ECB’s next move in a stagnant economy

Inflation numbers at 1.7% are at its lowest level since September 2024, sliding comfortably below the ECB’s 2.0% target. Today’s final Q4 2025 GDP numbers expectations stay stable by 1.3% year-on-year. Unemployment has just dropped to 6.2%, the lowest rate since October 2024.

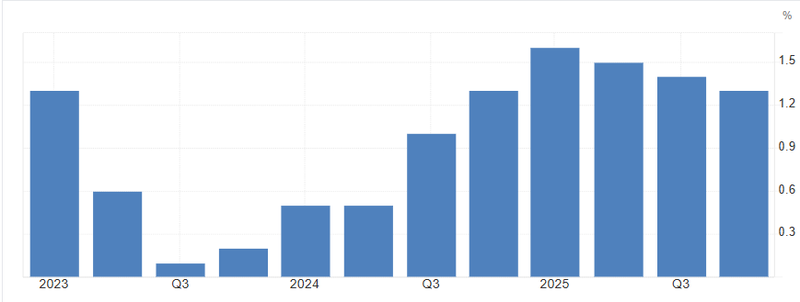

Expectations to close 2025 with 1.3% year-on-year GDP growth in Q4.

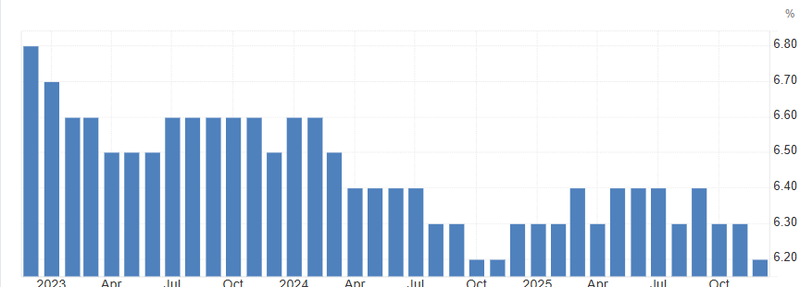

The unemployment rate declined to 6.2%, the lowest since October 2024.

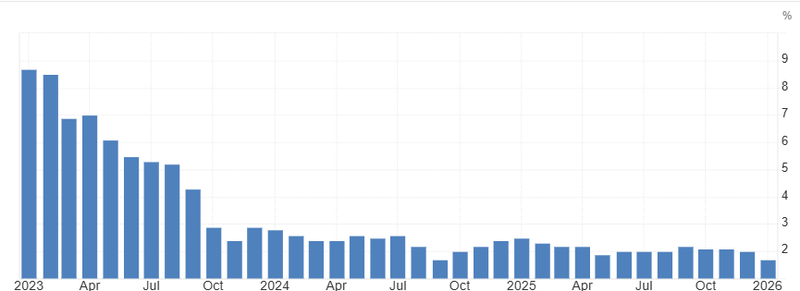

Annual inflation eased to 1.7%, its lowest reading since September 2024.

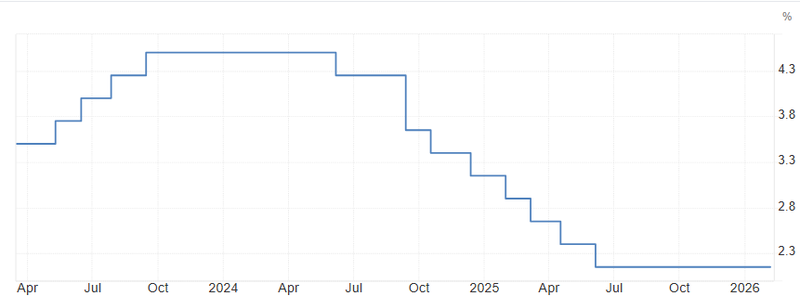

Expectations are gradually shifting toward the possibility of a rate cut at the beginning of Q3.

GDP stagnation

The euro area expectations to close 2025 with 1.3% year-on-year GDP growth in Q4, marking the slowest expansion in a year but broadly in line with expectations. The data confirms what many economists have described as a “low-speed expansion”, the economy is growing, but without strong acceleration in private investment or external demand.

Consensus forecasts suggest that annual growth is likely to remain near 1.2–1.3% through early 2026, reflecting structural constraints such as weak manufacturing activity, cautious corporate spending, and uneven performance across member states.

Source: Eurostat

The 6.2% unemployment paradox

The unemployment rate declined to 6.2%, the lowest since October 2024. This suggests that businesses, despite slower growth, are not aggressively cutting labor. Employment resilience is helping to stabilize household income and consumption.

Yet productivity growth remains modest. If economic momentum weakens further in Q2, firms may eventually slow hiring or reduce hours worked, which could soften domestic demand.

For now, however, the labor market remains one of the euro area’s strongest pillars.

Source: Eurostat

Inflation below target

In January, annual inflation eased to 1.7%, its lowest reading since September 2024 and below the European Central Bank’s 2% target. However, the picture beneath the headline is important. Core inflation has moderated but remains sensitive to wage negotiations, particularly in services sectors. If wage growth cools more rapidly in the first half of 2026, inflation could remain below target for longer than policymakers anticipate.

This creates a subtle shift in risk, for much of 2023–2024, the concern was inflation persistence. Entering 2026, the debate is increasingly about whether price pressures could undershoot sustainably.

Source: Eurostat

Monetary policy stability with flexibility

The European Central Bank has kept its key interest rate at 2.15% since June 2025, signaling a preference for stability while assessing incoming data.

With inflation below target but not collapsing, and growth positive but subdued, policymakers face a delicate balance:

Market pricing currently suggests expectations of policy stability through Q2, unless inflation declines materially below 1.5% or growth deteriorates unexpectedly.

However, expectations are gradually shifting toward the possibility of a rate cut at the beginning of Q3, should inflation remain sustainably below the 2% target through Q2. If price growth stabilizes in the 1.6%–1.9% range without signs of reacceleration and especially if wage pressures continue easing the ECB would gain additional room to recalibrate policy modestly.

In that scenario, a cautious 25-basis-point cut could be framed not as stimulus, but as normalization aligned with price stability.

The key condition remains credibility; policymakers will likely require clear confirmation that inflation is durably anchored below 2% before initiating any easing cycle.

Source ECB