Rising balance sheet, what to expect from Warsh

When President Donald Trump nominated former Federal Reserve governor Kevin Warsh to lead the U.S. central bank, markets immediately tried to answer a familiar question: is he a hard-liner inflation hawk, or a closet dove willing to cut rates when growth wobbles?

The important reality is that Fed chairs rarely get to be who they want to be.

There is a specific plan floating around, backed by Warsh and Scott Bessent.

Since December 2025, the Federal Reserve’s balance sheet has quietly begun to grow again.

Expectations for near-term rate cuts have faded.

The market always gets the last word

Investors may be asking the wrong question. The more important reality is that Fed chairs rarely get to be who they want to be. Markets, institutions, and economic conditions usually decide that for them.

History offers plenty of reminders. Central bankers can sound bold in speeches, but when markets push back, policy follows. In early 2020, ECB President Christine Lagarde famously suggested the central bank would not intervene to cap sovereign bond spreads. Within days, market stress forced a dramatic reversal. The message was clear: credibility is tested in markets, not press conferences.

If Warsh tries to get too creative or if he leans too hard into political optics the bond market will sniff it out. If investors lose faith in the Fed’s inflation-fighting credibility, yields will spike, the dollar will wobble, and Warsh will be forced to pivot back to "conventional" policy.

Bessent-Warsh friction

There is a specific plan floating around, backed by Warsh and Scott Bessent cut interest rates but shrink the Fed’s balance sheet. On paper, it sounds like a clean way to reduce the "Fed’s footprint." The conflict is Trump wants lower mortgage rates, that’s been a campaign staple, however if Warsh aggressively shrinks the balance sheet (Quantitative Tightening), the Fed has to sell off its mortgage-backed securities. That pushes mortgage rates up, not down.

Rising balance sheet and rate cuts can wait under Warsh

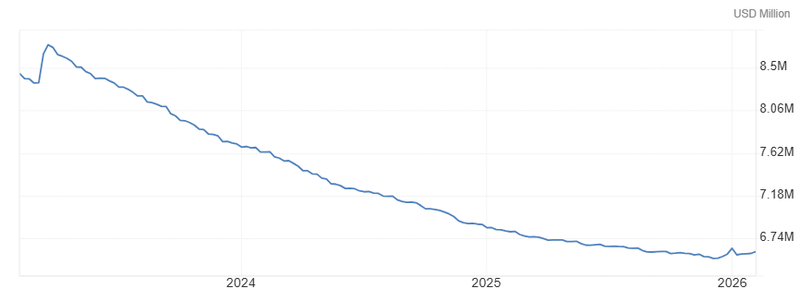

Since December 2025, the Federal Reserve’s balance sheet has quietly begun to grow again, the first sustained increase since the quantitative easing era ended. Officially, the move reflects technical Treasury bill purchases aimed at keeping liquidity ample and maintaining control over short-term rates. Unofficially, it is a reminder that the financial system still depends on a sizable liquidity buffer.

That reality complicates the outlook for monetary easing, especially with Kevin Warsh poised to take over as Fed chair. Warsh has long argued that the Fed’s large balance sheet distorts markets and should be reduced. But inheriting a balance sheet that is already expanding limits how quickly he could push for normalization without risking funding-market stress.

Source: Federal Reserve

Rate cuts likely to start under Warsh

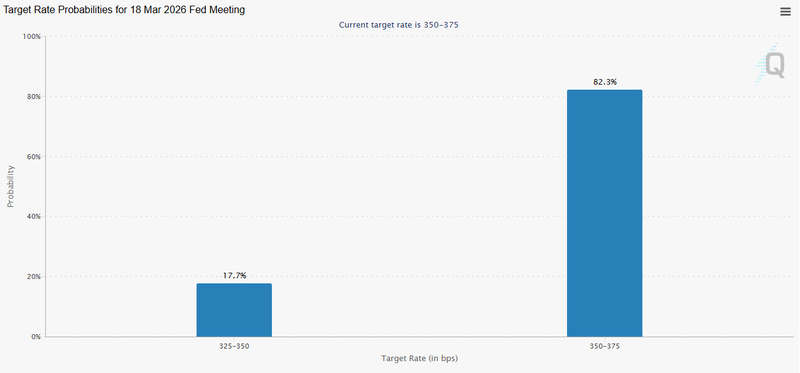

Expectations for near-term rate cuts in March and April have faded, with markets increasingly pricing in caution as inflation risks linger and liquidity is being maintained through a growing Fed balance sheet.

If the first rate cut of the year does happen, the odds now point to it occurring under Kevin Warsh’s leadership. Analysts see it as more likely to be a carefully measured move rather than the start of a broad easing cycle. Acting too quickly could conflict with plans to eventually reduce the balance sheet, but Warsh’s pragmatic approach suggests the Fed will take action once conditions clearly allow.

For investors, the takeaway is clear, policy remains data-driven and deliberate. Liquidity may be improving, but the first cut under Warsh is increasingly seen as a near-term probability rather than a distant possibility.

Source: CME Group