Decoding the Mexican peso's remarkable strength against US pressure

Despite rising U.S.–Mexico tensions, the Mexican peso has continued to appreciate. Recent data suggest this move is not primarily driven by carry-trade dynamics; instead, the currency has been supported by Mexico’s macroeconomic stability, resilient growth outlook and proactive diplomatic positioning.

The Mexican peso has gained roughly 11% since Q2 2025.

Statistical analysis indicates that carry-trade flows — as measured by the implicit country-risk premium — are not the main driver of the currency’s advance.

Instead, the appreciation has been largely supported by Mexico’s solid macroeconomic fundamentals and resilient growth outlook.

Continued bilateral diplomacy and cross-sector agreements have also strengthened international investor confidence in the MXN.

What has happened to the Mexican peso in recent months?

The Mexican peso has appreciated by roughly 11% since April 2025, even as U.S. pressure on trade policy and bilateral agreements intensified. This outcome contrasts with the market consensus, which had expected MXN depreciation following the tariff announcements — not least because Mexico sends more than 75% of its exports to the United States and imports around 50% of its goods from it (Reuters; El País; World Bank, 2025). The imbalance is notable: U.S. exports to Mexico account for just 16% of total U.S. exports and imports from Mexico for about 15% (Reuters; U.S. Census 2025).

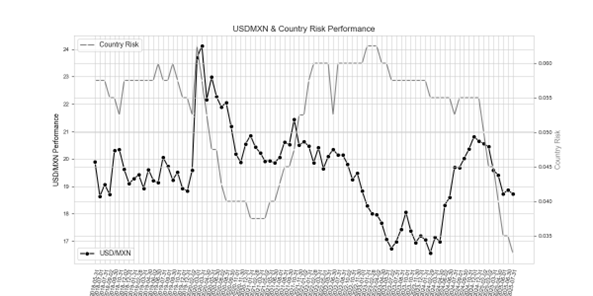

Many observers point to high Mexican sovereign yields relative to U.S. Treasuries as the key driver of the peso’s performance. Yield differentials clearly matter, but they do not fully explain the move and may be less important than often assumed. A comparison of USD/MXN against the implied country-risk premium (policy-rate differential) shows that MXN appreciated in 2022–23 while the premium remained elevated — but continued to strengthen in 2025 even as the premium declined. The relationship is therefore inconclusive.

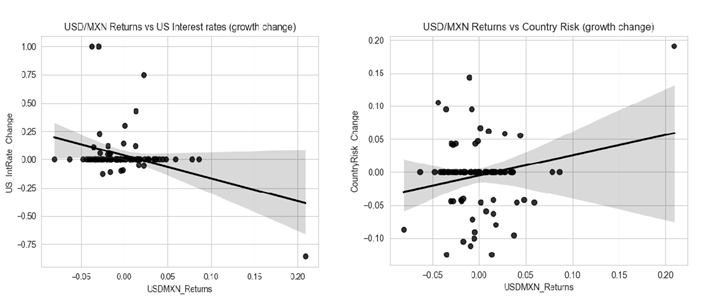

To test this further, correlation and regression analysis were conducted using exchange-rate returns, changes in the U.S. Federal Funds rate and the implied country-risk premium. The results show that USD/MXN returns are more sensitive to U.S. monetary policy (correlation: –0.36) than to fluctuations in the carry proxy (correlation: 0.22), which also exhibits higher dispersion and weaker statistical significance. Moreover, Fed and Banxico policy rates are highly correlated (0.95), reducing the relative importance of the carry channel in recent months.

Mexico’s macroeconomic context

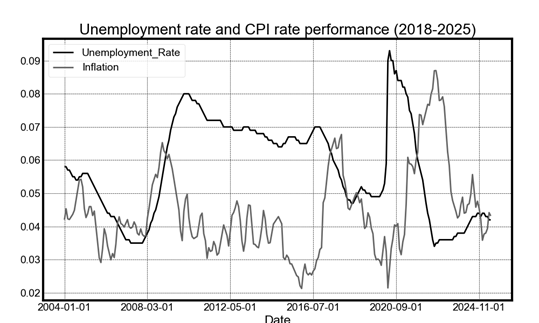

Mexico’s solid macro performance has provided a stronger anchor for the peso. Both the IMF and World Bank upgraded their GDP estimates for 2025 (from –0.3% and 0.0% in April to +0.2% in July), and the actual data have outperformed those revisions. Real GDP rose 0.2% q/q in Q1 and 0.7% in Q2, avoiding a technical recession. Unemployment remains close to historic lows and inflation continues to ease toward Banxico’s 3% target. In short, Mexico has demonstrated resilience despite its exposure to the U.S. economy.

Diplomatic developments

Constructive diplomacy has also supported investor sentiment. During negotiations in February and again in August 2025, President Claudia Sheinbaum secured 90-day postponements of several U.S. tariff actions. Although some levies on specific inputs outside the USMCA framework were implemented, the government’s cooperative approach was viewed positively by international investors. In addition, the “Plan Mexico” initiative — which aims to boost domestic investment through public-private coordination — helped reinforce confidence.

The peso’s recent strength cannot be attributed solely to carry-trade dynamics. Rather, it reflects Mexico’s resilient economic performance, sustained macro-stability and constructive diplomacy, even in the face of rising U.S. trade pressure. These factors have supported international confidence — and, in turn, the currency.