UK economy edges toward easier policy

UK economy is gradually slowing, with inflation trending lower and the labour market showing signs of stress. While headline prices remain above target, disinflationary trends are giving policymakers room to consider monetary easing, especially if economic slack widens further.

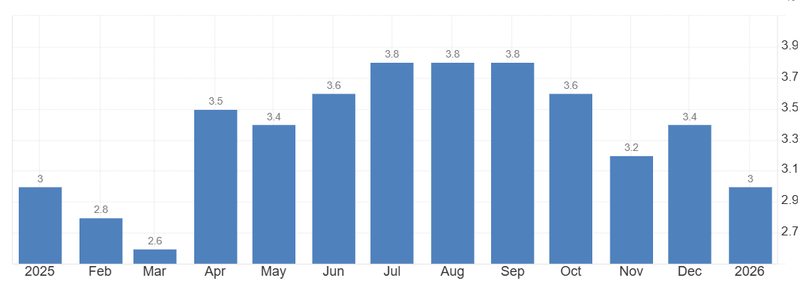

Inflation rate has moderated to 3.0% year-on-year for January 2026.

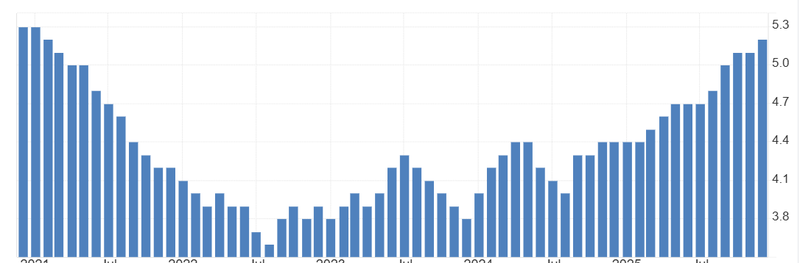

Unemployment rate rose to 5.2, highest level since February 2021.

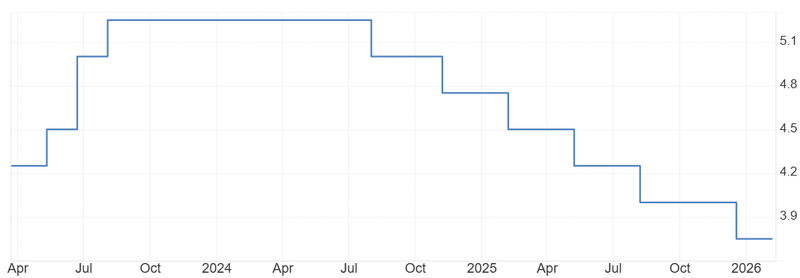

Economists now points to two distinct rate cuts this year.

Pricing power has evaporated

The primary driver for the Bank of England’s hawkish stance has effectively neutralized, inflation rate has moderated to 3.0% year-on-year for January 2026, a significant cooling from 3.4% in December.

The most telling statistic is not the annual rate, but the monthly movement. Prices fell by 0.3% in January alone. This monthly deflation suggests that pricing power has evaporated for retailers. With goods’ inflation turning negative, the risk of a "wage-price spiral" is now minimal. The inflation dynamic has shifted from "sticky" to "disinflationary," giving the central bank the green light to change course.

Source: Office for National Statistics

The labor market is weakened

While price stability is returning, the labor market is beginning to buckle under the weight of restrictive financial conditions, unemployment rate rose to 5.2% in the quarter ending December 2025, exceeding market expectations of 5.1%. This has been the highest level of joblessness since February 2021. In absolute terms, the economy added 94,000 unemployed individuals, bringing the total to 1.883 million.

Businesses facing higher refinancing costs and squeezed margins have moved from "hoarding labor" to shedding staff. A jump of nearly 100,000 unemployed in a single quarter is a warning signal. If the Bank of England maintains current rates, this 5.2% unemployment rate risks accelerating toward 6% by mid-year, effectively engineering a recession that is no longer necessary to curb inflation.

Healthy for the economy to have more people wanting to work, they are entering a market that is currently "mothballing" new projects. We now have 2.6 unemployed people for every 1 vacancy, the highest ratio in a decade (outside of the pandemic).

Because supply (workers) is rising while demand (jobs) is falling, expect downward pressure on wages to accelerate. This "slack" in the market is exactly what the Bank of England needs to see before they feel safe cutting rates.

Source: Office for National Statistics

March cut is now likely

Given the divergence between falling inflation and rising unemployment, the Bank of England’s mandate is clear. The "balance of risks" has flipped: the danger is no longer entrenched inflation, but an unnecessary economic contraction.

Markets should price in a rate cut at the March meeting. The central bank needs to act preemptively to stabilize the labor market. Waiting for inflation to hit exactly 2.0% before cutting it would likely be a policy error, as the full effect of the cut would take months to filter through to the real economy.

Risks remain as services inflation, which tends to be more persistent could slow more slowly than expected. Sterling exchange rate movements and external demand conditions also influence the inflation trajectory. If inflation proves stickier than current data suggests, the Bank may choose a more cautious approach to easing.

Overall, the evolving data suggests a transition toward a looser monetary stance in 2026, driven by slower inflation, weakening labour market indicators, and subdued growth but the timing and scale of rate cuts will depend on how these trends develop in the coming months.

The consensus among economists now points to two distinct rate cuts this year. The first, likely in March, will be a "calibration" cut to move policy from restrictive to neutral. A second cut later in the year will depend on whether consumption data stabilizes.

Source: Bank of England