Hold rates is Bank of Canada most likely path

CPI has been relatively contained for over a year, fluctuating in the 2% to 2.5% range. That stability has helped rebuild confidence, the mid-2025 contraction, when GDP shrank by 0.5% in a single quarter, marked the peak of economic stress following the aggressive rate hikes of 2023.

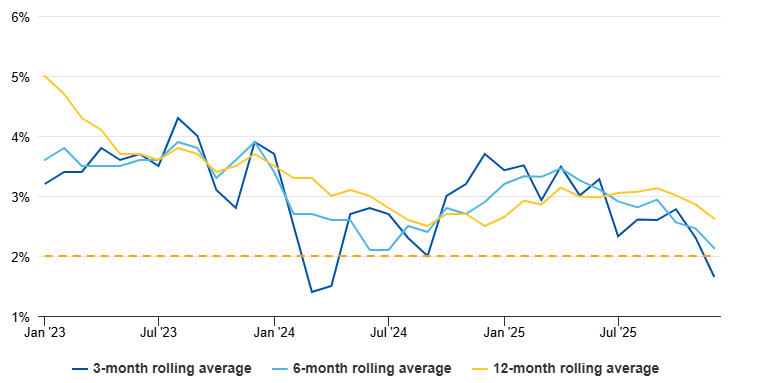

CPI has been relatively well-behaved for over a year bouncing comfortably around the 2% to 2.5% range.

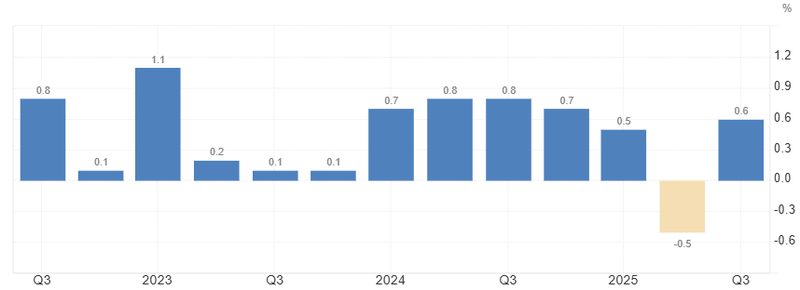

GDP bouncing back to a solid 0.6% growth rate.

The bleeding in the job market appears to have stopped.

Stable core inflation

CPI has been relatively contained for over a year, fluctuating in the 2% to 2.5% range. That stability has helped rebuild confidence, but for the Bank of Canada, headline numbers are only part of the story. The real focus has always been on core inflation, particularly the median and trim measures that strip out volatile components and provide a clearer signal of underlying price momentum.

Those core indicators have now turned decisively lower. The three-month annualized pace has eased to roughly 1.6%, slipping below the 2% target. Meanwhile, the six- and twelve-month trends are moving steadily downward, confirming that the slowdown is broad-based rather than a single-month anomaly. Services’ inflation, which has been particularly sticky, is also gradually moderating as wage growth cools.

For policymakers, sustained cooling in core inflation significantly reduces the case for further tightening. Unless price pressures reaccelerate unexpectedly through energy shocks, housing demand, or renewed wage acceleration the data argues for patience rather than renewed rate hikes.

Source: RBA

GDP from contraction to stabilization

The mid-2025 contraction, when GDP shrank by 0.5% in a single quarter, marked the peak of economic stress following the aggressive rate hikes of 2023. At the time, recession fears intensified quickly, with tighter financial conditions weighing on housing, business investment, and consumer spending.

However, subsequent rate cuts helped stabilize activity. The latest quarterly growth reading of 0.6% signals that the economy has regained balance. Growth is modest rather than strong, but stabilization matters more than acceleration at this stage.

Source: Tradingeconomics

Balance sheet policy

An important and often overlooked factor is the balance sheet policy of the Bank of Canada. While interest rates were being adjusted, the central bank also continued quantitative tightening, allowing bonds to roll off their balance sheet. This gradual reduction in liquidity reinforced the disinflation process without adding further rate pressure. In other words, policy normalization has come through both the price of money (rates) and the quantity of liquidity (balance sheet).

Canada is no longer contracting, but neither is it overheating. Financial conditions remain restrictive compared to pre-2022 levels, even with rates at 2.25%, because liquidity is no longer abundant. That combination moderate growth, easing inflation, and a shrinking balance sheet reflects a transition from crisis management to policy normalization.

This is precisely the environment central banks aim for after a tightening cycle: cooling inflation without triggering a prolonged recession, while gradually restoring policy space for the next downturn.

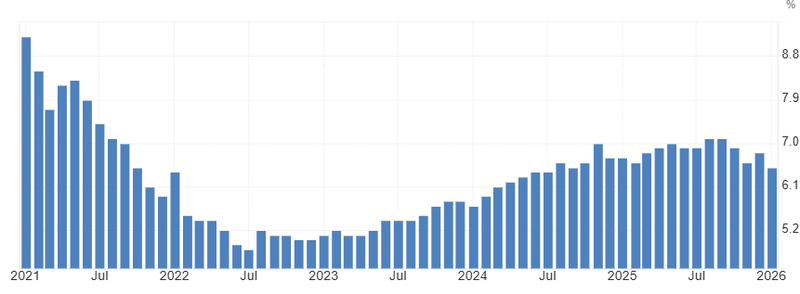

Steady labour market

The labour market absorbed much of the policy tightening shock. Unemployment rose from around 5% in 2022 to nearly 7% by mid-to-late 2025, as slower hiring and softer wage growth became necessary to relieve inflationary pressure. Businesses pulled back on recruitment, vacancy rates declined, and wage gains gradually cooled from unsustainably strong levels.

More recently, unemployment appears to be stabilizing near 6.5%. It remains well above the ultra-tight post-pandemic conditions, but the pace of deterioration has slowed significantly. Wage growth has moderated alongside this adjustment, easing pressure on services inflation, one of the most stubborn components in the broader price basket.

Importantly, this stabilization aligns with the improvement in core inflation trends and the return to modest GDP growth. The labour market is no longer overheating, but it is not collapsing either. That balance is critical.

As long as job losses do not reaccelerate and participation remains steady, policymakers can afford patience. A steady labour market reinforces the case for holding rates rather than reacting prematurely in either direction.

Source: Tradingeconomics

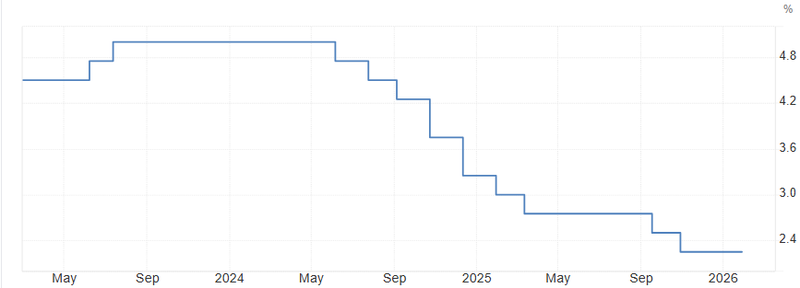

Extended pause likely

The combination of sub-2% core inflation on a short-term basis, modest positive GDP growth, and a stabilizing labour market points toward policy stability.

The Bank of Canada does not need to cut rates further unless growth weakens again. Additional easing could reignite housing demand and reintroduce inflation risks, particularly in interest-sensitive sectors. At the same time, there is little rationale for rate hikes when underlying inflation is running below target on recent trends and wage pressures are moderating.

Probability of one rate cut this year

Based in current data, one rate cut at most and possibly none.

If current trends hold, policymakers are likely to remain on pause through most of the year. A single 25-basis-point cut could materialize in the second half of 2026 if core inflation remains sustainably below 2% and GDP growth softens back toward stall speed (around 0–0.3% quarterly).

However, absent a clear downturn, the more probable outcome is zero additional cuts this year, with rates anchored near 2.25%.

A return to emergency-era 0.25% rates would require a sharp external shock or a renewed recession. Conversely, a move back toward 5% would demand a fresh inflation surge, something current data does not indicate.

For now, the most realistic outlook is a steady, largely uneventful policy path not because risks have vanished, but because the balance between growth and inflation has materially improved.

Source: Tradingeconomics