The changing value of the US dollar: A gradual transition

Despite the endless doom-and-gloom headlines, the U.S. dollar isn’t collapsing—it’s evolving. What many call “debasement” is largely the natural effect of inflation in a growing economy, not the destruction of value. While fiscal deficits, money printing, and inflation are real challenges, global confidence in the dollar remains unshaken. It’s still the backbone of global finance because no viable alternative exists.

The U.S. dollar’s decline in purchasing power reflects inflation, not structural debasement.

Global confidence in the dollar remains strong, with 60% of reserves still held in USD.

Money supply growth has broadly tracked economic growth since 1959.

The “death of the dollar” narrative thrives on fear, not fundamentals.

For more than a century, the U.S. dollar has been the cornerstone of the global financial system—trusted, traded, and sometimes despised. But in the past few years, headlines warning of “U.S. dollar debasement” or even “imminent collapse” have flooded financial media and social platforms alike. YouTube personalities brandish long-term charts showing the dollar’s purchasing power plunging by 90 %, while influencers preach gold or Bitcoin as salvation from paper money.

It’s a seductive story: the Federal Reserve prints trillions, inflation roars, debt balloons, and the greenback supposedly dies. But beneath the hysteria lies a complex truth: the dollar has indeed eroded over time—but what’s happening is less a story of collapse and more one of evolution.

A historical lens: The real debasement

Currency debasement is hardly new. In the ancient world, rulers physically clipped silver coins or mixed them with base metals to fund wars. The value of money fell because its substance was literally diluted.

The early United States was designed to avoid that fate. The Constitution tied money to gold and silver, constraining governments from arbitrary expansion. For nearly 150 years, the dollar’s value was anchored to metal—first under the classical gold standard, then under the Bretton Woods system after World War II.

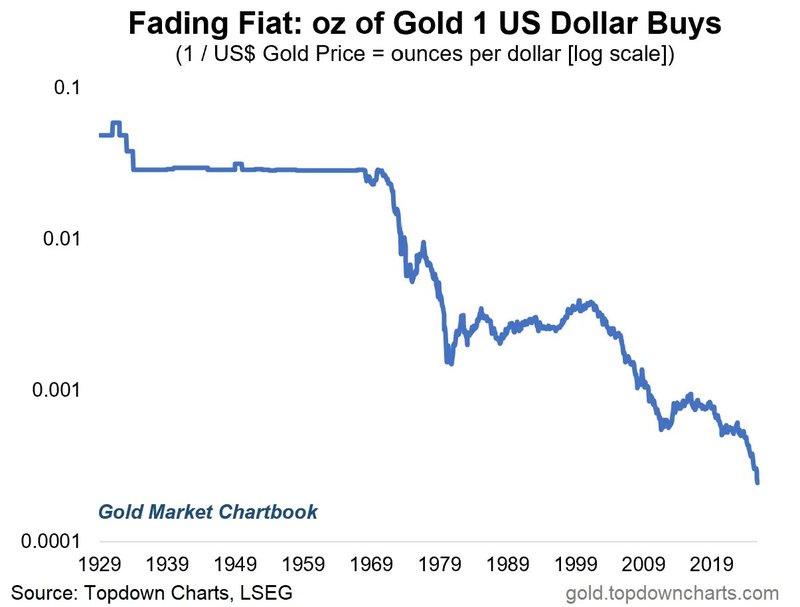

That discipline ended in 1971, when President Richard Nixon “closed the gold window,” severing the dollar’s last formal link to gold. The modern fiat era was born. Since then, the dollar’s purchasing power has undeniably declined. According to long-term data, the dollar has lost roughly 96 % of its value since the creation of the Federal Reserve in 1913. But this loss is not unique—it’s the natural outcome of a fiat system in which the supply of money grows with the size of the economy.

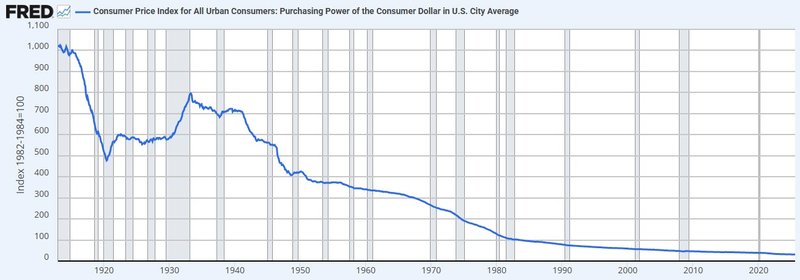

The 90 % chart that sells fear

One of the most recycled visuals in financial circles is the “purchasing power of the U.S. dollar” chart. It shows a sharp, century-long decline and is often wielded as proof of catastrophic debasement.

Source: FRED

The image is powerful—but misleading. What it shows is inflation, not debasement. Inflation is a function of rising demand, population growth, productivity, and the expansion of credit in an economy that’s far larger and more complex than it was a century ago.

Prices rise because the economy expands; goods, services, and incomes multiply. In other words, it’s not that the dollar has been structurally ruined—it’s that the denominator of the economy has grown immensely.

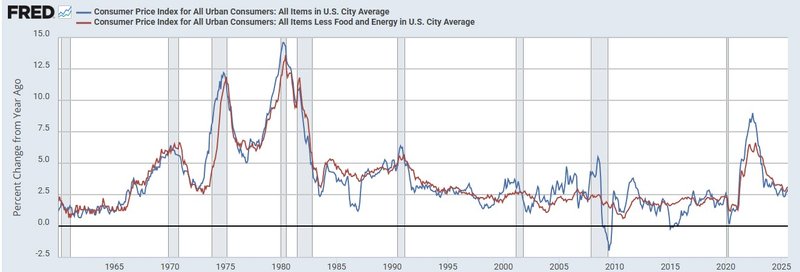

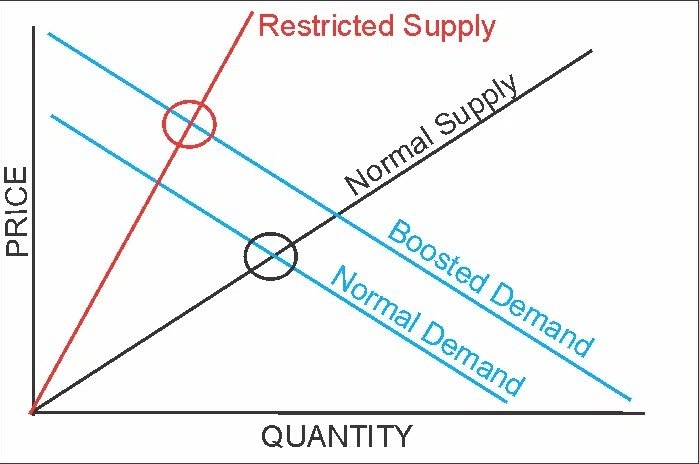

Inflation vs. debasement: Two different creatures

Inflation is the rise in prices when demand outpaces supply. Debasement, by contrast, refers to a deliberate structural weakening of a currency—like removing silver from coins or breaking a hard-backing link.

Rome debased its currency by reducing the silver content of the denarius. The United States ended its gold convertibility in 1971—that was genuine debasement, a fundamental change in the structure of money. But since then, within the fiat framework, “printing money” does not dilute a metallic base because none exists. The structure no longer depends on gold or silver but on confidence, productive capacity, and the government’s creditworthiness.

Prices rise over time because demand increases due to population growth, rising incomes, and growing consumption. This is especially true in a post-industrial, service-driven economy that incentivizes credit expansion and capital investment. As we often say, it’s not the US dollar losing value; it’s the economy expanding.

Source: FRED

That’s why the term “debasement” today functions more as a psychological metaphor than a mechanical one. It signals fear that confidence in fiat money will erode—but confidence, not silver content, is what underpins modern currencies.

The pandemic shock and the M2 mirage

Critics point to the explosion in the money supply during 2020-2021 as proof that the dollar is being destroyed. It’s true that M2—the broad measure of money—soared by more than $6 trillion during the pandemic. But context matters. The U.S. was facing the most severe economic collapse since the Great Depression. The Federal Reserve and the Treasury stepped in aggressively to prevent systemic failure, and the intervention worked.

Source: FRED

The surge in liquidity pushed demand higher than supply, triggering a wave of inflation that peaked above 9 %. But the same surge also produced record-low unemployment and one of the fastest post-recession recoveries in modern history.

Crucially, over the long run, the growth of M2 has tracked closely with GDP. Since 1959, money supply growth and economic output have remained broadly aligned. Even after the pandemic spike, M2 as a percentage of GDP has been falling, not rising. That’s hardly the picture of a currency being structurally debased.

Global confidence still anchors the Dollar

If the dollar were truly being debased, global capital would flee. Treasury demand would collapse. Foreign reserves would diversify rapidly into other currencies. None of that is happening.

The U.S. dollar still accounts for roughly 60 % of global reserves and about 80 % of global trade settlements. Central banks continue to hold Treasuries as their safest asset. Even countries publicly calling for “de-dollarization” continue to store their surpluses in U.S. assets.

The Dollar Index (DXY) remains historically strong, despite cyclical swings. Its resilience reflects deep liquidity, the rule of law, transparent capital markets, and military and economic dominance unmatched by any rival.

The US Dollar Index remains strong. Most notably, the bigger picture reveals a more resilient and globally dominant currency than many alarmists will admit. The US dollar is still at the center of 80% of global transactions, and nearly 60% of all global reserves. The “debasement” argument is at best premature, and at worst, deeply misleading.

Source: LSEG

Japan in the 1980s, the euro in the 2000s, and the yuan today have each been hailed as potential replacements. None has come close to replicating the dollar’s reach.

What’s really at stake

The narrative of “dollar death” thrives because fear sells. It’s easier to gain clicks by forecasting collapse than by explaining equilibrium. Human psychology magnifies threats more than opportunities—a trait financial media understands all too well.

Yet, for investors, the real issue isn’t debasement—it’s inflation. Over decades, inflation steadily erodes purchasing power, not through destruction but through progress. A suit that cost $35 in 1900 costs about $2,000 today, not because money has been “destroyed” but because productivity, wages, and living standards have multiplied.

Still, inflation matters. It means that cash loses value over time, and savers must seek assets—equities, property, or even gold—that grow faster than the inflation rate. Gold remains a hedge, but equities, over the long run, have vastly outperformed as a store of value in real terms.

The long arc

From silver coins to digital payments, the dollar’s story is one of transformation, not terminal decline. Genuine debasement—the removal of precious-metal content—ended decades ago. What remains is the challenge of balancing money creation with real economic growth, managing fiscal discipline, and maintaining confidence in U.S. institutions.

Yes, inflation eats away at purchasing power, and yes, deficits and political dysfunction pose risks. But the U.S. dollar is not collapsing. It’s adapting.

The real debate isn’t whether the dollar will vanish—it’s how the U.S. manages its privilege and responsibility as issuer of the world’s reserve currency in a time of shifting geopolitics and technological change.

In that sense, the “death of the dollar” remains a myth yet. The more interesting story—the one investors should watch—is how the dollar continues to evolve amid a new global order defined by debt, data, and digital money.

The dollar isn’t dying; it’s adapting to a world that keeps expanding. Yet nations are slowly reducing their reliance on it, turning to gold as a reserve of trust.