Latin America’s role in the new global economic context

As geopolitics escalate and U.S. trade policy becomes increasingly protectionist, Latin America's combination of macroeconomic resilience, strong market performance, and deep commodity resources makes the region both a stabilizing influence and a beneficiary, although with significant policy and diplomatic implications.

Average 2.5% GDP growth is expected for Latin America in 2025–2026.

Several regional indices (IPSA, IPC, Bovespa) have outperformed the S&P 500 YTD.

Abundant commodities support medium-term growth potential.

Risks persist from global trade policy, domestic politics, and diplomacy.

General context of Latin American economies

Latin American economies have shown resilience amid U.S. tariff actions that directly affect regional value chains. The World Bank projects ~2.5% average annual growth for Latin America and the Caribbean in 2025–2026. Still, forecasting remains challenging given the region’s tight trade links to the U.S. (notably Mexico and Canada) and increasingly forceful tariff measures—such as U.S. levies on selected Brazilian imports—already filtering through supply chains.

Despite elevated uncertainty, regional equity performance has been notable. Over the past year, Chile’s IPSA +38%, Argentina’s Merval +20%, Mexico’s IPC +11%, and Brazil’s Bovespa +4%. Year to date, IPSA, IPC, and Bovespa have outpaced the S&P 500, reflecting investor interest fueled in part by comparatively attractive valuations versus the more fully priced U.S. market.

Commodity landscape in Latin America

Another defining feature of Latin American economies is their natural-resource depth. Brazil and Mexico are significant crude exporters—Brazil in particular, with roughly 12% of the global market (OEC, 2025). Argentina is a major shipper of soybeans (~12% of total exports) and corn (~10%), and it also has meaningful lithium potential. Chile is the world’s leading copper exporter, with copper representing about 42% of its total exports. In Mexico, oil accounts for roughly 5% of exports, and northern reserves position the country as a prospective lithium producer.

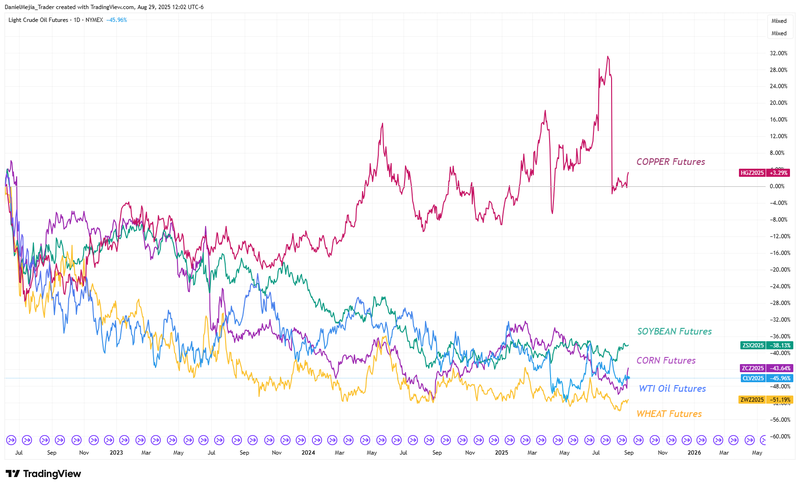

The next figure shows three-year price trends for copper, soybean, corn, oil, and wheat futures. Most contracts have drifted lower—except copper—but all remain above key structural support levels, limiting deeper drawdowns. Over a longer horizon, all five commodities still exhibit upward trends, an important backdrop for Latin American exporters given the outsized role of commodity revenues.

Strengths and weaknesses

Strengths. Commodity wealth underpins export earnings and investment pipelines. Demographics—relatively young populations—support consumption growth and expand the pool of skilled labor, aiding productivity over time. Moreover, macro indicators have remained resilient, particularly in Mexico and Brazil.

Weaknesses and risks. Heavy reliance on a narrow set of commodities increases exposure to price shocks (e.g., Chile and copper). Macroeconomic management continues to be challenging in certain economies: Argentina's inflation rate is slowing but remains elevated at approximately 36% year-over-year, and IMF-backed fiscal consolidation efforts are having a negative impact on public services and poverty levels. Chile's inflation rate, that is near 4.5% on average from 2024, is making it difficult for the central bank to continue with its easing cycle. Brazil faces headwinds from reciprocal 50% tariffs in U.S. trade policy. Mexico contends with uncertainty around USMCA renewal (mid-2026 review) amid periodic threats to the accord.

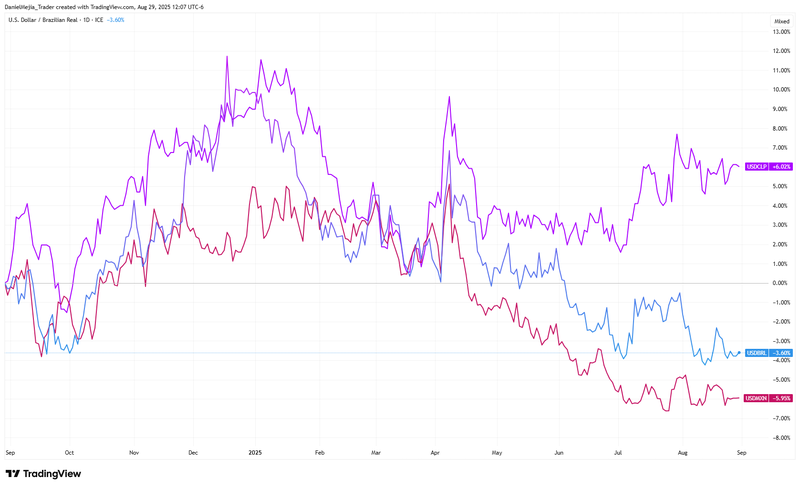

Regional currency performance has reflected these cross-currents: over the last year, the Mexican peso increased +6%, Brazilian real +3.6%, while the Chilean peso decreased −6%. The Argentine peso underwent a sharp, policy-driven devaluation at end-2023, after which market functioning has been constrained. The dispersion highlights how investors weigh several factors as monetary policy, macro fundamentals, domestic politics, trade policy, and the diplomatic setting when allocating to LATAM FX and local assets.

Conclusion

Latin America’s natural-resource base and demographic profile provide tangible growth optionality in a world of fragmenting trade blocks and shifting supply chains. Yet commodity dependence, macroeconomic fragilities, and policy/diplomatic risks can cap near-term visibility.

By diversifying exports and liberalizing trade with new partners, Latin American countries could gradually reduce their dependence on the U.S. economy. That transition is difficult: crafting and executing the necessary commercial and diplomatic strategies would require sustained effort, institutional capacity, and time.