Bull traps in trading: your guide to spotting, avoiding & risk management

A bull trap is a false upside breakout that persuades traders to buy just as the market is about to reverse lower. Spotting these deceptive surges—and knowing how to handle them when you’re wrong—can preserve both capital and confidence.

Definition: A bull trap is a short-lived rally through resistance that quickly collapses, “trapping” late-buying bulls with losses.

Why it happens: Liquidity hunting by large players, news whipsaws, and bear-market short-covering rallies are the main triggers.

Early warning signs: Weak volume, momentum divergence, and failure to retest support often flag false breakouts.

Protection: Wait for confirmation, scale into positions, and keep stops just below the breakout level.

Unpacking the bull trap: from breakout to breakdown

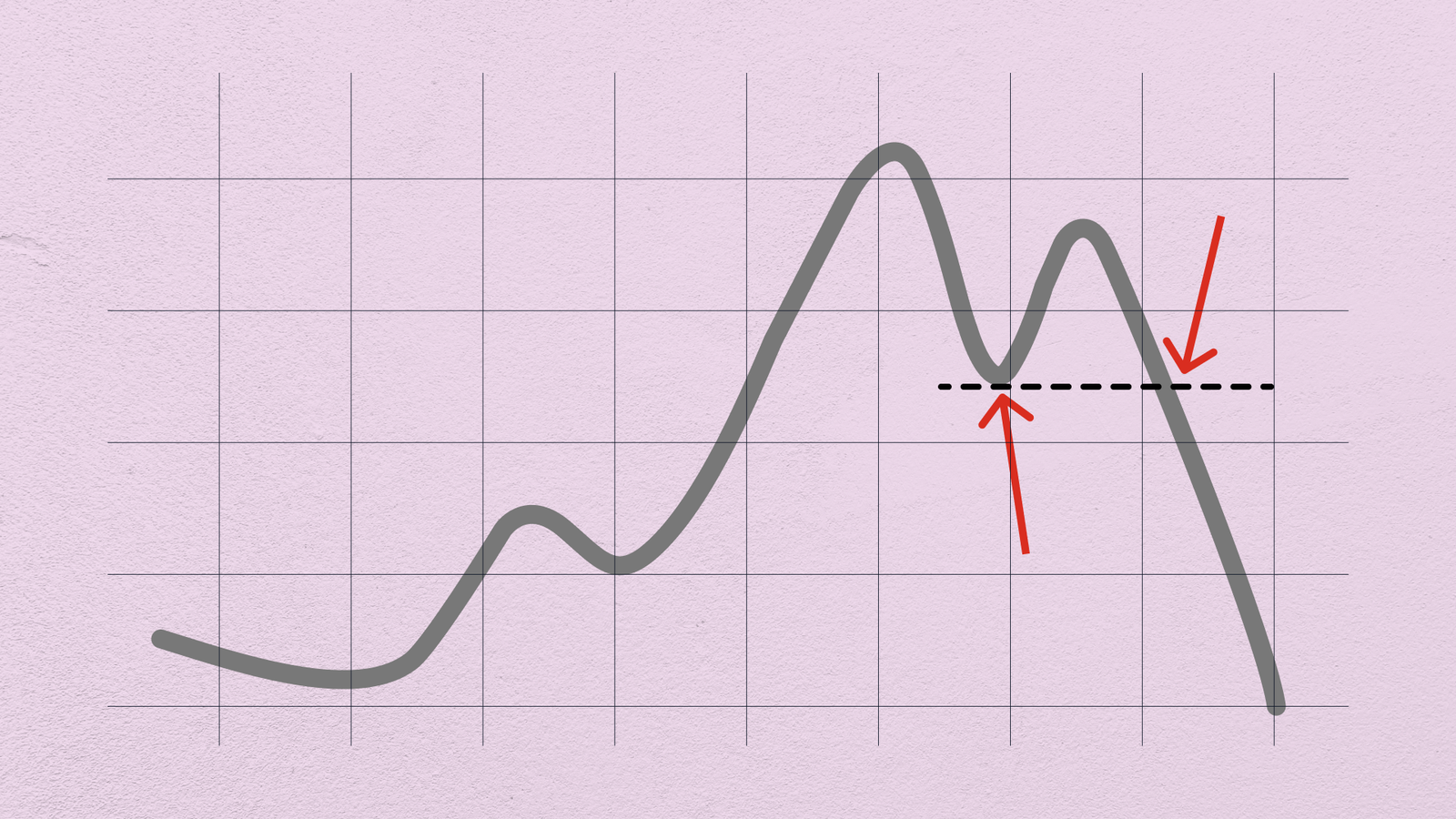

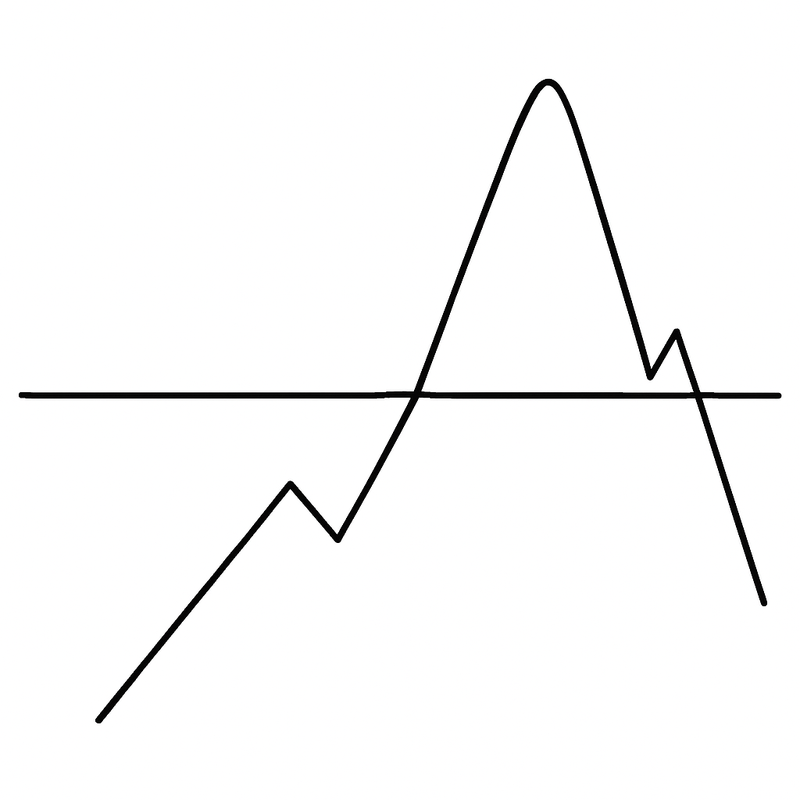

A bull trap begins the moment price pushes through a widely watched resistance line or prints a fresh yearly high. That fleeting surge convinces many traders a new up-leg has started, yet within hours—or even minutes—sellers reclaim control and drive price back below the breakout level. Anyone who chased the move is now holding a losing long, often forced to exit at a loss, which adds downside momentum and deepens the reversal.

Traps usually form for one of three reasons. First, large players may deliberately nudge price beyond resistance to harvest buy-stop liquidity, only to dump stock or contracts into that wave of eager buyers. Second, knee-jerk headlines—a surprise CPI print, an unexpected rate decision—can produce sharp, low-conviction spikes that fade once traders digest the data. Third, in established down-trends an oversold market sometimes sparks a “bear-market rally”: shorts cover, price shoots higher, and momentum stalls as soon as the covering subsides.

Recent episodes that caught traders off guard

During April 2025 the Nasdaq-100 gapped more than twelve percent on what looked like a decisive breakout. Breadth indicators, however, remained anemic and volume failed to expand. Ten trading days later the index had surrendered eight percent of that gain. A few weeks after, the S&P 500 closed above the psychological 4,900 mark for the first time in months, only to collapse three sessions later when weaker PMI data reminded investors that the macro backdrop had not improved. Both moves illustrate a core principle: speed without validation is the breeding ground for bull traps.

Distinguishing genuine breakouts from clever fakes

The surest test of any breakout is volume. When committed buyers step in, turnover expands; if price pierces resistance on thin activity, caution is warranted. Equally important is the retest. Authentic breakouts often pull back, kiss the old ceiling—now potential support—and then rebound decisively. A failure to hold on that retest is a classic trap tell. Traders should also consult momentum tools: if the RSI, MACD, or on-balance volume is diverging while price pushes higher, the breakout lacks motor power. Finally, step back to a higher time frame. A minor higher high inside a weekly down-trend is noise; what matters is the sequence of higher lows that confirms a broader shift.

Practical tactics for staying out of the snare

One of the simplest safeguards is to commit only a fraction of intended size on the very first close above resistance—think of it as a probe. Additional size is justified only if the subsequent retest holds. Time filters help as well: many experienced traders demand that price finish the session (or the four-hour candle, depending on their horizon) above the breakout line. Wicks that fade before the close are traps in disguise. When order-book data are available, thinning depth or iceberg sellers just beyond resistance can signal engineered liquidity grabs.

No safeguard, however, beats disciplined stops. A logical protective stop sits just beneath the broken level, adjusted for average true-range noise. Should the trap spring, the loss is small and defined, rather than catastrophic. Many professionals reduce position size or skip breakout trading altogether ahead of binary events such as central-bank meetings, recognising that headline whipsaws inflate the odds of false moves.

A step-by-step checklist

Begin by outlining the obvious resistance zone that attracts crowd attention. Wait for a daily or, at minimum, four-hour candle to close firmly above it. Cross-check that volume is expanding and momentum indicators are confirming. On the pullback, watch whether price respects the breakout line; if it does, fresh longs become attractive. If it doesn’t—if candles sink back into the prior range—step aside or even consider a tactical short, because the odds now favour a bull trap playing out.

Managing the psychology of FOMO

Bull traps thrive on fear of missing out. The antidote is preparation. Craft entry levels and stop distances when the market is closed, so decisions are made with a cool head. Accept that missing a move costs nothing, whereas forcing a trade out of impatience often proves expensive. Keep statistics: record how many times you bought an unconfirmed breakout and what it cost. Watching those numbers in a journal is a powerful deterrent against impulsive chase behaviour.

Micro-structure and regulatory context

Since 2020 the trading landscape has changed: the SEC’s half-penny tick pilot, tighter MiFIR circuit breakers in Europe, and increasingly fragmented liquidity have made breakouts more prone to abrupt reversals, especially during late-Friday sessions or holidays when order books are thin. Recognising when the market is structurally fragile—and throttling size accordingly—adds another defensive layer against getting trapped.

Bull traps are as old as speculation itself, but electronic trading and social-media hype have made them faster and more convincing. Traders who demand volume confirmation, respect retests, align signals across time frames, and size conservatively can sidestep these snares and sometimes even profit by fading them. As ever, capital preservation precedes capital growth; avoiding traps is the prerequisite to thriving in the long run.

Frequently asked questions (FAQs)

Do bull traps only appear in bear markets?

While they’re more common during broad down-trends, any overextended or low-volume rally can morph into a trap if buying interest evaporates quickly.

Is there a single indicator that flags bull traps?

No single tool is sufficient. A blend of price action, expanding volume, and momentum confirmation provides the most reliable defence.

Can strong fundamentals override a bull-trap signal?

Occasionally. Breakouts fuelled by genuinely transformative news—major earnings beats, central-bank pivots—can convert a suspected trap into a lasting trend.

Does shorting every failed breakout make money?

Not by default. Wait for a decisive close back inside the range and maintain disciplined stops; failed breakouts sometimes whipsaw a second time before trending lower.