Dollar strengthens as BOJ seen moving toward easing

The US dollar index has risen for four consecutive days, with the Japanese yen leading currency depreciations, while German trade data has shown a contraction in both exports and imports.

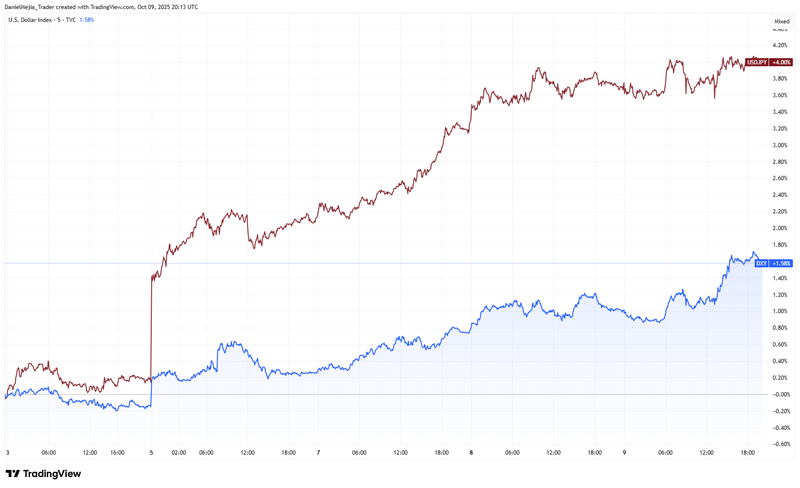

The US dollar index has registered a week-on-week increase of 1.58%, while the Japanese yen has posted a 4% loss against the dollar.

The yield on 10-year sovereign bonds in Japan reached a fifteen-year high amid expectations of expansionary policy in the country.

German exports contracted, driven by lower demand from European Union countries and reduced sales to the US following the implementation of tariffs.

Brent and WTI oil benchmarks fell at the close of the market following reports of a potential peace agreement in the Middle East.

DXY recovers on Japanese yen weakness

The dollar index (DXY), which compares the US dollar against six major developed-country currencies, has appreciated by 2% over the last month and 1.58% in the past week (see Figure 1). While currencies such as the euro and the pound sterling have depreciated, contributing to the DXY's advance, the currency that has depreciated the most is the Japanese yen, which has posted a 4% loss against the dollar week-on-week.

One of the main factors driving the yen's depreciation is the rise of Sanae Takaichi to the leadership of the ruling political party. The conservative leader has publicly stated her intention to boost the Japanese economy through expansionary fiscal policies. This prospect has boosted equities, while there has been a growing expectation that the Bank of Japan (BoJ) may curb its monetary tightening intentions. As a result, the Japanese yen has been negatively impacted by the expectation of an expansionary monetary policy.

Furthermore, according to Reuters, an economic adviser to Sanae Takaichi stated that a weaker yen could be beneficial for foreign investment in the country, provided it is accompanied by adequate fiscal stimulus. These statements reinforce the argument for an expansionary approach if she secures the position of prime minister.

Figure 1. Dollar Index vs USD/JPY parity, weekly change. Source: data from the Intercontinental Exchange (ICE). Proprietary analysis conducted on TradingView.

Japan's 10-year bond yield hits record high

The yield on 10-year government bonds reached a fifteen-year high of 1.69%. Over the past five years, the upward trend has remained largely intact amid market expectations of likely monetary tightening by the BoJ (see Figure 2). Inflation in Japan is currently at 2.7% year-on-year, above the central bank's target. Consequently, the Bank of Japan has repeatedly mentioned that a tighter monetary policy may be necessary to contain prices.

However, Sanae Takaichi's rise to the leadership of the ruling party has shifted expectations, as she seeks expansionary policies to boost the country's economy. If she becomes Japan's first female prime minister, the trend reflected by the bond market could see a turning point, as the BoJ would be expected to adopt a less restrictive stance in its future decisions.

Figure 2. Japan Government Bonds 10-Year Yield (2020-2025). Source: Image obtained from TradingView.

German exports and imports show contraction

According to data from the Federal Statistical Office of Germany, German exports fell by 0.5% month-on-month (previous: –0.2%), which was below the consensus estimate. Meanwhile, imports registered a sharper drop than expected, contracting by 1.3% month-on-month (previous: –0.7%). Consequently, the euro ended the session 0.54% lower against the dollar.

According to Trading Economics, the largest decreases in German exports by destination were to the United Kingdom (–6.5%) and the US (–2.5%, attributed to tariff implementation). Exports to fellow European Union member states also fell by 2.5% due to lower demand. In contrast, exports to China increased by 5.4%, and shipments to non-EU countries rose by 2.2%. Regarding imports, purchases from EU countries decreased by 1.9%, imports from China fell by 4.5%, and imports from the United Kingdom dropped by 4.6%. In contrast, imports from the US increased by 3.4% from the previous month.

Oil benchmarks fall on declining geopolitical risk premium

Brent (BRNZ5) and WTI (CLX5) oil futures contracts closed lower after a first-phase ceasefire in the Middle East conflict was agreed upon, lowering the geopolitical risk premium. Brent fell 1.55%, closing at $65.22 per barrel. Meanwhile, WTI fell 1.66% to $61.51 per barrel.

Oil prices have displayed directionless, oscillating behaviour, with benchmarks remaining within a sideways range over the past two months. On the one hand, estimates of lower demand due to economic slowdowns and forecasts of higher supply from OPEC+ members have exerted downward pressure on prices. On the other hand, the geopolitical risk premium from the conflicts in Ukraine and the Middle East has pushed prices up due to ongoing impacts on energy supply chains.

The focus now is on the peace agreement becoming effective, as it is currently only in the first phase of diplomatic development.