Safe-haven assets amid market volatility

Amid 2025's market volatility and global uncertainty, investors are increasingly seeking safe-haven assets. This analysis highlights traditional and innovative strategies, with a special focus on gold as the leading refuge against geopolitical tensions, inflation risks, and lingering tariff effects.

Global market volatility has sharpened the focus on safe-haven assets.

Traditional instruments such as government bonds and precious metals offer stability amid economic turbulence.

Gold, in particular, has emerged as the leading safe haven amid geopolitical strains and trade policy uncertainties.

How investors are adapting to 2025

The global economic environment in 2025 is marked by pronounced uncertainty, driven by fluctuating monetary policies, escalating geopolitical tensions, and persistent inflationary pressures. Central banks have been forced to adapt rapidly to these challenges, resulting in a volatile market climate that has prompted investors to re-examine their portfolio strategies. Amid this backdrop, safe-haven assets have come to the forefront, serving as both a shield against market shocks and a platform for potential yield.

Traditional safe investments in focus

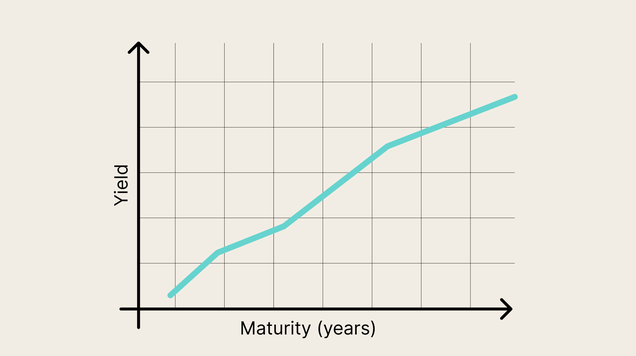

Historically, assets such as government bonds and precious metals have been the cornerstone of defensive investment strategies. U.S. Treasuries and European sovereign bonds have enjoyed renewed demand, largely because their stability offers investors a reliable return even in uncertain times. Alongside these instruments, precious metals have consistently provided a refuge; gold, in particular, has maintained its status as a trusted store of value. Its intrinsic worth and liquidity have made it an enduring favorite among those seeking to hedge against currency devaluation and inflation.

Gold: The premier safe haven asset

In today’s geopolitical landscape, gold has distinguished itself as the premier safe-haven asset. With tensions simmering on multiple fronts and the specter of trade disruptions exacerbated by the enduring impact of Trump-era tariffs, investors are increasingly relying on gold’s intrinsic value as a bulwark against uncertainty. The lasting effects of these tariffs have contributed to persistent concerns about global supply chains and inflation, further elevating gold’s role in portfolio diversification.

Over recent months, gold has not only provided a hedge against the erosion of purchasing power but also served as a stabilizing force during periods of market stress. Its performance has been particularly notable against the backdrop of inflation uncertainties, as well as geopolitical conflicts that have rattled global markets. In this environment, the metal’s limited supply and historical resilience have reinforced its appeal, making it a critical asset for investors prioritizing capital preservation and risk mitigation.

Gold remains the cornerstone of crisis-era portfolios due to its historical resilience, scarcity, and intrinsic value disconnected from sovereign monetary policies. As a non-correlated asset, it thrives when traditional markets falter: during inflationary spikes, geopolitical shocks, or currency devaluation, investors flock to bullion as a store of wealth. Unlike fiat currencies, gold cannot be printed or diluted, insulating it from central bank balance sheet expansions. Notably, its inverse relationship with real interest rates amplifies its appeal when yields fail to outpace inflation—a scenario seen during 2023’s stagflation fears. Recent years have also highlighted its strategic role in central bank diversification, with institutions like the People’s Bank of China aggressively accumulating reserves to hedge against dollar hegemony. While gold generates no yield, its price elasticity during crises—such as the 15% surge during the 2023 banking turmoil—cements its role as a portfolio stabilizer. As gold presented an amazing performance through the geoploitical tensions these days.

In essence, gold’s millennia-tested ability to preserve purchasing power ensures its relevance even in modern, algorithm-driven markets.

Embracing low-risk opportunities

Beyond gold and traditional safe investments, market participants are actively seeking low-risk opportunities that can offer stability and liquidity. Short-dated government securities have emerged as attractive options in this context, balancing modest yields with the security investors need. High-quality corporate bonds, issued by financially robust companies, are also capturing attention for their favorable risk-adjusted returns. Additionally, money market funds continue to be a preferred vehicle, prized for their ease of access and capital preservation capabilities in a volatile market.

Navigating the quest for higher returns

The quest for safe investments that also promise higher returns has led to the development of innovative financial instruments. While conventional safe-haven assets tend to prioritize stability over yield, structured products are now gaining popularity among sophisticated investors seeking a blend of principal protection and yield enhancement. Equities of companies known as dividend aristocrats, which boast consistent records of dividend increases, are attracting interest as well. Furthermore, diversified multi-asset portfolios—integrating fixed income, equities, and commodities—are being designed to achieve low volatility while capturing incremental gains, even in a challenging economic environment.

Reassessing the concept of “risk free”

The idea of risk-free investments has come under renewed scrutiny in 2025. While instruments like highly rated sovereign bonds have long been viewed as nearly impervious to market fluctuations, recent economic developments have underscored that no investment is entirely devoid of risk. Fluctuating yields driven by inflation expectations and emerging counterparty concerns remind investors that even the safest assets require a nuanced assessment. This reality reinforces the importance of diversification, as relying solely on any single asset class may expose portfolios to unforeseen shocks.

Data insights and emerging trends

Recent market data from 2025 illuminate the evolving dynamics of safe-haven investing. U.S. 10-year Treasury yields have stabilized above 4%, reflecting a cautious yet steady optimism among investors. Concurrently, gold has demonstrated remarkable resilience, maintaining a stable price range that underscores its value as a hedge against both economic and geopolitical uncertainties. Meanwhile, safe-haven currencies like the Swiss Franc continue to appreciate modestly, offering additional layers of security amid volatile market conditions. The growing interest in structured products and diversified funds also signals an appetite for investment solutions that reconcile the dual imperatives of safety and yield enhancement.