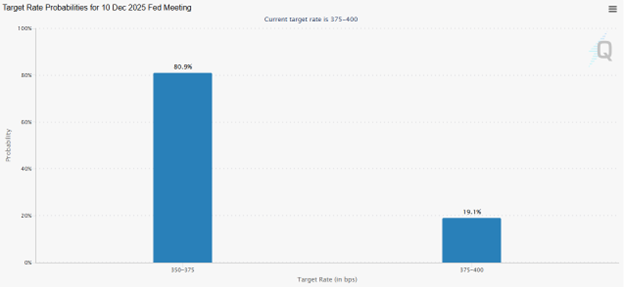

December cut priced in while markets eye delayed US figures

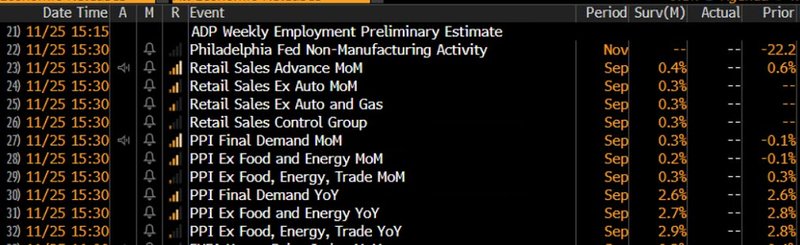

With a December Fed cut largely in the price, equities, bonds, and bullion have firmed while the dollar cools only at the margins. The next test is today’s catch-up prints—retail sales and PPI—unlikely to move the needle unless they deliver a genuine surprise.

December rate cut now the base case; limited FX follow-through

Focus shifts to shutdown-delayed U.S. retail sales and PPI

Daly backs a December move, flagging rising labor-market risk

Gold grinds toward 4,155 as yields ease and dovish bets build

Pricing in the cut, waiting on data

Markets have largely settled on a quarter-point reduction in December. That’s kept risk assets supported—equities steady, duration bid, and precious metals resilient—while FX shows less conviction. Dollar sellers are hesitant to extend the move without fresh catalysts, and today’s September retail sales and producer-price data are expected to inform, not shock. Only a material beat or miss would meaningfully shift rate expectations.

Fed signals: Daly tilts the balance toward easing

San Francisco Fed President Mary Daly signaled support for a December cut, arguing the downside risks in employment now outweigh the risk of another inflation flare-up. She described the labor market as “vulnerable,” noting the possibility of nonlinear weakening that would be harder to manage if policy lags. On inflation, she pointed to limited pass-through from tariffs so far, reducing the case for a hawkish hold. Her stance—alongside earlier centrist remarks—pushes the committee’s center of gravity toward easing.

Source: CME Group

Limited dollar downside without a shock

With the cut narrative embedded, currencies are in wait-and-see mode. A routine retail-sales/PPI mix likely keeps the dollar range-bound. A soft growth print alongside contained pipeline inflation would nudge rate-cut odds higher and cap the dollar; the opposite would spark only a modest squeeze given positioning has already lightened.

Rates and gold: yields drift, bullion benefits

Treasury yields have eased as December odds climb, and convexity flows are muted compared with prior episodes. The softer-yield backdrop is supporting gold, which is grinding toward 4,155. A decisive move likely awaits confirmation that core demand is cooling without a renewed inflation scare. New highs remain a 2026 story, but dips are well-sponsored while real yields edge lower.

Source: TradingView

What could move the needle today

Retail sales: A broad miss, especially ex-autos and control group, would reinforce the growth-cooling narrative and lift cut probabilities.

PPI: Benign core pipeline inflation would validate the “no re-acceleration” view and help extend the bond bid.

Fed speak: Any pushback from voting hawks could temper the easing impulse, but the bar for a repricing higher is high.

The December cut is effectively priced. Barring a genuine data surprise, markets will trade the glide path—softer yields, supported gold, and a dollar that needs fresh information to break lower.

Source: Bloomberg