most liquid companies on the Hong Kong Stock Exchange. Its composition is variable; however, according to the "Hang Seng Indexes" official website, the HSI currently covers 88 companies. The main sub-indices include the Finance, Utilities, Properties, and Commerce & Industry sectors.

- FTSE China A 50: Includes the 50 largest and most liquid A-shares listed on the Shanghai and Shenzhen stock exchanges. It is considered the most widely used Chinese index by international investors seeking exposure to the country.

Figure 1. Chinese stock indices (Year-to-Date). Source: data from Shanghai Stock Exchange, Shenzhen Stock Exchange, Beijing Stock Exchange, and Hong Kong Exchange. Own analysis conducted via TradingView.

Types of bonds in the Chinese debt market

According to the International Monetary Fund, described in its 2019 research "The Future of China's Bond Market", the bond market will be a relevant foundation for Chinese financial and economic development. The Chinese bond market is already considered the third largest in the world, and its size is expected to increase due to the government's intention to open up its financial system. Among the debt securities in the Chinese bond market, the following classifications stand out:

- Government bonds: Sovereign, policy-bank and local-government financing instruments, collectively representing a significant portion of outstanding debt.

- Credit bonds: These focus primarily on issuance by companies, whether private or state-owned. They include corporate bonds, enterprise bonds, and medium-term notes.

- Financial bonds: Instruments issued by banks and other financial institutions to fund lending and liquidity requirements.

- Green bonds: Labelled debt that finances environmentally beneficial projects and supports China’s sustainability agenda.

- Asset-backed securities: Debt securities backed by a pool of underlying financial assets, such as mortgage loans, accounts receivable, or consumer loans.

Regulatory framework in China

The national regulatory body that oversees the capital and futures markets is the China Securities Regulatory Commission (CSRC). Its responsibilities include the constant supervision of the Shanghai, Shenzhen, and Beijing stock exchanges. In turn, the Securities and Futures Commission (SFC) regulates Hong Kong's securities and derivatives market.

In addition, the People's Bank of China (PBOC) exerts an indirect influence on Chinese capital markets. The PBOC's monetary policy tools influence the valuations of stocks and bonds, making the central bank a significant participant in the Chinese regulatory framework.

Conclusion

China’s securities market is deep, multifaceted and increasingly integrated with global capital. Its unique combination of robust market infrastructure, a large and diverse bond market, and a regulatory framework shaped by significant state involvement distinguishes it from many Western markets. While opportunities for investors are substantial—across equities, fixed income and green finance—successful engagement requires an understanding of the market structure, regulatory dynamics and the policy objectives that can influence asset valuations and access to issuance.

Frequently asked questions

Who regulates the Chinese stock market?

The stock market in China has two main regulators. The Mainland China market (the Shanghai, Shenzhen, and Beijing stock exchanges) is overseen by the China Securities Regulatory Commission (CSRC). The Hong Kong securities and futures market is regulated by the Securities and Futures Commission (SFC).

What is the difference between the stock exchanges in Mainland China (Shanghai, Shenzhen, Beijing)?

Although all of them finance Chinese companies, they have different approaches:

- Shanghai (SSE): It is the largest in Mainland China and the most diversified, including a large number of industries and sectors.

- Shenzhen (SZSE): It focuses mainly on financing companies in emerging and high-innovation industries, such as technology, renewable energy, and biotechnology.

- Beijing (BSE): It is the most recent (2021) and its primary mission is to finance small and medium-sized enterprises (SMEs) with innovative profiles that are in the early stages of their life cycle.

Which index is considered the most representative of the Mainland China market and why?

The CSI 300 index is considered the most representative benchmark for Mainland Chinese stocks. The reason is its hybrid composition, as it includes the 300 largest and most liquid A-shares from the two main exchanges (Shanghai and Shenzhen), offering a consolidated view of the market.